Black Sea Grain Corridor, Weather and Harvest Pressure Wheat Prices

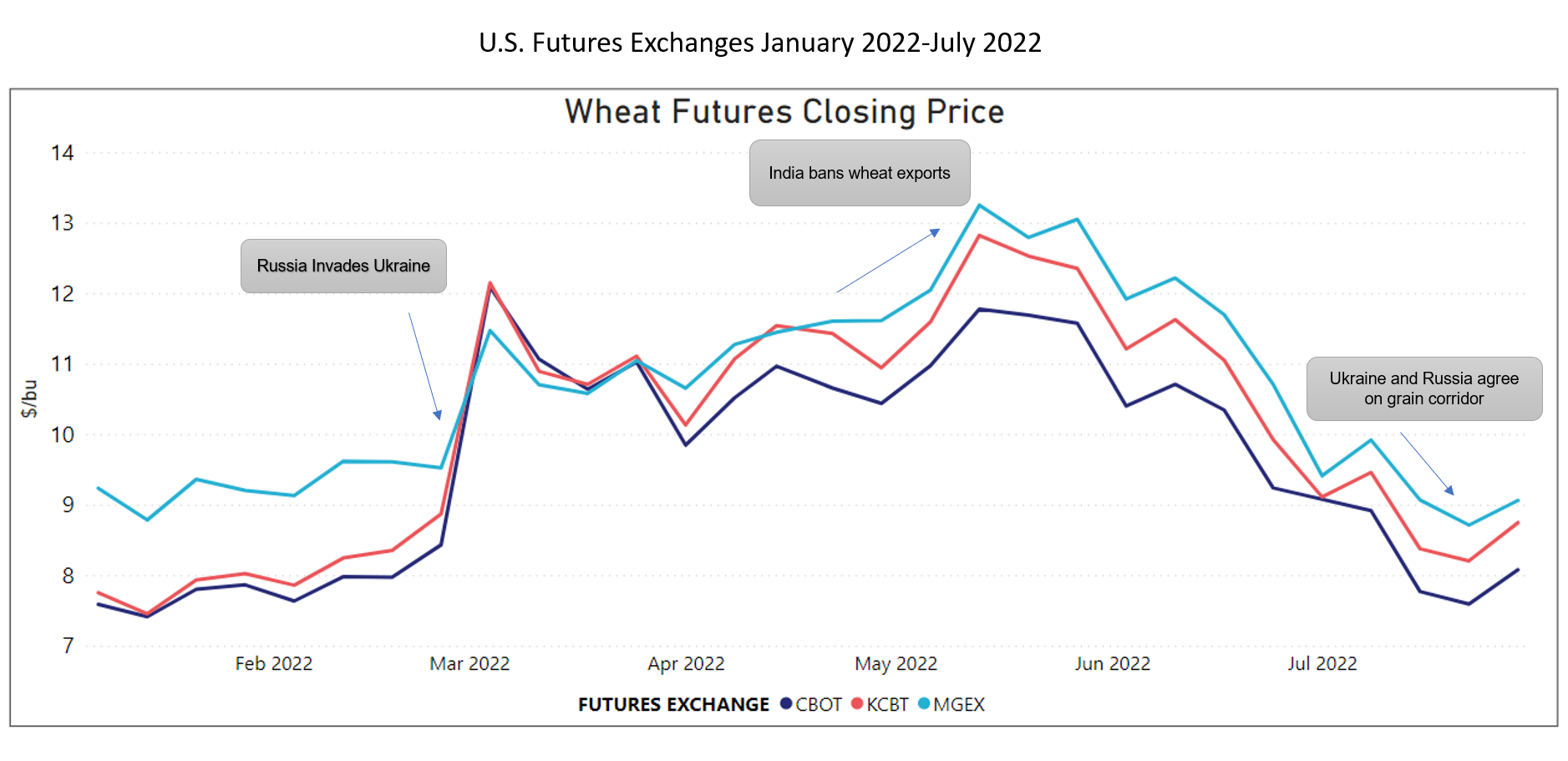

Russia’s unprovoked invasions of Ukraine sent already bullish wheat futures prices soaring earlier this year.

However, the first grain vessel to leave Ukraine since Russia’s February invasion set sail on Monday, August 1. The ship, carrying 27,000 metric tons (MT) of corn bound for Lebanon, was able to sail nine days after Ukraine and Russia agreed to a deal brokered by the United Nations (U.N.) and Turkey.

The news of the Ukrainian grain cargo’s safe arrival in Turkey sent Chicago Board of Trade wheat futures down more than 3% on August 2. Harvest across the northern hemisphere is another factor helping global wheat prices soften. However, the weather will play a crucial role in the weeks ahead. Hot weather could slash yields as it did in India this year. Too much rain could create quality issues.

In its July World Agricultural Supply and Demand Estimates (WASDE) report, the USDA forecast that global wheat production would total 771.6 million metric tons (MMT), falling 1.7 MMT from USDA’s June estimate and 7.3 MMT less than in 2021/22. Global consumption is forecast at 784.2 MMT, outpacing production by 12.6 MMT.

The tighter balance sheet for worldwide wheat year-over-year is partly due to the Black Sea conflict, but other key exporting regions are worth a look.

