Rail Rates Directly Affect Basis Values for Wheat Importers

Grain companies serving Pacific Northwest (PNW), Gulf, Lakes and Atlantic ports overcome challenging logistics to efficiently deliver wheat that consistently meets contract specifications to buyers around the world. Rail rates, for example, make up a significant percentage of U.S. wheat export basis and, ultimately, the FOB price paid by importers.

Exporting grain companies draw from inland country elevators that play a vital role in the U.S. wheat export system. And, according to the National Grain and Feed Association (NGFA), which represents and provides services for country elevators and other related commercial businesses, having access to efficient, competitive rail transportation is crucial. In fact, NGFA notes that 72% of U.S. wheat moves to domestic and export markets by rail.

Base and Secondary Rail Markets

Dr. Frayne Olson, Crop Economist/Marketing Specialist with the North Dakota State University Extension, says the United States has a very strong network of reliable freight rail systems that move wheat and other grains from where it is produced to domestic and export locations. He suggests that most deliveries to export elevators in the Pacific Northwest (PNW) or the Western Gulf rely on 110-car shuttle trains dedicated to wheat or other grain deliveries. The total cost of shuttle train delivery includes a base tariff rate and, if needed, a secondary market.

A shuttle train is loaded with grain at an inland elevator in this image from a video lecture by Dr. Frayne Olson, North Dakota State University, produced for USW. Arrows indicate the rail engines and covered grain cars.

“The base rate does not change rapidly,” Dr. Olson said in a recently produced video lecture on grain transportation for U.S. Wheat Associates (USW). “With shuttle systems, the base rate reflects the use or leasing of a train for about a 12-month period by the exporting company.”

U.S. railroads are also allowed to apply a fuel surcharge per car.

The secondary market allows exporters to contract for unanticipated rail requirements by purchasing unused space in a rail car and move the grain to the export terminal. Because the secondary rail market correlates directly with the principles of supply and demand, it can be considerably more volatile than the base rate tariff.

The Agricultural Marketing Service (AMS) of USDA notes that secondary rates are most often a small fraction of the full cost or rail shipments relative to the base tariff rate.

Total rail rates make up a significant percentage of U.S. wheat export basis. Each week, USW Market Analyst Michael Anderson polls export grain traders about changes in export basis. In their reports, the traders consider factors that directly affect basis including rail capacity’s effect on rates. Nearby futures prices and average basis are included in the USW Price Report to provide an estimate of weekly FOB prices for several classes and protein levels from PNW, Western Gulf and Lakes ports.

Current Rail Rates

Overall, current rail rates for shipping U.S. wheat are about equal to or slightly less than they were one year ago. In its July 15, 2021, “Grain Transportation Report,” AMS reported the following base rail tariffs, plus a fuel surcharge, per metric ton (MT) for shuttle trains:

Great Falls, Mont., to PNW Ports: $39.90

Wichita, Kan., to Western Gulf Ports: $42.07

Grand Forks, N.D., to PNW: $56.37

Grand Forks to Western Gulf: $59.54

Colby, Kan., to PNW: $63.35

NGFA points out that agricultural producers and shippers now are dependent upon only four U.S. Class 1 carriers to haul most grains and oilseeds by rail. Those four railroads typically originate more than 80 percent of such traffic, compared to only 53 percent in 1980.

