Favorable Weather and Strong Income Potential Support 2021 Winter Wheat Seeding

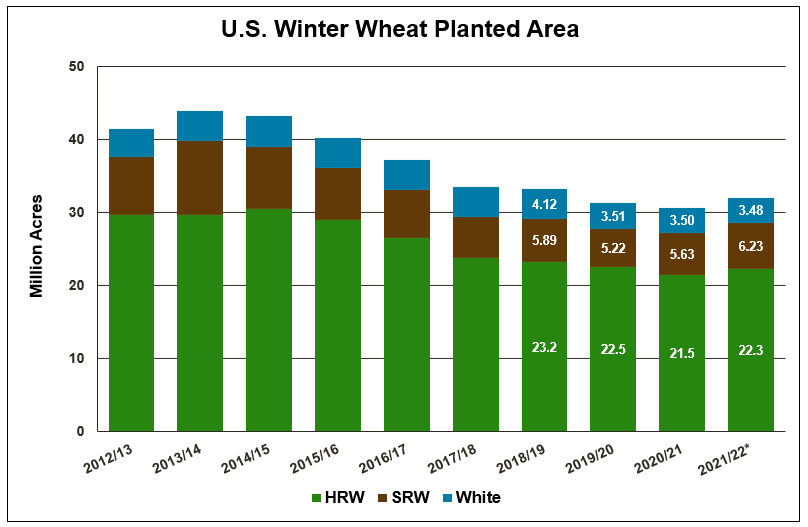

For the first time since 2013/14, total U.S. winter wheat planted area increased on the year as producers took advantage of dry seeding conditions and strong prices through fall 2020. USDA’s 2021/22 Winter Wheat Seeding report, released Jan. 12, reported U.S. farmers planted 32.0 million acres (12.9 million hectares) of winter wheat for harvest in 2021, up 5% from marketing year 2020/21. Increases for hard red winter (HRW) and soft red winter (SRW) more than offset a slight decrease in white winter wheat planted area.

Hard Red Winter

USDA assessed HRW planted area at 22.3 million acres (9.02 million hectares), up 4% on the year. Planted acreage is up year-over-year in several major HRW-producing states with the largest increases reported in Montana, South Dakota and Kansas. Montana planted area increased 10% on the year to 1.70 million acres (688,000 hectares) and South Dakota planted area jumped 13% from last year to 710,000 acres (287,000 hectares). In both states, dry planting conditions from September to October were a welcome change compared to sodden, impassable fields in fall 2019.

“To look at this year, we have to first go back to fall 2019 planting when fields were extremely wet and producers left many acres to prevent plant,” said Reid Christopherson, executive director, South Dakota Wheat Commission. “Finally, in fall 2020 there was optimism around wheat. Conditions for seeding were good and prices were giving us encouragement, which boosted HRW planted area.”

In Kansas, HRW planted area for harvest in 2021 is up 10% from last year at 7.30 million acres (2.95 million hectares) as extreme dryness deterred producers from planning to plant corn, which is more water intensive than wheat.

