By Steve Mercer, USW Vice President of Communications

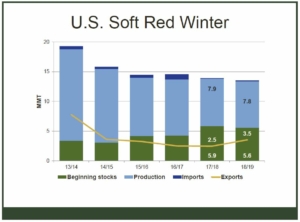

Grown in the eastern United States, soft red winter (SRW) wheat is a profitable choice for producing confectionary products like cookies (biscuits), crackers and cakes, and to blend its flour for baguettes and other bread products. U.S. Wheat Associates (USW) wants to share some key points about SRW exportable supply in marketing year 2018/19 and look ahead to its potential for 2019/20.

1. Good Quality. While excessive rain on the 2018/19 SRW crop did slightly lower average test weight and falling number, protein (9.9% on 12% moisture basis, composite) is above average and DON level (0.7 ppm composite) is slightly below average. Processors should find good qualities for crackers and segments of the crop with good cookie and cake qualities. The higher protein and good extensibility in the crop should add value in blending for baking applications. See more information at https://www.uswheat.org/market-and-crop-information/crop-quality/.

2. Least Cost. SRW is the lowest cost milling wheat in the world today, offered at an average FOB export price of US$202 per metric ton* for June delivery from U.S. Gulf ports. The International Grains Commission in its March Grain Market Report estimated SRW FOB price at $211, which is $6 less than French soft wheat. SRW exportable supplies are also available from Lakes ports (Toledo, Ohio), and Atlantic ports (Norfolk, Virginia, and Wilmington, North Carolina). See more information at https://www.uswheat.org/market-and-crop-information/price-reports/.

