For 40 years, U.S. wheat farmers have supported U.S. Wheat Associates’ (USW) efforts to work directly with buyers and promote their six classes of wheat. Their contributions to state wheat commissions, who in turn contribute a portion of those funds to USW, qualifies USW to apply for export market development funds managed by USDA’s Foreign Agricultural Service. Currently, 17 state wheat commissions are USW members and this series highlights those partnerships and the work being done state-by-state to provide unmatched service. Behind the world’s most reliable supply of wheat are the world’s most dependable people – and that includes our state wheat commissions.

Member: South Dakota Wheat Commission

Member of USW since 1980

Location: Pierre, S.Dak.

Classes of wheat grown: Hard Red Winter (HRW) and Hard Red Spring (HRS)

USW Leadership: Milo Schanzenbach, 1983/84; Stanley Porch, 1994/95; Darrell Davis, 2012/13.

The South Dakota Wheat Commission (SDWC) was established in 1961 when the legislature passed the South Dakota Wheat Resources Act declaring it “the public policy of the state of South Dakota, by protecting and stabilizing the wheat industry and the economy of the areas producing wheat.” Its mission “to stabilize and improve South Dakota’s wheat industry through research, market development and education,” has grown the footprint of South Dakota wheat to over 100 countries around the world. Research has allowed farmers to produce high-quality, high yielding wheat that has enhanced the overall appeal of wheat grown in the Great Plains state.

Darrell Davis, 2012/13 USW Chairman and South Dakota wheat farmer at the 2012 USW Summer Board Meeting.

Why is export market development important to South Dakota wheat farmers and why do they continue to support USW and its activities?

South Dakota is historically the sixth largest U.S. wheat producing state. Production is nearly equally split between U.S. HRW and HRS wheat. Unfortunately, despite its production size, there are no flour mills in South Dakota, so every bushel of wheat produced must leave the state. The final destination of the wheat varies between domestic and global markets. Without a strong global market for high quality milling wheat, South Dakota wheat farmers would lack the competition that is necessary to also enhance the value of domestic sales. Collaboration with other wheat producing states, through a USW membership, greatly strengthens South Dakota’s global promotion and export opportunities.

How have South Dakota wheat farmers recently connected with overseas customers?

