The United States is the world’s most reliable choice of high-quality milling wheat, with unmatched service and value. The U.S. wheat store is always open, and our customers can depend on the integrity of our supply chain, the quality of U.S. wheat and our unmatched reliability as a supplier because prices are transparent and honored; quality is assured; government intervention is banned; and U.S. Wheat Associates provides trade servicing and technical support.

Click here to interact with a map of U.S. wheat production by class and how it is transported to export terminals.

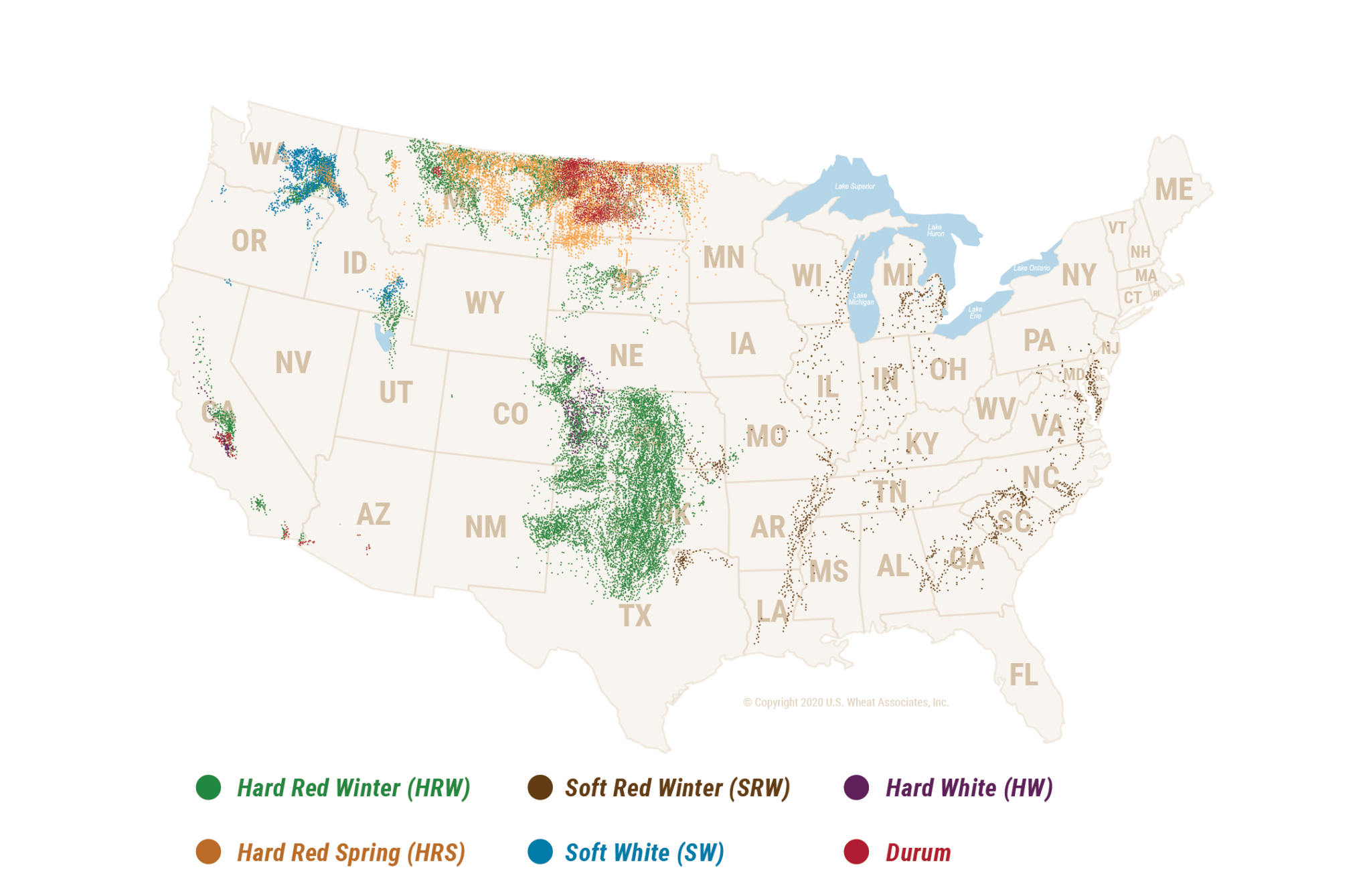

WHERE IS U.S. WHEAT PRODUCED?

The U.S. wheat store is always open: U.S. farmers overcome significant risks every year to meet domestic wheat demand and still provide about half their crop for export markets. Farmers and commercial warehouses can store and efficiently transport wheat in top condition to meet overseas demand.

Wheat is grown or harvested every month of the year in 42 of the 50 U.S. states. U.S. agricultural areas differ dramatically in topography, soils and climate, so the wheat grown varies widely by region. Thus, an importer or domestic miller should select the appropriate class with the correct quality specifications to obtain the wheat they need.

