By Claire Hutchins, USW Market Analyst

U.S. wheat farmers across the Northern Plains are hard at work trying to plant spring wheat for the 2020 harvest. Their efforts depend on widely varying regional conditions so many producers are behind schedule while some have pulled ahead.

USDA’s most recent crop progress report shows total U.S. spring wheat planting at 42 percent complete, slightly ahead of last year but well behind the 5-year average of 63 percent. Cool temperatures, overly wet field conditions and delayed field work from the 2019 harvest are slowing farmers down in northwestern Minnesota, eastern North Dakota and northeastern South Dakota. More favorable conditions are helping farmers progress across other parts of the Northern Plains.

According to USDA, only 40 percent of Minnesota spring wheat is planted, compared to the 5-year average of 67 percent. Most delays are in the northwestern part of the state.

“We’re only 15 to 20 percent planted in northwestern Minnesota where wetter conditions are slowing field work,” said Charlie Vogel, Executive Director of the Minnesota Wheat Research and Promotion Council.

Conditions are similar in eastern North Dakota.

According to Dr. Frayne Olson, Crop Economist and Marketing Specialist at North Dakota State University, eastern North Dakota had a very wet fall and not all of the region’s wheat, canola, corn and soybeans were harvested on time which pushed fall field work into spring 2020.

“Spring weather has remained cool and wet with very few days suitable for field work,” he said.

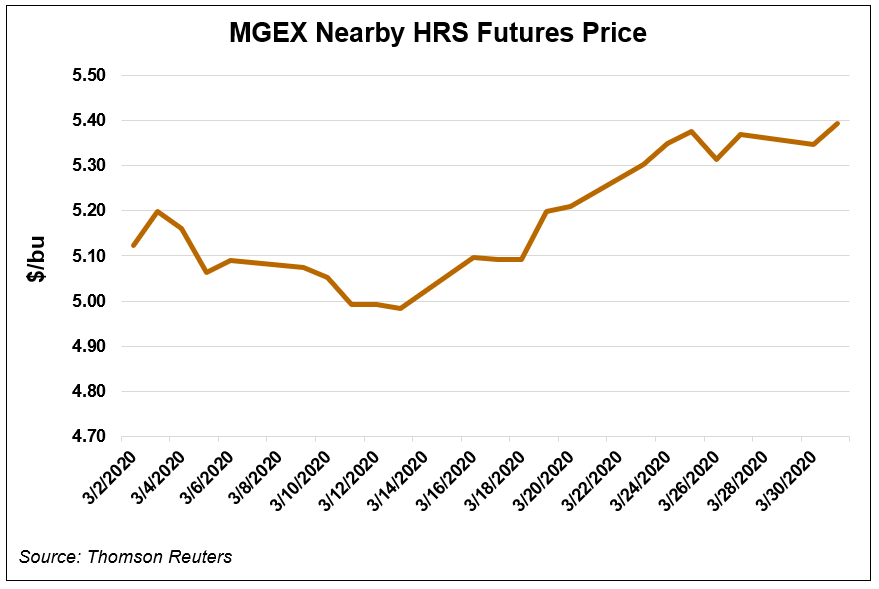

As of May 10, North Dakota spring wheat is only 27 planted compared to the 5-year average of 63 percent. Overly wet field conditions could drive farmers to opt for “Prevent Plant,” or fallow out, spring wheat acres. Farmers are eligible for crop insurance payments on fields when extreme conditions prevent them from planting the crop by a final, prescribed planting date.

“Even if some fields will be planted past the optimum seeding dates, there is still good yield potential,” Dr. Olson said. “Weather during the growing season will have a major impact on final yields and quality.”

In northeastern South Dakota, wet weather and colder soil temperatures are also delaying farmers’ ability to do spring field work. In this part of the state, farmers are also likely to Prevent Plant a portion of spring wheat acres. USDA estimates South Dakota producers will plant 850,000 acres (about 344,000 hectares) of spring wheat this year.

