The U.S. durum market remains supported by tight supplies, leading to a reduction in consumption that may, or may not, hold until the 2022 harvest. That is an observation by North Dakota Wheat Commission Policy and Marketing Director Jim Peterson in a Feb. 2, 2022, webinar sponsored by the Northern Crops Institute (NCI).

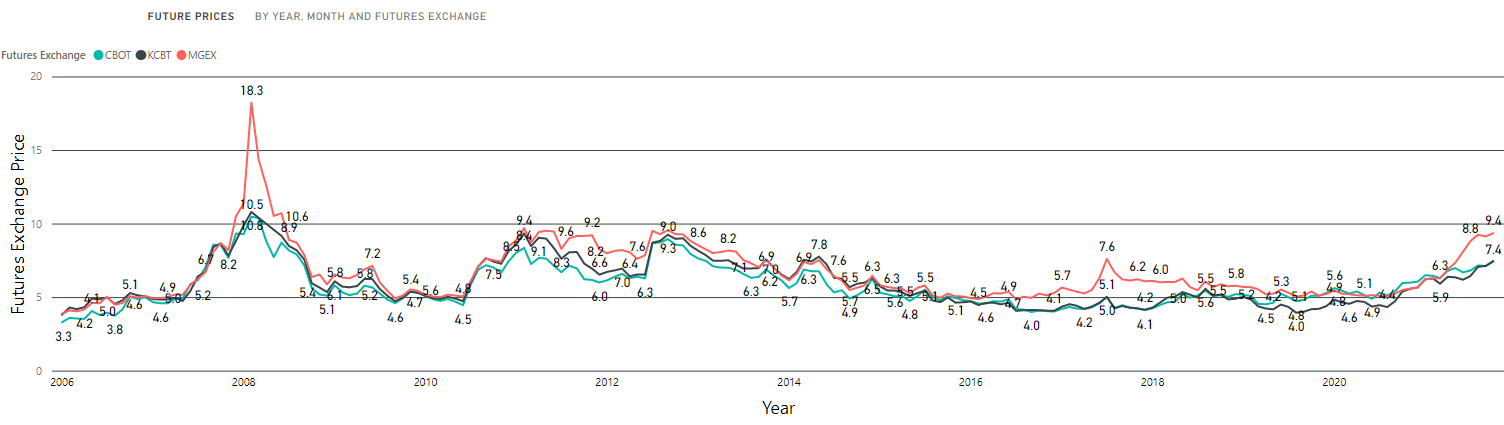

Following a run up fueled by supply issues, durum prices have “softened in values since mid-January,” Peterson said. That is reflected in what the International Grains Council estimates as a 20-year low in total durum use.

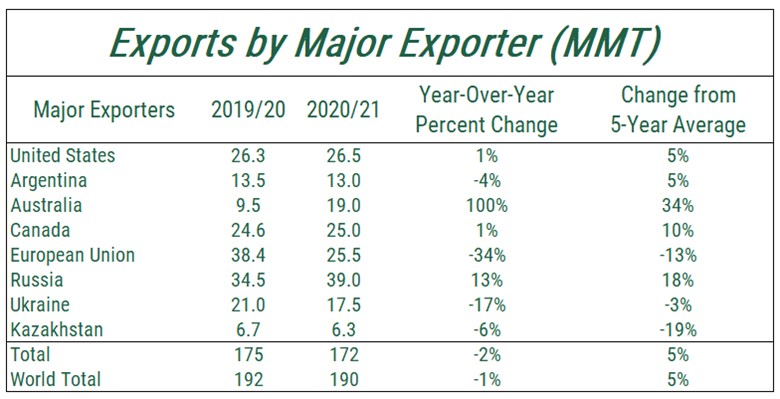

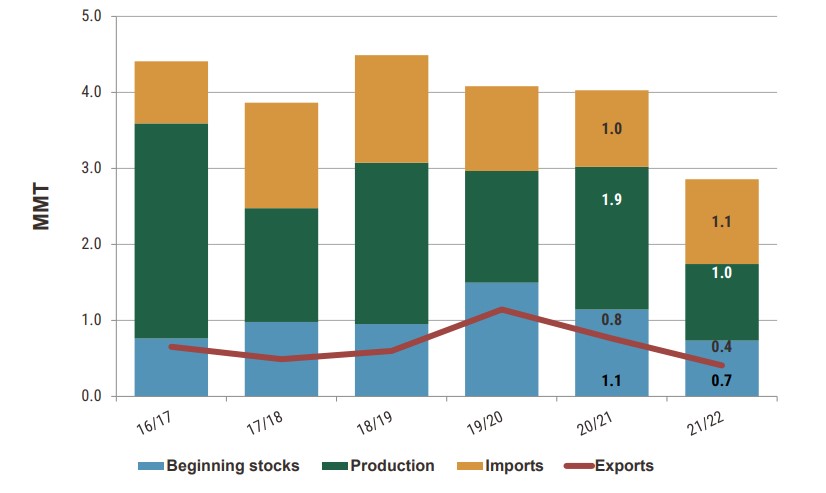

For example, USDA currently expects U.S. durum exports in 2021/22 at 410,000 metric tons (MT). U.S. Wheat Associates (USW) reports commercial U.S. durum sales at about 168,000 MT to date in marketing year 2021/22. That is down from about 658,000 MT at the same time last year. Canadian durum exports from August through December 2021 are also about half their total sales compared to the year before.

U.S. Durum Market Supply and Demand. Drought cut U.S. durum production in 2021, and in Canada. Higher prices have rationed demand, reflected in USDA’s lower export estimate as of February 2022.

Buying Hand-to-Mouth

Peterson said durum buyers are only purchasing when the market gives them a chance to save some money. In addition, end-users are, when possible, increasing the amount of non-durum wheat flour for pasta production.

“We will see how long that rationing can continue,” Peterson said. He said buyers will have to replenish supplies before the 2022 harvest starts in June.

European durum prices are lower than Canadian and U.S. durum market prices. However, we sense more tightness in the European market and hopefully, that will translate into some export sales over the next few months,” Peterson said.

What is Ahead?

Jim Peterson, Policy and Marketing Director, North Dakota Wheat Commission.

North American farmers are now making spring planting plans. In the U.S durum market, farmers will consider the difference in federal crop insurance prices for hard red spring (HRS) and durum crops, Peterson explained.

“There is no question that the durum crop insurance price will be at a premium to spring wheat,” he said. Farmers will know what the difference is after February. In addition, Peterson said U.S. farmers will compare the potential income from durum and spring wheat before making their planting decisions.

Still, the Canadian and U.S. durum markets could see a 10% increase in durum planted area in 2022.

Tight Supplies

Of course, until the 2022 durum crop gets in market position, Peterson noted, “we could have some very tight months coming up depending on what happens with demand.”

Readers can watch a recording of NCI’s one-hour webinar on the world and U.S. durum market online here.