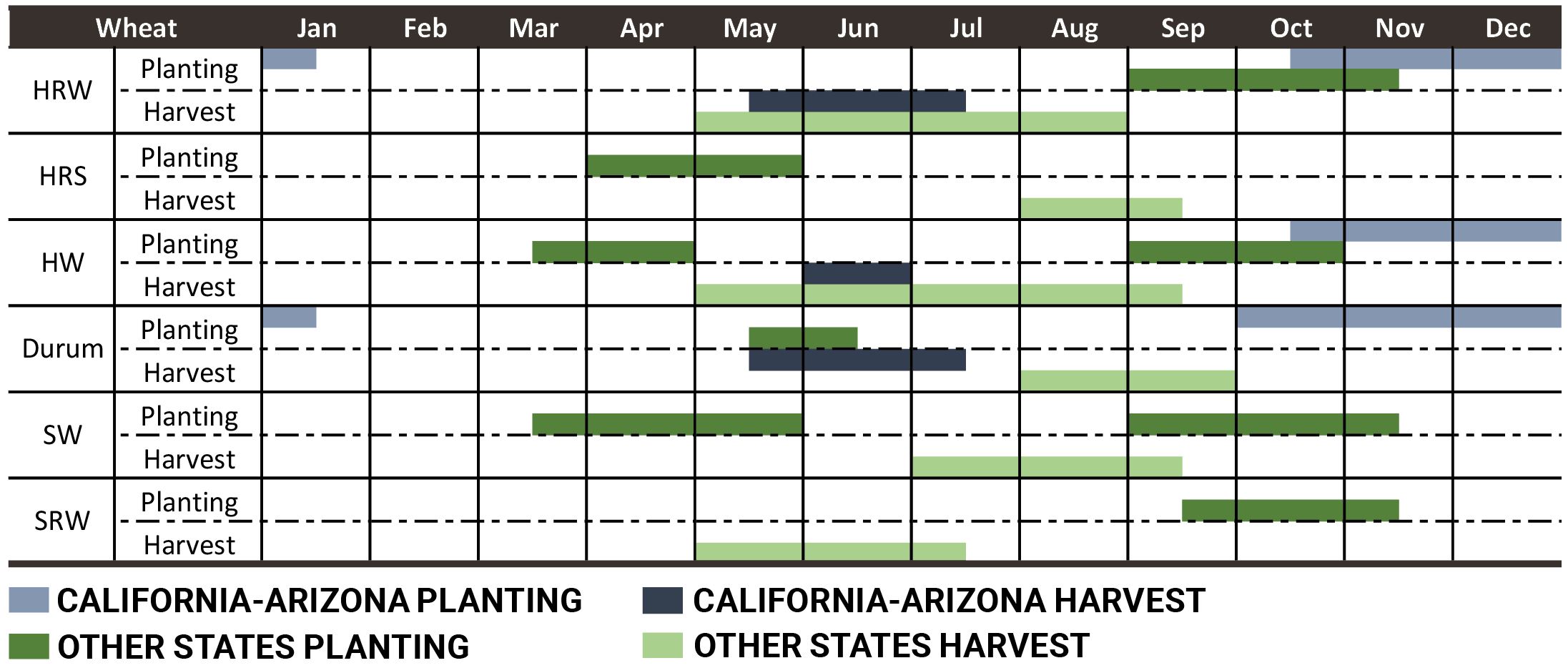

WHEN IS U.S. WHEAT PLANTED AND HARVESTED?

WHO SUPPLIES U.S. WHEAT?

USW encourages wheat buyers to make their first point of contact with their local USW office. Our experienced staff and consultants are prepared to help buyers before, during and after the sale, for service that enhances U.S. wheat value.

Find the nearest USW office here.

Private exporters of U.S. wheat also have representatives worldwide, so buyers will also want to contact them for additional information.

Other important resources include:

- Agricultural Attaché and Counselors: The U.S. agricultural attaché and/or agricultural counselors are in the American Embassy or in the Agricultural Trade Office (ATO). Find the nearest U.S. Embassy or ATO.

- NAEGA Trade Lead Form: Many companies and cooperatives that supply U.S. wheat belong to the North American Export Grain Association (NAEGA). To contact potential suppliers, please fill out the trade lead form.

- Registered Grain Exporter’s Directory: The USDA’s Federal Grain Inspection Service maintains a list of registered exporters on its website.

HOW IS U.S. WHEAT PURCHASED?

U.S. wheat prices are discovered through futures exchanges and basis prices published daily. Export basis and FOB export price indications are surveyed weekly and published each Friday on USW’s webpage. Private exporters use risk management tools to honor sales contract prices often made months in advance of vessel loading. For an inquiry to be considered by a reputable exporter, a buyer should be prepared to provide the following information:

- Quantity and loading tolerance

- Quality (be very specific and provide the client’s tender specifications)

- Shipment period

- Vessel size and restrictions

- Vessel load and discharge rate guarantees

- Vessel demurrage and dispatch rates

- Loading and discharge capacity

- Number of allowable berths

- Phytosanitary certification requirements

- Mycotoxin requirements

- Proposed method of payment

- Copy of the letter of credit (if this is the proposed method of payment)

- Financial references of your company

- Statement from the buying principal that your firm is the sole and exclusive agent

- Statement from the buying principal that the exporter will not be held liable for brokerages, finder’s fees, commissions, etc.