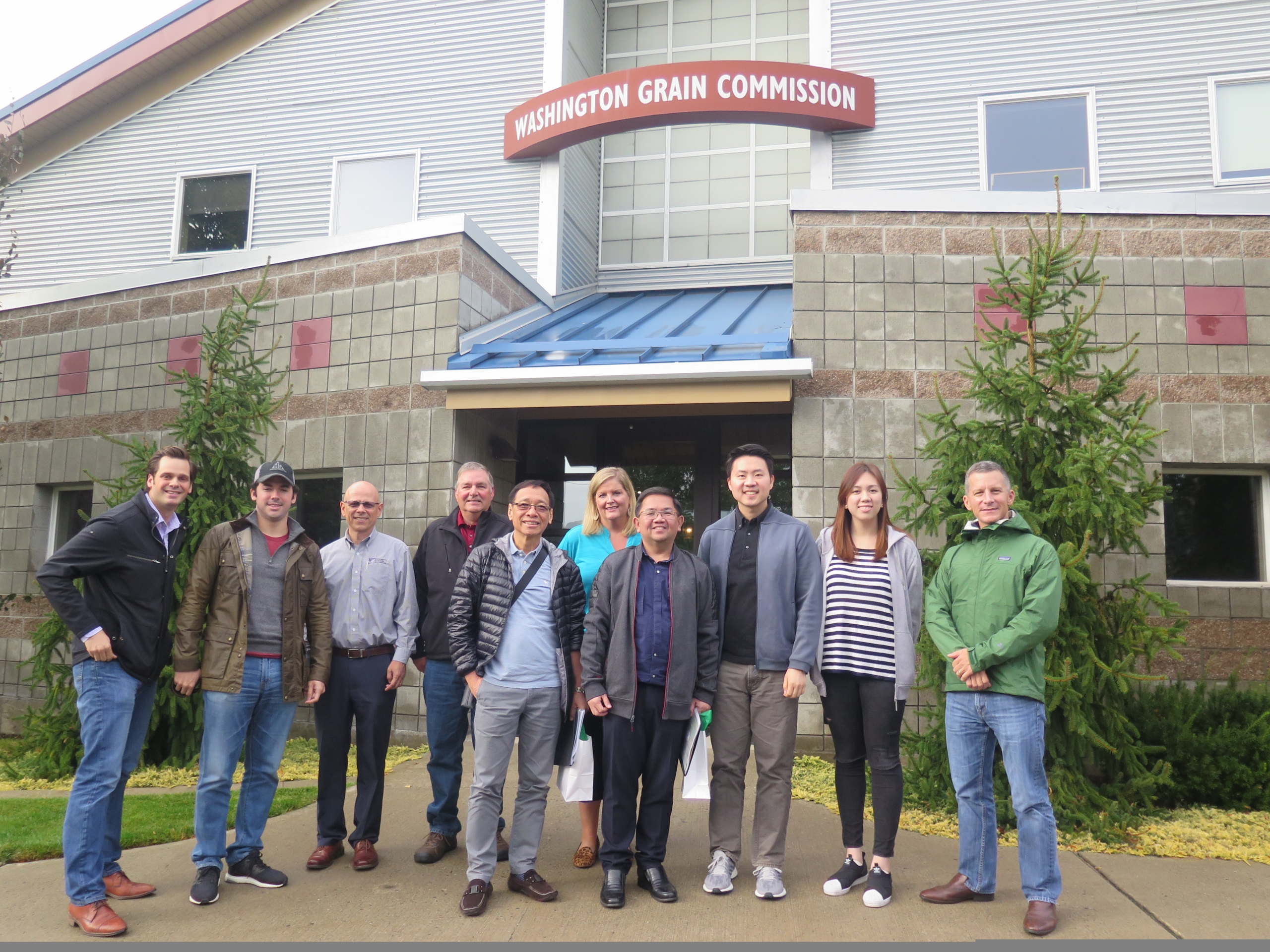

South Dakota wheat farmers enjoyed hosting the Taiwan Flour Mills Association Goodwill Mission in 2019. It was a pleasure to once again jointly sign a Letter of Intent that confirms their desire for the procurement of high milling quality, U.S. wheat. A special fellowship develops in the opportunity to connect outstanding wheat farmers with outstanding global wheat customers. When health precautions prevented the visit of a Sub-Saharan Africa trade delegation to South Dakota in 2020, that opportunity for information exchange and a face-to-face experience was repackaged into a virtual visit. The virtual format provided exposure to an even larger group of customers than might be included in a normal trade delegation visit.

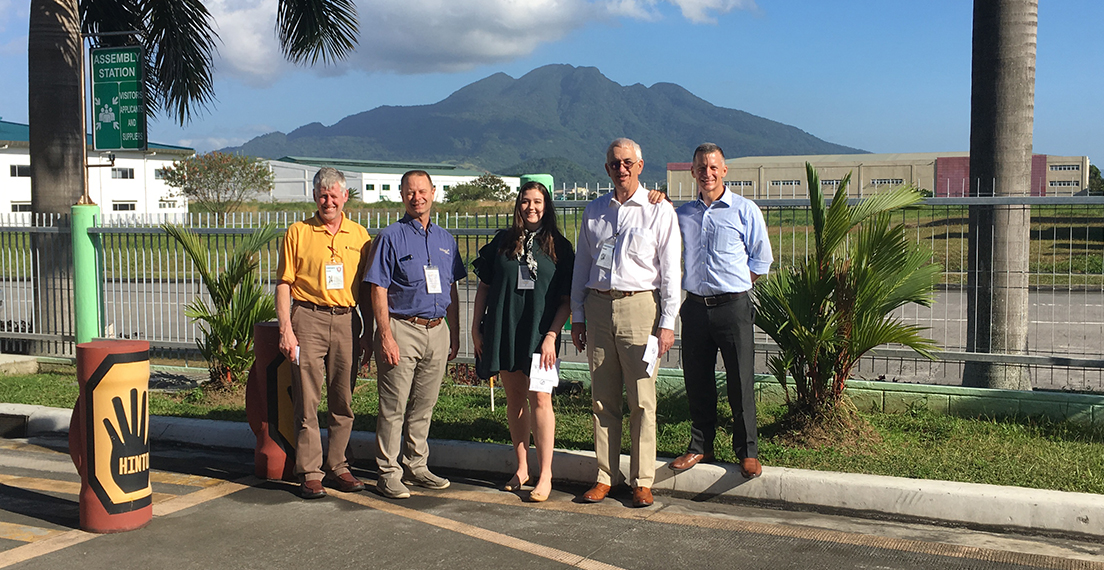

Ralph Bean, Agricultural Counselor, USDA Foreign Agricultural Service, U.S. Embassy Manila (far right), met with farmers from South Dakota, North Dakota and Montana during their trip to South Asia as a part of the 2017 USW Board team. Pictured second from the right is Clint Vanneman, South Dakota wheat farmer. The farmers were guests of honor at the 9th International Exhibition on Bakery, Confectionary and Foodservice Equipment and Supplies, known as “Bakery Fair 2017,” hosted by the Filipino-Chinese Bakery Association Inc.

1994/95 USW Chairman and South Dakota wheat farmer Stanley Porch (far left) hosted the 2015 USW Nigerian Trade Delegation on his farm and is pictured here with past USW Cape Town and Lagos staff, Gerald Theus (middle left) and Muyiwa Talabi (middle right), as well as 2012/13 USW Chairman and South Dakota wheat farmer Darrell Davis (far right).

What is happening lately in South Dakota that overseas customers should know about?

Recent wet climatic conditions have reduced the wheat acres seeded across South Dakota in recent years. Although acres were reduced, the 2020 harvest was phenomenal! A new state record was established for HRW wheat. Harvest results consistently revealed high yielding fields with desirable test weight and protein. Throughout the season, the wheat had strong straw strength with extremely limited disease challenges. Results from the 2020 HRS wheat harvest also showed strong yields, test weight and protein with limited disease challenges. The exceptional wheat harvested in South Dakota in 2020 will produce equally exceptional milling potential for our customers!

Learn more about the South Dakota Wheat Commission on its website here and on Facebook and Twitter.