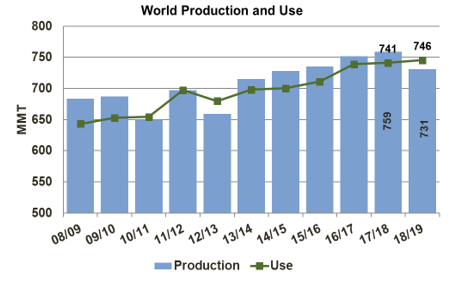

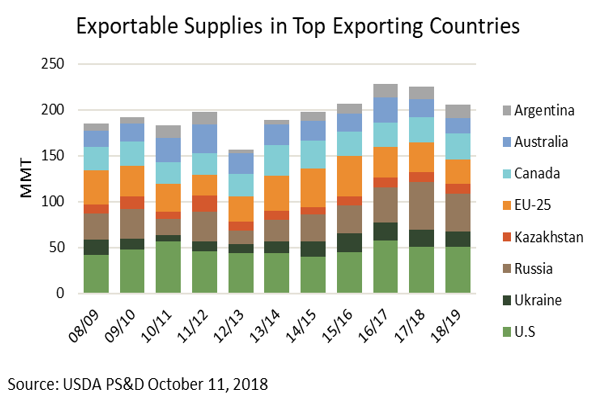

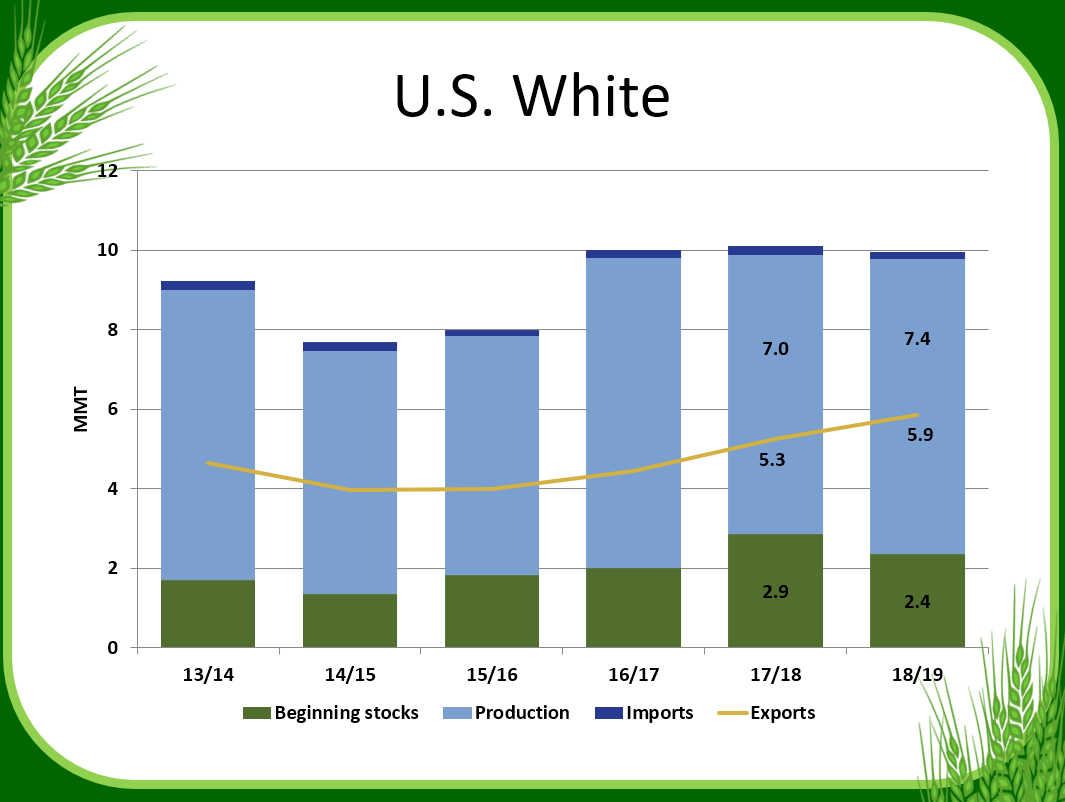

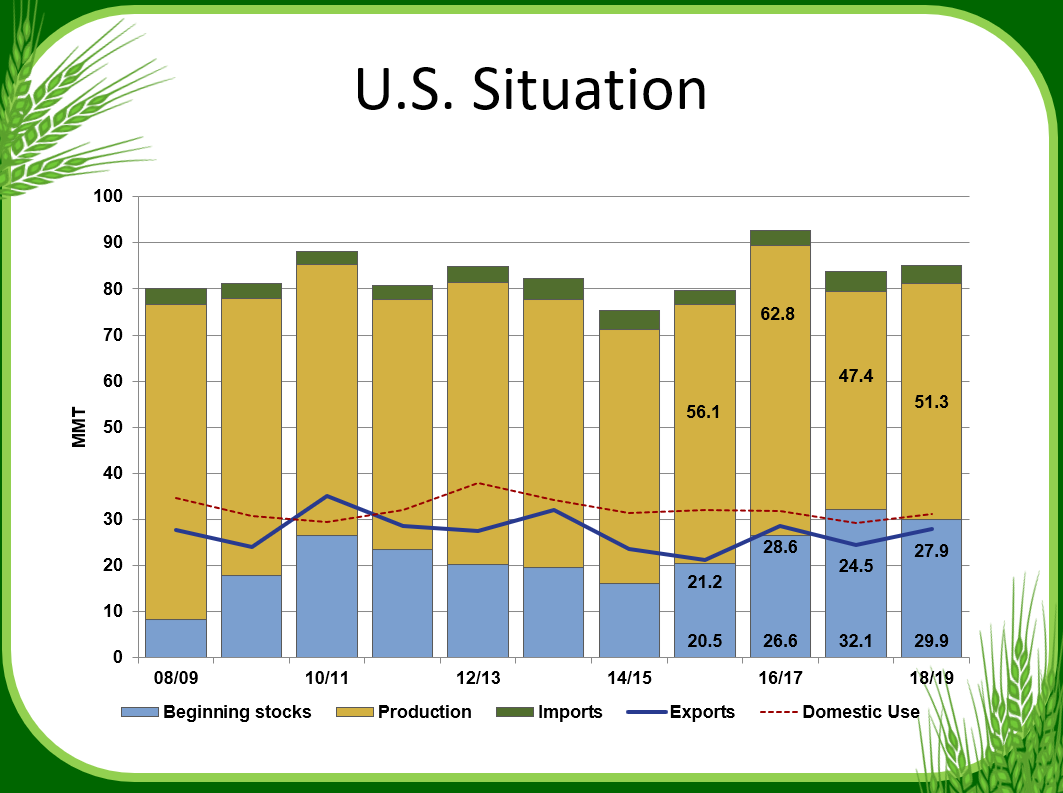

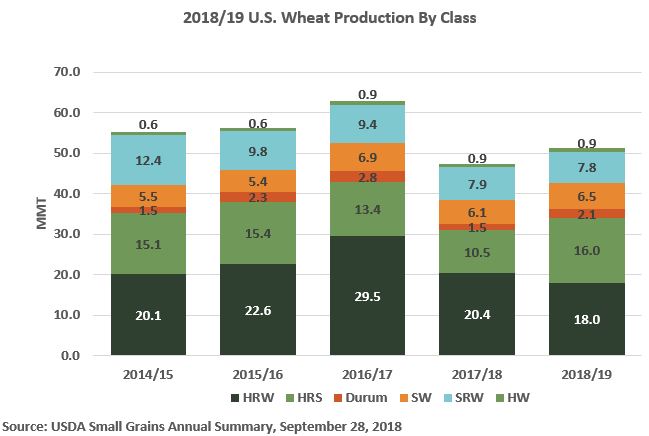

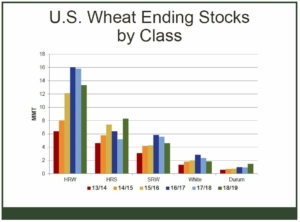

3. Supply is Down. Ending stocks of SRW have declined from 5.9 MMT in 2016/17 to USDA’s latest estimate of 4.6 MMT for 2018/19 (by comparison, SRW ending stocks in 2013/14 were 3.1 MMT after China imported 3.6 MMT that marketing year). Reduced supply relates to a near 50% decline in total production from 15.4 MMT in 2013/14 to USDA’s current estimate of 7.8 MMT in 2018/19, as well as an upturn in exports (see below). See more information at https://www.uswheat.org/market-and-crop-information/supply-and-demand/.

SRW ending stocks have declined steadily since 2016/17 on less production and more exports. Source: USDA

4. Demand is Up. As of April 4, SRW exports of 3.3 million metric tons (MMT) are 36% more than at the same time in marketing year 2017/18. This represents the most volume SRW sales year to date since 2014/15. Commercial SRW sales to Mexico, Colombia, Peru, Ecuador and Brazil are up significantly, as are imports by Central American and Caribbean countries and Nigeria. See more information at https://www.uswheat.org/market-and-crop-information/commercial-sales/.

U.S. SRW wheat supplies are down; export demand takes an upturn. Source: USDA

5. Planted Area is Down. In February 2018, USDA reported that SRW seeded area for 2019/20 is 5.7 million acres (2.4 million hectares), or down 7% from last marketing year. Most of the states that typically produce the most exportable SRW supplies planted less. This decline is not more significant only because some farmers can harvest SRW and then quickly plant soybeans to get a double crop from the same acre. In general, U.S. crop farmers, who are driven by economic circumstances to minimize their net losses at best this year, are turning away from winter wheat to other crops that offer better returns. Total U.S. winter wheat seeded area for 2019/20 is at its second lowest level on record. See more information at https://www.nass.usda.gov/Publications/Todays_Reports/reports/wtrc0219.pdf.

*Source: USW Price Report, April 12, 2019