- A brief company history, including the names of the officers

An importer who is ready to buy will typically seek offers from exporters through either direct negotiation with specific suppliers or an invitation for bids, or tender. Buyers who negotiate directly usually watch the U.S. cash market for advantageous times to make their purchase and then negotiate private transactions. Those issuing an invitation for bid (IFB) operate through a public or private tender system.

HOW IS TRANSPORTATION ARRANGED?

The United States has the most extensive storage and transportation infrastructure in the world. Since wheat ships from several different ports, the purchase and sale of grain is only part of the importing process.

There are three types of contracts under the U.S. marketing system:

- C&F (Cost and Freight): The Seller provides the cargo, covers the loading costs and charters the ocean vessel for a specific destination. The Buyer must pay for insurance and discharge of the grain from the vessel. The Buyer specifies shipment period.

- CIF (Cost, Insurance, Freight): The Seller provides the cargo, covers the loading costs, charters the ocean vessel, and insures the cargo until it reaches its destination. The Seller determines the final loaded quantity within the contract quantity tolerance, and the Buyer pays for discharge. The Buyer specifies shipment period.

- FOB (Free on Board): The Seller is responsible for placing grain at the end of the loading equipment. The Buyer is responsible for providing the ocean vessel and all other costs after the grain is delivered on board, including stowing and trimming the cargo in the holds. The Buyer determines the final loaded quantity within the contract quantity tolerance. The Buyer specifies delivery period.

Bulk grain is usually sold on an FOB basis. Buyers of less-than-shipload quantities or those wishing to avoid the complications of chartering vessels may prefer to buy grain on C&F or CIF terms.

HOW IS U.S. WHEAT QUALITY ASSURED?

Customers know U.S. wheat will meet their specifications because the supply chain follows uniform grain segregation and regulated inspection procedures. The Federal Grain Inspection Service (FGIS) independently inspects wheat at vessel loading to certify that the quality loaded matches the quality stated in the customer’s contract. Since the passage of the Grain Standards Act in 1916, the United States has been the pioneer in providing quality assurance to grain buyers. FGIS oversees impartial inspectors who sample, weigh, inspect and certify wheat shipments exported from the United States.

This overview of U.S. wheat inspection provides information on U.S. wheat standards, inspection methods and certification procedures. USW publishes an annual Crop Quality Report shared with customers through crop quality seminars, videos and trade servicing visits.

HOW IS A CONTRACT WRITTEN?

Once the Seller and Buyer agree on price, grain quality, payment, credit, transportation, and delivery, the agreement is usually written by the Seller in a sales agreement or contract of sale form that varies with the type of transaction.

For example, the North American Export Grain Association (NAEGA) has a widely used, four-page, standard use contract for FOB purchases of bulk grain and oilseeds called the NAEGA standard contract No. 2. It has 30 separate clauses delineating the various aspects of grain purchase.

Other forms have been developed, such as the Grain and Feed Trade Association of London (GAFTA) contract for C&F and CIF U.S. and Canadian grain transactions.

Elements of a good contract

- Parties (Buyer and Seller)

- Commodity

- Quantity and loading tolerance

- Quality specifications

- Weights and grade

- Price and method of payment

- Shipment period

- Delivery basis

- Loading guarantee

- Shipping documents required for payment (L/C)

- Default factors

- Remedies for injured parties

- Forum for disputes

- Phytosanitary requirements of the importing country

Several federal laws protect the sanctity of all export contracts. The only exception is a declared national emergency. Export tariffs on U.S. products are forbidden by Article I, Section 9, Clause 5 of the U.S. Constitution.

Access NAEGA contracts here.

Access more than 80 GAFTA contracts covering CIF, FOB and delivered terms here.

HOW DO BUYERS FINANCE AND PAY FOR WHEAT?

Traditionally, payment is made in U.S. dollars, and a Letter of Credit (LC) is the most common form of payment. Under a Letter of Credit, the buyer’s bank first establishes a letter of credit in favor of the seller. When the grain is shipped and documentation is presented, the seller’s bank makes payment to the seller, then the buyer’s bank makes payment to the seller’s bank. A letter of credit significantly reduces the commercial risk for the seller but involves higher bank service charges.

Variations on the letter of credit include specifying a time for payment or deferred payment. Buyers and Sellers with a long-standing relationship can save transaction costs by trading on an open account where the Buyer pays the Seller directly upon delivery of the grain.

In addition to price risk, a Buyer purchasing on commercial extended credit may wish to consider covering the foreign exchange risk that can occur with an international transaction.

If Buyers cannot obtain commercial credit for their importing needs, they may be able to obtain financing assistance from various U.S. government programs. In many countries, USDA Export Credit Guarantee Programs can help make commercial financing available for imports of U.S. food and agricultural products on deferred payment terms. The GSM-102 program guarantees payment from approved foreign banks, typically to U.S. financial institutions that extend credit to them to finance imports of U.S. agricultural commodities.

USDA provides answers to commonly asked questions about how to participate in the GSM-102 Export Credit Guarantee Program.