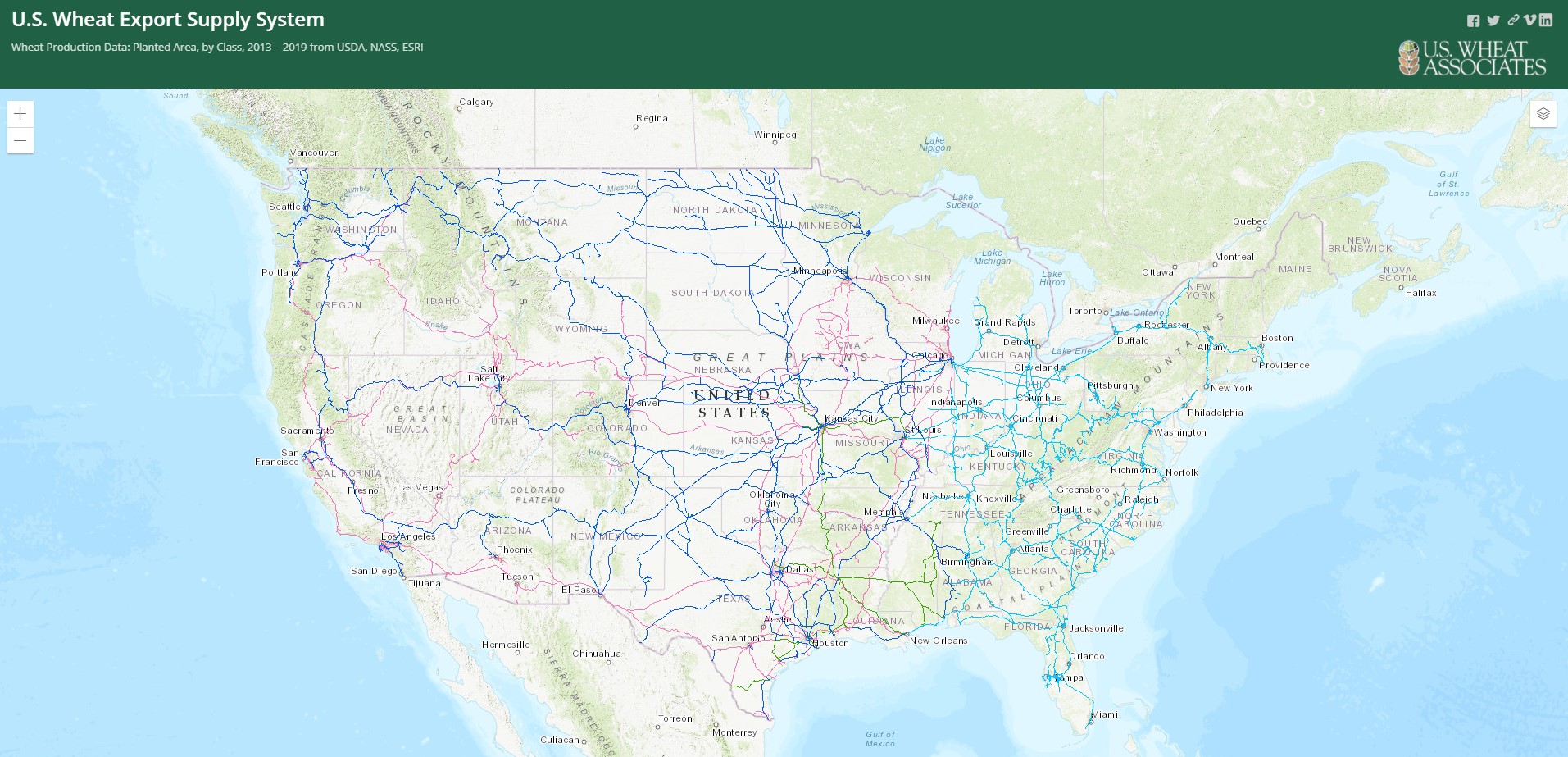

U.S. Class 1 railroad routes are shown in this image from USW’s interactive map of the U.S. Wheat Export Supply System.

Monitoring Rail Rates and Policies

Like NGFA, the U.S. wheat industry is closely watching the current proposal for control of Kansas City Southern Railroad by Canadian National Railway and a potential competitive offer by Canadian Pacific Railways. USW’s Wheat Transportation Working Group will weigh in on these proposals to the U.S. Surface Transportation Board (STB) with public comments.

In addition, USW has joined several other organizations, including NGFA, urging the STB to adjust rail regulations to ensure sufficient competition and, ultimately, the most efficiency and value for farmers, the grain trade and overseas wheat buyers. Anderson will report on that effort in the next Wheat Letter post July 22, 2021.