News and Information from Around the World Wheat Industry

Speaking of Wheat

“USW received an invitation to meet with Iraqi Prime Minister al Sudani during his trip to Washington, DC. He was accompanied by the Director General of the Grain Board of Iraq, who we met with privately ahead of the meeting with the Prime Minister. This was an opportunity for us to remark to the Prime Minister about USW’s relationship with Iraqi Grain Board and the efforts that USW has extended in our work with Iraq’s flour milling industry going back more than 50 years.” – U.S. Wheat Associates (USW) President Vince Peterson. Read more here.

Ana Laura Salinas Marks 25 Years with USW

Ana Laura Salinas

Ana Laura joined the USW Mexico City office in 1999 and serves as Regional Finance and Administration Manager. “Over the past 25 years, Ana Laura has played a pivotal role in the overall financial management of our office,” said USW Regional Vice President, Mexico, Central America, Caribbean, Mitch Skalicky. “She has been a key factor in assuring we are in full compliance with all regulations, policies, and procedures. Beyond that, she plans regional conferences, workshops, and seminars. We highly value Ana Laura’s contributions as a much-appreciated member of the USW/Mexico City team.” ¡Gracias por tu servicio Ana Laura!

Report Cites Indian, Russian, Turkish Trade Barriers

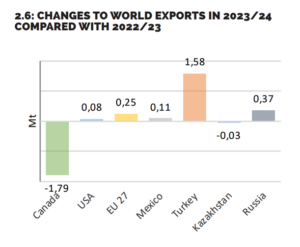

The United States Trade Representatives’ 2024 National Trade Estimate Report on Foreign Trade Barriers includes several concerns from U.S. wheat stakeholders. For example, the report notes that wheat and rice account for the largest share of products procured under the Indian government’s Minimum Support Price (MSP) program, which utilizes highly distorting market-price support. The report shares concerns about Russia’s provision of transportation subsidies for wheat and other products from the interior to export destinations. Concerns also continue about Türkiye’s subsidies, inward processing program for wheat, and its reimbursement of freight costs for certain exports.

The Craft of Wheat Quality

Kansas Wheat publishes an interesting podcast called “Wheat’s On Your Mind.” A recent episode featured a conversation with Kathy Brower, Laboratory Manager for Grain Craft’s Innovation and Quality Lab at the Kansas Wheat Innovation Center in Manhattan, Kan. Noting that wheat is a food ingredient that requires quality control, she explains what makes wheat good or bad from a miller’s perspective. Listen to the podcast here.

International Food Aid Showcase

The United States provides critical foreign humanitarian assistance through international food aid programs administered by USDA and USAID, helping populations in need around the world while supporting U.S. suppliers. On Thursday, May 2, stakeholders from all segments of the U.S. food assistance value chain including USW and the National Association of Wheat Growers will participate in an International Food Aid Showcase at USDA including a panel discussion and interactive displays for networking and collaboration.

Resilience in the Face of Climate Variability

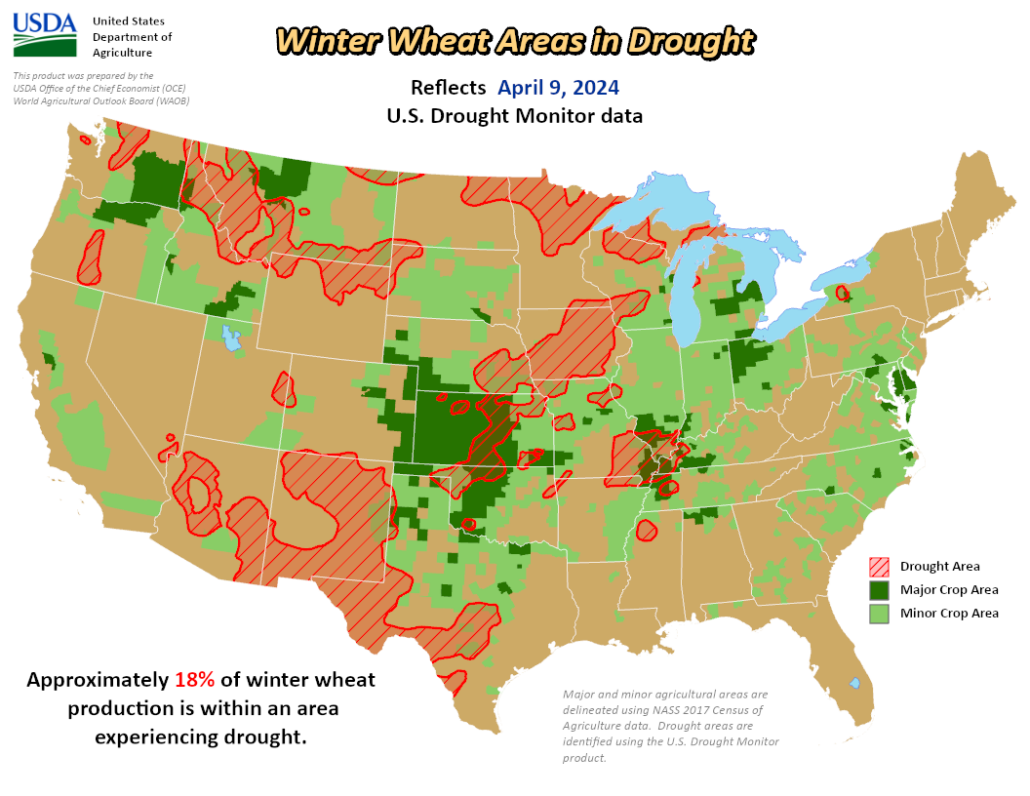

In recent decades, the U.S. wheat market has shown remarkable stability despite facing the growing challenges of climate change and extreme weather conditions. A recent study led by the University of Southampton delves deep into the wheat sector’s resilience and the broader theme of food security in developed countries. The research highlights the crucial role of market forces in maintaining price stability in the food market. Even under the pressures of varying climate conditions, this stability has persisted over the past half-century. Read more here.

Subscribe to USW Reports

USW publishes various reports and content available to subscribe to, including a bi-weekly newsletter highlighting recent Wheat Letter blog posts and wheat industry news, the weekly Price Report, and the weekly Harvest Report (available May to October). Subscribe here.

Follow USW Online

Visit our Facebook page for the latest updates, photos, and discussions of what is going on in the world of wheat. Also, find breaking news on Twitter, video stories on Vimeo and YouTube, and more on LinkedIn.