Fundamental, Technical Factors Lifted U.S. Wheat Futures Prices

Given the strong surge in U.S. wheat futures prices over the past several weeks, U.S. Wheat Associates (USW) wants to share more information about the market factors behind the rise.

Some of the bullish factors do not appear to be short-lived. Driving the recent highs was remarkably higher Chinese demand for U.S. soybeans, corn and wheat; increased investments by managed money in U.S. agricultural commodities exchanges; news that the Russian government increased its wheat export tax; and continued dryness in the High and Southern Plains.

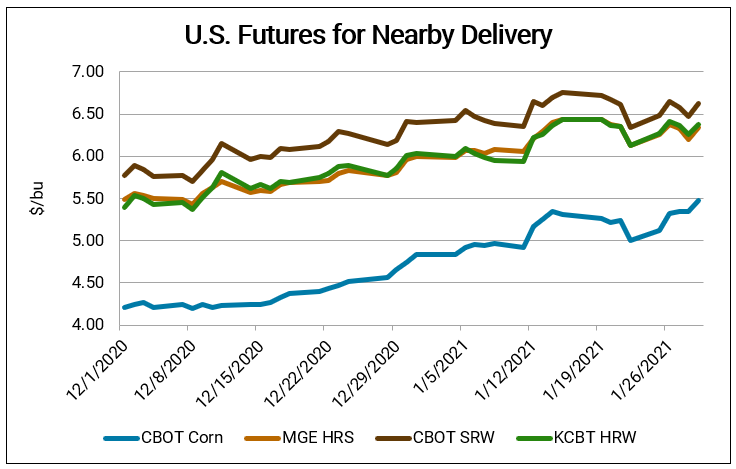

By late January 2021, CBOT soft red winter (SRW) and KCBT hard red winter (HRW) futures prices reached their highest level in more than six years and MGE hard red spring (HRS) futures prices reached their highest level since late 2017. Source: DTN

U.S. Corn, Soybean and Wheat Exports to China

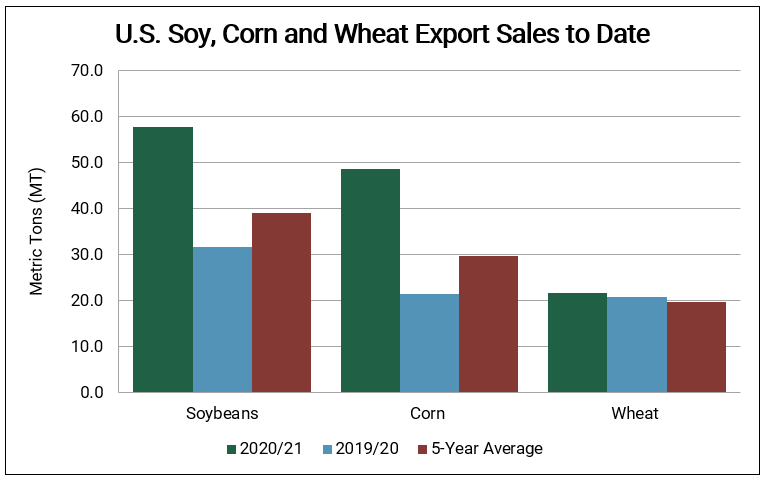

Historic U.S. commodity sales to China are supporting high wheat futures prices. To date, the United States has sold 11.8 million metric tons (MMT) of corn to China, completely eclipsing the last record of 4.90 MMT shipped to China in 2013. According to Reuters, China is on track to be the largest importer of U.S. corn for the first time in history. And sales aren’t slowing down: on Jan. 29, USDA reported a flash sale of 2.10 MMT of corn to China, the largest sale of U.S. corn to an overseas customer in a single day since 1991.

U.S. soybean sales to China have also set records. To date, the U.S. has sold 34.7 MMT of soybeans to China, 190% more than this time last year and 74% more than the 5-year average.

China’s demand for U.S. wheat has also been strong. Total sales to China, now the third-largest market for U.S. wheat, are substantially higher than this time last year at 2.58 MMT, more than 5 times greater than the 5-year average. HRW sales to China now total 1.13 MMT, the first major Chinese HRW purchase in many years. HRS sales to China of 566,000 metric tons (MT) are nearly nine times greater than the same period in 2020 and white wheat (soft and hard) sales are up more than 400% at 714,000 MT.

Source: USDA FAS export sales data as of Jan. 21, 2021

Technical Strength

Joining the trade excitement are managed futures funds, an investment where professionals actively manage a futures contract portfolio. These speculative commodity funds are buying significant amounts of U.S. corn, soybean and wheat futures contracts. They are “long” in the markets with the expectation that the contracts will gain value over time.

“Simply put: China is driving the boat,” said one U.S.-based trader. “Funds are pouring money into Chicago and other exchanges because of our massive balance sheet of sales to China.”

“If corn jumps 19 cents per bushel in one day, wheat is going to follow in a big way,” said another trader.

Managed fund participants serve an important role in futures markets, giving buyers and users of a commodity like wheat the opportunity to hedge their price risk through speculators that accept the risk of price movements.

