Because no two crops are alike, the world’s flour millers, bakers and wheat food processors must have some assurance that the wheat they buy will meet their needs. That is why USDA Foreign Agricultural Service cooperator U.S. Wheat Associates (USW) and its partner organizations collect and analyze samples of all six classes of U.S. wheat, compile results and share that data around the world every year.

Legacy organizations to USW first identified the need to quickly gather and share new crop data in 1960. Since then, wheat farmer checkoff dollars and Market Access Program (MAP) funding have been invested to publish a complete picture of each year’s harvest. This commitment to transparency offers confidence in the data that, together with the trade service and technical support also funded by MAP and the Foreign Market Development (FMD) program, help differentiate U.S. wheat exportable supplies from competing supplies from Russia, Ukraine, Europe, Canada, Australia and Argentina.

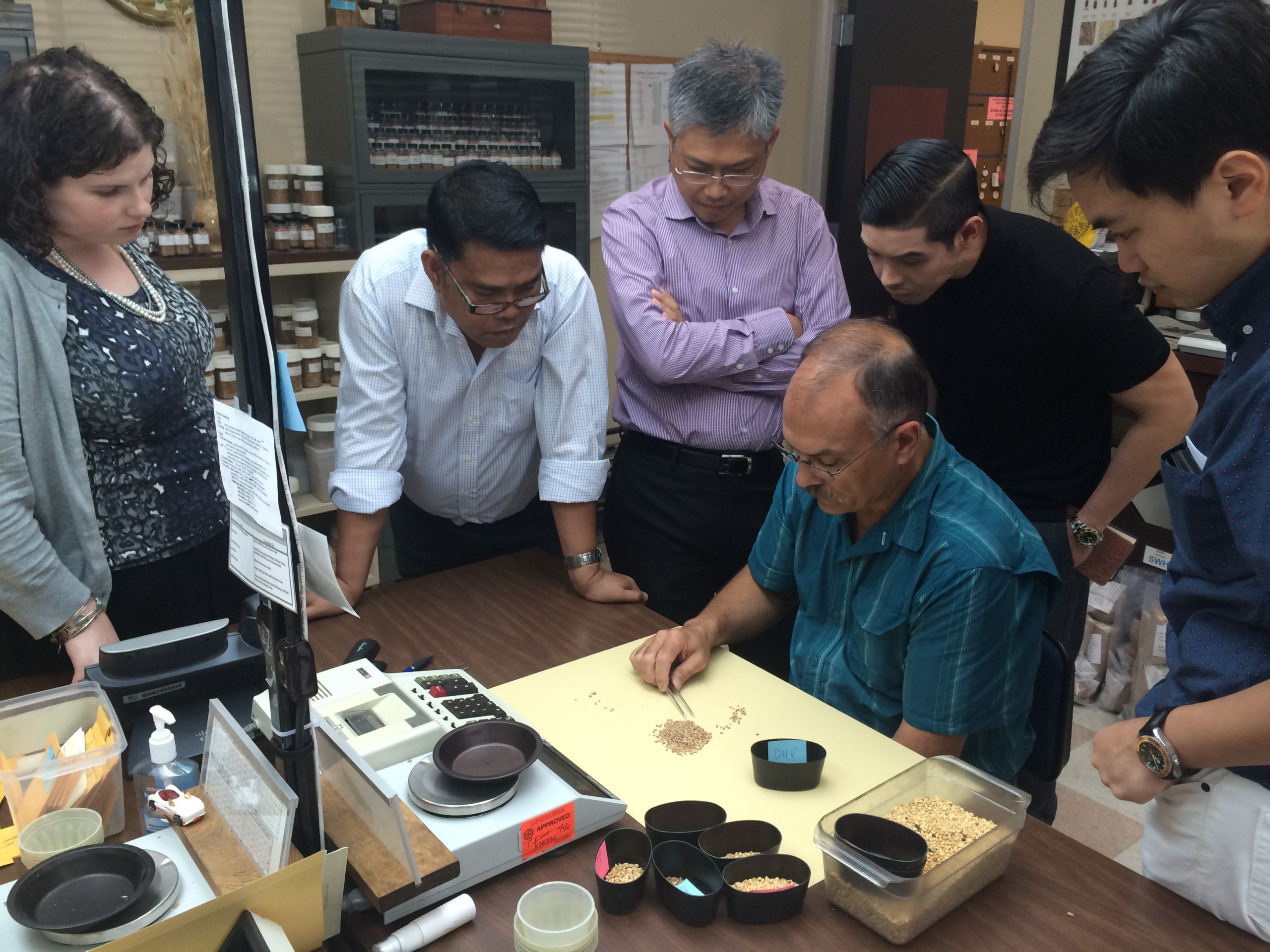

USW works with several wheat quality organizations, including the Federal Grain Inspection Service and the USDA/ARS Hard Winter Wheat Quality Laboratory, to collect, grade and analyze thousands of wheat samples from local elevators and sub-lot samples from export elevators. Sampling begins with early winter wheat harvest and continues until the U.S. hard red spring (HRS) and durum harvests are complete, usually by early October. The data is compiled by class and by production region. By late October, class reports and a complete USW Crop Quality Report are published on USW’s website and the Crop Quality Report is printed as a booklet in English, Spanish, French, Arabic and Mandarin.

USW then sends teams of farmers, wheat quality experts and representatives out to present that year’s data to its buyers. By mid-December, USW has presented current characteristics on grade factors, protein levels, flour extraction rates, dough stability, baking loaf volume, noodle color and texture and more for all six U.S. wheat classes to hundreds of buyers, millers and processors in more than 25 countries. Buying decisions are made because of this effort; some are acted upon quickly. For example, with information they learned at USW’s 2015 Crop Quality Seminar, millers in Portugal imported 36,500 metric tons of HRS for the first time in 3 years.

U.S. wheat crop quality data forms the basis for our farmers’ ability to compete in the global wheat market. Without funding from MAP and the support of federally-funded inspection and quality analysis labs, this essential service to overseas customers would not be possible. It provides crucial support to annual U.S. wheat export sales averaging more than 26 million metric tons per year.