“At the beginning of the season, I thought we would come in a lot lower than USDA’s number due to overly wet field conditions, but recently, in the central part of the state, dealers sold of out spring wheat seed,” said Reid Christopherson, Executive Director of the South Dakota Wheat Commission. “Overall, we could end up close to USDA’s numbers.”

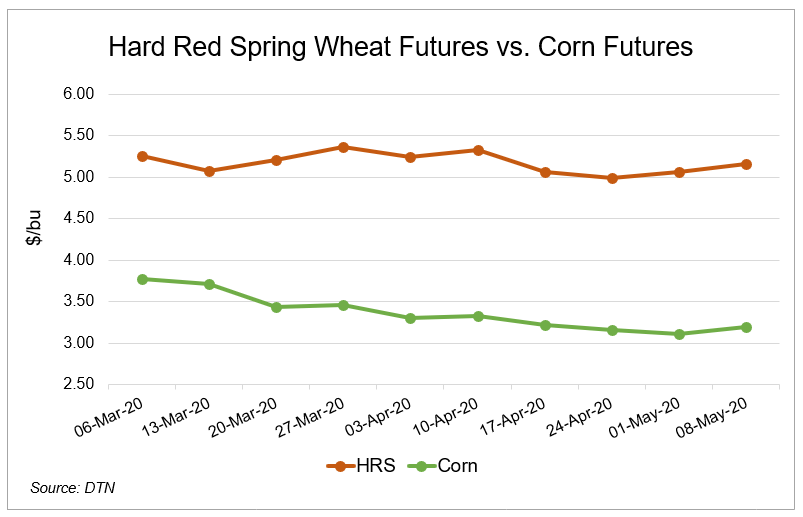

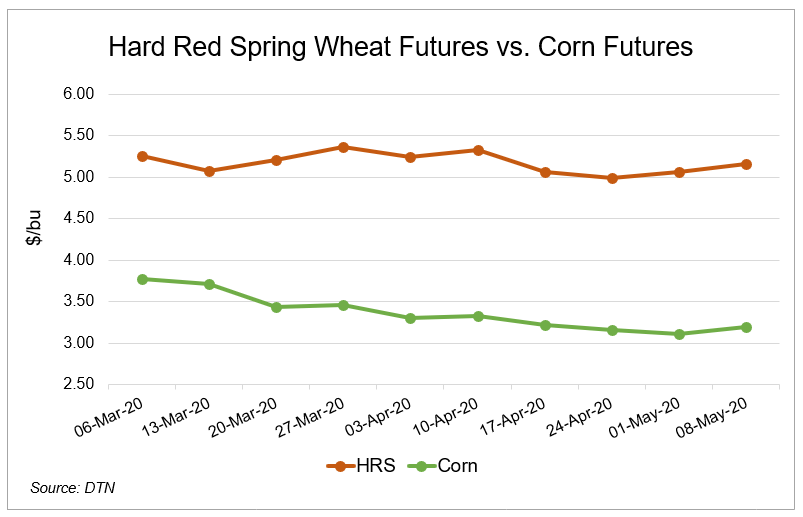

According to Christopherson, farmers are closely watching the decline in corn and ethanol demand and its impact on corn prices compared to spring wheat.

“Early in the planting window, producers may choose spring wheat over corn. Late in the planting window, they may choose soybeans,” said Christopherson.

Despite challenges in the eastern Northern Plains, spring wheat producers further west and south are making strong progress in the 2020 planting season.

“Warmer, drier weather, better harvest progress in fall 2019 and an earlier start are giving farmers a boost in central-western and southwestern Minnesota,” said Vogel.

About 85 percent of intended spring wheat acres are planted in that part of the state. Vogel estimates Minnesota’s southwestern region could add 50,000 “new” spring wheat acres this year (acres that would traditionally would have gone to either corn or soybeans) as producers explore spring wheat and cover cropping rotational opportunities that could add value to overall farm profitability.

“In the north, we saw record seed corn sales in January, but we have recently seen record seed corn returns so some of those acres will go to spring wheat,” said Vogel.