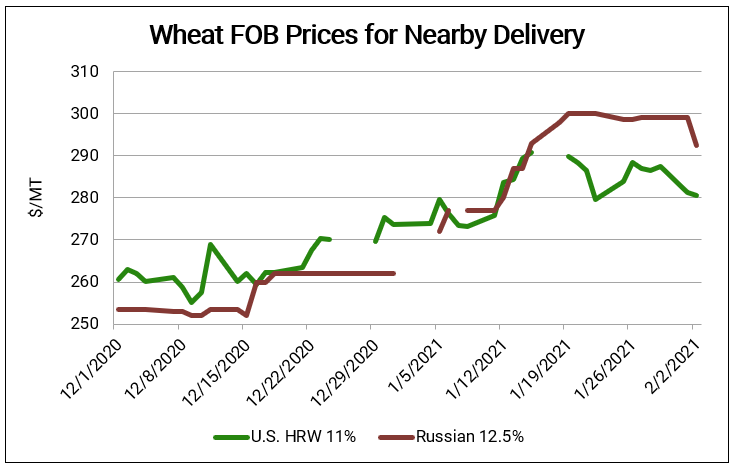

Russian Wheat Export Tax

What happens in a leading wheat exporting nation can move the market. On Jan. 26, the Russian government announced it would increase the country’s wheat export tax from €25 per MT to €50 per MT for March 1 to June 30 deliveries in an attempt to secure domestic food supplies and stabilize domestic prices. After Russia’s government approved the tax increase, Minister of Economic Development Maxim Reshetnikov said: “We hope in the near future the price situation will stabilize and we will be able to switch to a permanent mechanism of export duties.” Even so, USDA expects total Russian wheat exports in 2020/21 will reach 39.0 MMT, up 13% from last year and 18% more than the 5-year average, if realized.

The increased wheat export tax and minimal domestic selling by Russian farmers have also supported global wheat export prices. According to AgriCensus, between early December 2020, before the initial €25 per MT tariff was announced, and early February 2021, Russian 11.5% protein wheat (dry matter basis) free on board (FOB) prices increased 15% to $292 per MT. By comparison, Texas Gulf 11% HRW (12% moisture basis) FOB traded at $280 per MT at the beginning of February.

Source: AgriCensus

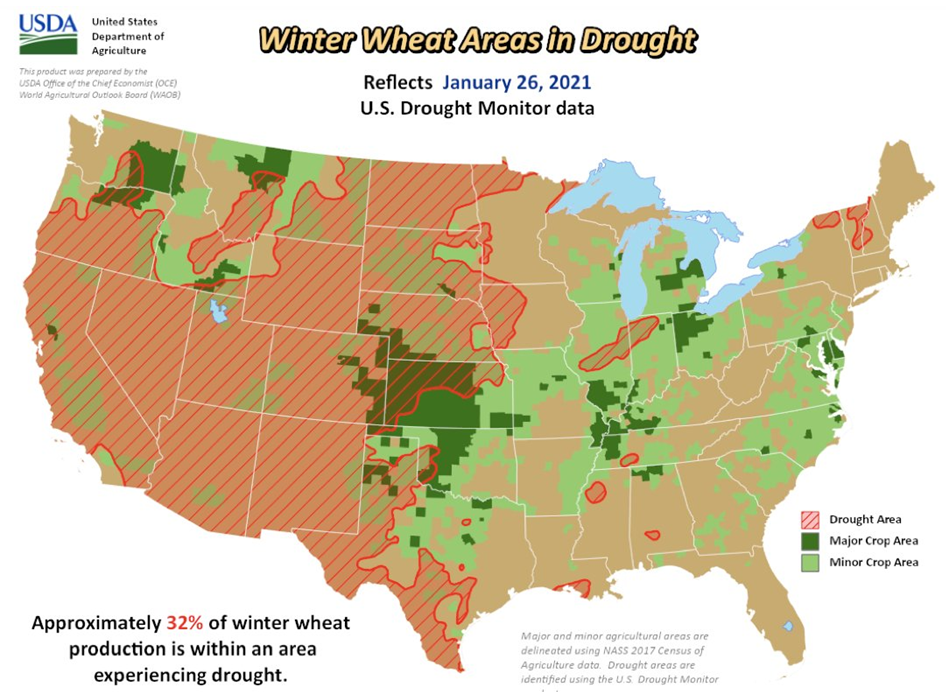

Drought Stress Across the Great Plains

Despite recent precipitation in some areas, extreme dryness continues to plague U.S. winter wheat producers, an all too familiar situation for wheat farmers in eastern Colorado, western Kansas, western Nebraska and eastern Wyoming.

“Dryness in the Plains adds underlying support to wheat futures prices,” said a grain trade representative.

As of Jan. 28, according to USDA, Colorado winter wheat ratings slipped from 19% good to excellent in early January to 17% by late January and 43% of Kansas winter wheat was rated good to excellent, down from 46% in late December 2020. USDA also reported that as of Jan. 26, 2021, “an estimated 32% of U.S. winter wheat production is within an area experiencing drought,” including major sections of U.S. hard red spring and northern durum production regions.

Every Friday, USW compiles information from market sources, including U.S. wheat exporters of all classes from various U.S. ports.

By Claire Hutchins, USW Market Analyst