United States

The most recent USDA Crop Progress Report, published August 1, reported that 82% of the winter wheat crop was harvested. USDA expects 2022/23 hard red winter (HRW) production to reach 15.9 MMT, falling 6.0 MMT from last season. Soft red winter (SRW) production is estimated at 10.2 MMT, higher than last season, and winter soft white (SW) production at 7.8 MMT, 1.3 MMT more than 2021/22. Many state wheat commissions have reported very limited disease pressure because of dry conditions during the growing season.

In the same report, the USDA rated U.S. spring wheat at 70% good or excellent. Last week the annual hard red spring (HRS) tour estimated that HRS yield would reach 49.1 bushels per acre (bpa) (3.3 MT/ha), the highest since 2015 and above the 5-year average of 39.4 bpa (2.6 MT/ha). In a weekly update, the North Dakota Wheat Commission said spring wheat remains behind in its maturation but added that recent warmer temperatures are helping the crop develop.

Read the weekly U.S. Wheat Associates (USW) Harvest Report here. In addition, North Dakota Wheat Commission Policy and Marketing Director Jim Peterson reviewed U.S. and global durum supply and demand in a webinar sponsored by the Northern Crops Institute (NCI) Aug. 3.

Canada

Canada is rebounding from a drought that slashed spring wheat and durum production there in 2021/22. The USDA raised the Canadian wheat forecast by 57% compared to last year. An analyst with MarketsFarm warned that the USDA is too optimistic and does not take into account the late plantings in the eastern Prairies and the lingering drought in western Canada. The USDA puts 2022/23 exports at 25.0 MMT.

European Union

The European Union (E.U.) has recently been hit with a severe heat wave. Last week the E.U.’s crop monitoring service, MARS, cut its yield forecast to 5.74 MT/ha. France, the largest wheat-producing country in the E.U. experienced its driest July on record and the driest month since 1961. Last week, Agritel, a French consultancy, cut its forecast for French wheat. German farm group DBV, increased Germany’s 2022 winter wheat harvest by 1% to 21.38 MMT.

While the hot weather in some E.U. countries is concerning, a drought in Romania is affecting the water levels on the Danube River. The river is a major artery for transporting Romanian and, increasingly, Ukrainian grains to E.U. countries and to the Black Sea. The lower water levels mean that ships must sail at reduced tonnage. The Rhine River in Germany and Po River in Italy are also low meaning that barges carrying grain are either unable to sail or must sail with reduced cargos.

Australia

Production in Australia is expected to fall 6.3 MMT to 30.0 MMT this season following the bumper crop harvested in 2021/22. Exports are expected to fall 3.5 MMT to 24 MMT, but this is still 45% above the 5-year average. Even with the surplus of exportable wheat, port capacity in Australia is tight, making it hard for exporters to manage increased demand.

Argentina

The USDA Foreign Agricultural Service attaché, on July 25, lowered the 2022/23 export forecast to 12.35 MMT or 1.15 MMT less than the July WASDE forecast. The wheat-growing region is experiencing prolonged dry weather due to a protracted La Niña weather event making it difficult for farmers to plant their wheat crops.

Russia

Russia is expected to harvest a record crop this season. SovEcon, a Russian market analyst, put total wheat production at 90.9 MMT. The USDA estimates a more modest 81.5 MMT, but even that is 8% higher than in 2021/22 if realized. Recent heavy rain has affected the quality of the wheat being harvested reported Reuters. AgriCensus said that the amount of wheat designated as feed grain would be higher.

Ukraine

Ukraine is expected to harvest 19.5 MMT of wheat in 2022/23 according to USDA, falling 41% behind its 2021/22 production level. Exports are expected to fall to 10.0 MMT, dropping nearly 9.0 MMT year-over-year. Exports are down because of Russia’s Black Sea blockade; however, grain exports through the Black Sea resumed this week. Unfortunately, the ultimate outcome of this deal remains unknown.

Kazakhstan

The Kazak minister of agriculture said that wheat production in the Central Asian country would be 15% to 20% higher this year compared to last. The minister forecasts up to 13.5 MMT total wheat production this season. The Kazakh Grain Union is even more optimistic, indicating 16.0 MMT of wheat production and 9.0 MMT of grain available for export.

Nontraditional Wheat Exporters

Brazil is expected to harvest a record wheat crop in 2022. According to Conab, the food supply and statistics agency, wheat farmers in Brazil planted the largest area in 32 years, around 2.9 million hectares (7.16 million acres), and will harvest a record 9.0 MMT of wheat if the weather holds up. Conab said that Brazilian farmers boosted their plantings due to higher prices caused by supply disruptions.

India boasted plans to export as much as 10.0 MMT of wheat this season. However, hot weather weeks before harvest cut yields. The country instead banned wheat exports, thereby adding even more uncertainty and disruption to the global wheat market.

Chicago Board of Trade (CBOT) wheat futures have averaged $9.61 since January. On Tuesday, August 2, the September contract was trading at $7.74. This is good news for wheat buyers. Allowing Ukrainian wheat back into the market via the “grain corridor” is a positive move for the global price of wheat. The weather in key growing regions, both during harvest and during fall planting, will be the thing to keep an eye on.

By USW Market Analyst Michael Anderson