In late March, USDA estimated Minnesota producers would plant 1.35 million acres (about 546,000 hectares) of spring wheat, down 7 percent year-over-year, if realized. Given recent marketing and price challenges with corn and the interest in new crop rotation systems, Vogel estimates Minnesota producers could actually plant up to 1.44 million acres (about 583,000 hectares) of spring wheat this year, in line with 2019.

In western North Dakota, “Producers are seeing better progress due to warmer, drier conditions,” said Erica Olson, the North Dakota Wheat Commission’s Market Development and Research Manager. Despite the possibility for more Prevent Plant acres in the eastern part of the state, she believes North Dakota spring wheat acres could still reach USDA’s estimate of 6.10 million acres (about 2.5 million hectares) in 2020.

Favorable planting weather in central South Dakota is helping farmers get into the fields and plant more quickly than their peers in the northeastern part of the state. According to USDA, 75 percent of the state’s spring wheat is planted compared to 38 percent last year and the 5-year average of 78 percent.

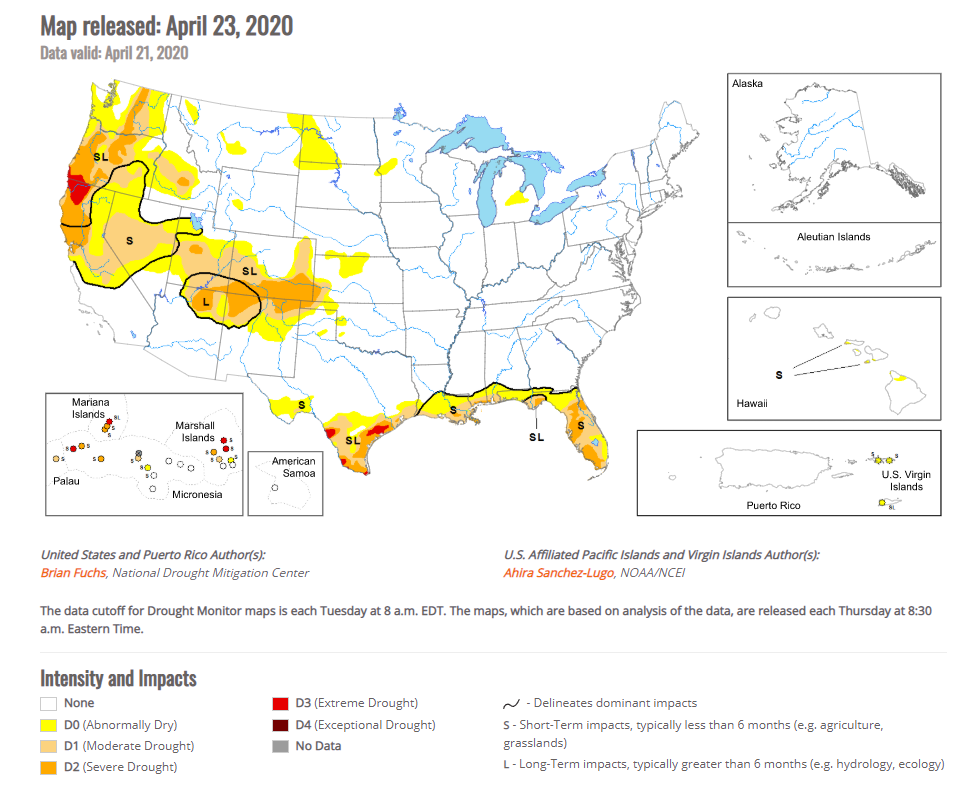

Dry weather is helping Montana producers work through their spring wheat planting efforts. Though only 50 percent of the state’s spring wheat is in the ground compared to the 5-year average of 62 percent, progress is right in line with last year. Additionally, according to Cassidy Marn, Executive Vice President of the Montana Wheat and Barley Committee, Montana could see more spring wheat planted area than USDA’s initial estimate of 3.30 million acres (about 1.34 million hectares) due to potentially less acres planted to barley in 2020.

“We could easily reach 3.30 million acres this year, and I wouldn’t be surprised if we reached 3.40 to 3.50 million acres,” said Marn, which would be up to 1.42 million hectares.