For 40 years, U.S. wheat farmers have supported U.S. Wheat Associates’ (USW) efforts to work directly with buyers and promote their six classes of wheat. Their contributions to state wheat commissions, who in turn contribute a portion of those funds to USW, qualifies USW to apply for export market development funds managed by USDA’s Foreign Agricultural Service. Currently, 17 state wheat commissions are USW members and this series highlights those partnerships and the work being done state-by-state to provide unmatched service. Behind the world’s most reliable supply of wheat are the world’s most dependable people – and that includes our state wheat commissions.

Member: Minnesota Wheat Research & Promotion Council

USW Member since 1980

Location: Red Lakes Falls, Minnesota

Classes of Wheat Grown: Hard Red Spring (HRS), Hard Red Winter (HRW)

USW Leadership: Don Loeslie, 1989/90 Chairman; Bruce Hamnes, 2000/01 Chairman; Rhonda K. Larson, 2019/20 Secretary-Treasurer (slated for 2021/22 Chairman)

The Minnesota Wheat Research & Promotion Council builds opportunities for farmer profitability working to enhance wheat research and promote wheat in the marketplace.

(L to R): Michael Peters, Oklahoma; Rhonda Larson, Minnesota; Darren Padget, Oregon; Doug Goyings, Ohio; Vince Peterson, USW.

Why is export market development important to Minnesota wheat farmers and why do they continue to support USW?

Like most of the country, more than half the wheat grown in Minnesota is exported. Developing and maintaining wheat export markets is vital to improving farm profitability.

“We produce more wheat in Minnesota than can be consumed by Minnesota, so overseas customers are essential customers for our wheat farmers,” said Charlie Vogel, Chief Executive Officer.

Scott Swenson (second from left), a farmer from Minnesota, participated on the 2018 USW Board Team that traveled to China and Taiwan.

How have Minnesota wheat farmers recently interacted with overseas customers?

Minnesota has proudly hosted many trade teams over the years and are excited to continue to elevate this effort in the future. Most recently, Minnesota hosted a team from Africa that visited the Duluth Seaway Port Authority, toured the CHS Export Terminal, met with Riverland Ag regarding storage in Duluth, wheat farms and elevators throughout Northern Minnesota.

“Most of our interaction with overseas customers has been possible because of U.S. Wheat Associates and the Northern Crops Institute,” said Vogel. “This face to face interaction is where we have a chance to tell our story and demonstrate the value and quality of Minnesota Wheat to our customers.”

What is happening lately in Minnesota that overseas customers should know about?

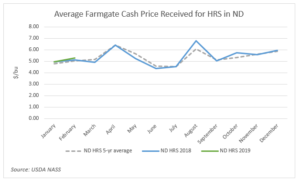

University of Minnesota wheat breeders and private breeders are increasing their emphasis on improving wheat quality in our varieties. They are making strides in improving yield that helps farmers, but at the same time, elevating the level of quality wheat we’re able to provide. Historically, HRS wheat in Minnesota produces a high protein product and a high-quality baking experience.

“Minnesota growers are by far the most progressive people I’ve ever worked with in terms of weighing economic, environmental and consumers demands,” said Vogel. “They look beyond the farm gates, to a bigger picture of the customers we serve around the world.”

Learn more about the Minnesota Wheat Research & Promotion Council on its website and on Facebook and Twitter.

Greg LeBlanc (fourth from right), a farmer from Minnesota, participated on the 2016 USW Board Team that traveled to Japan and Korea.

Minnesota representatives Mark Jossund (second from left) and Kevin Leiser (third from left) at the 2016 USW Board of Directors Summer Meeting.

Minnesota Wheat CEO Charlie Vogel with USW Market Analyst Claire Hutchins and South Dakota Wheat CEO Reid Christopherson at the Northern Commodity Transportation Conference in Bloomington, MN, in March 2020.