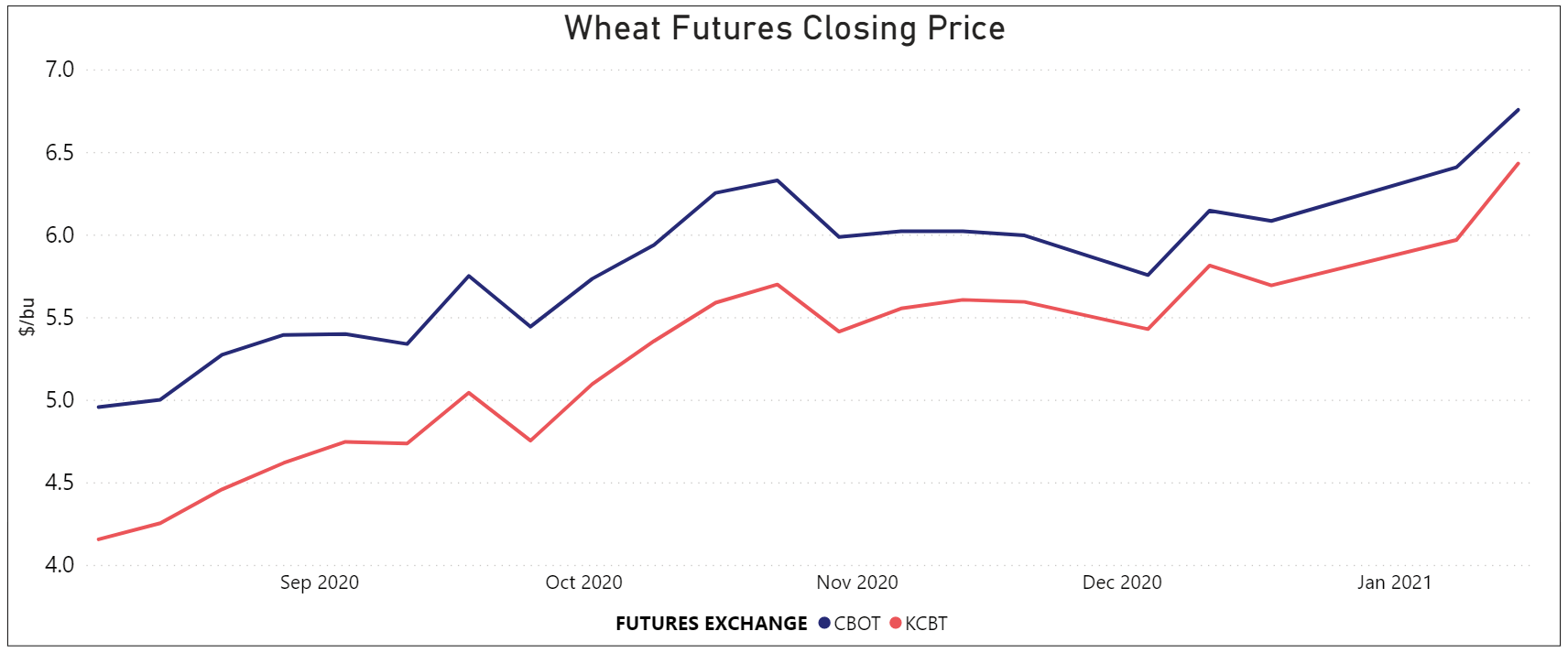

Strong markets also incentivized the expansion of U.S. winter wheat acres. According to Justin Gilpin, CEO, Kansas Wheat Commission, many fallow acres in western Kansas went back into winter wheat last fall as producers reacted to a spike in futures prices. Between late August and mid-October, Kansas City Board of Trade (KCBT) HRW futures prices for nearby delivery jumped 18% to $5.59/bu, the highest since August 2018, as “managed money” or commodity funds bought significant amounts of U.S. wheat futures contracts with the expectation that the contracts would gain value over time.

HRW planted area in Colorado and Oklahoma, two other major winter wheat producing states, also increased several percentage points on the year as producers jumped on higher HRW prices.

Soft Red Winter

Total SRW planted area of 6.23 million acres (2.52 million hectares) is up 12% from 2019 and 8% from the 5-year average as producers took advantage of pristine planting conditions and strong Chicago Board of Trade (CBOT) futures prices. Increases in major SRW-producing states more than offset decreases in Ohio and Maryland.

Planted area is up significantly in states tributary to the Gulf of Mexico, namely Wisconsin, Illinois, Missouri and Tennessee. Wisconsin planted area is up 72% from last year, Missouri planted area is up 38%, Illinois planted area is up 11% and Tennessee planted area is up 33%.

“Strong futures prices, strong farm gate prices and a quick soybean harvest in many Midwestern states incentivized SRW producers to plant more wheat acres this year, specifically in Wisconsin and Missouri,” said a grain trade manager.

Like with HRW futures prices, SRW futures prices also saw a significant jump during the fall planting season as commodity funds poured money into the Chicago futures exchange.

Every Friday, U.S. Wheat Associates (USW) publishes its Price Report, compiling information from market sources, including U.S. wheat exporters of all classes from various U.S. ports. Subscribe here to receive the weekly report.

By Claire Hutchins, USW Market Analyst