Rounding Up U.S. Wheat Planted Area Estimates

By Claire Hutchins, USW Market Analyst

As the U.S. government shutdown enters its fourth week, U.S. Wheat Associates (USW) leans on its network of media and industry resources to illuminate the information void left by a partially-funded USDA, which cannot publish its critical economic reports until the agency receives full funding again. Fortunately, many other sources have estimated planted area, so USW can approximate the direction of winter wheat and spring wheat planting trends year over year. Winter wheat acres, for 2019 harvest, are expected to fall slightly below planting levels for 2018 harvest, while spring wheat acres, planted in the coming months, are expected to rise above 2018 levels.

A Reuters poll of commercial export analysts, published on Jan. 8, 2019, estimated total winter wheat seedings for the 2019 harvest at 32.3 million acres (MA), down nearly 1 percent year over year. This figure falls slightly below USDA ERS data, last updated Dec. 12, 2018, which indicates winter wheat area could total 33.0 MA. The poll’s averaged estimates predict nearly uniform area reductions for all winter wheat classes. Other sources expect a steeper decline in winter wheat acres. Informa Economics forecasts a 1 MA decline year over year at 31.5 MA. However, Justin Gilpin, chief executive officer of Kansas Wheat, believes total U.S. winter wheat acres will remain relatively steady year over year.

The Reuters analyst poll estimated 2019 hard red winter (HRW) seeding area at 22.7 MA, down from 22.9 MA planted for 2018 harvest. Gilpin expects a 10 percent decrease in HRW acres in Kansas, Oklahoma and Texas due to extremely wet conditions which delayed the soybean harvest and in turn HRW planting. However, he expects an uptick in HRW planted area in northern states, which would partially offset reduced area in the south. Paul Morano, Syngenta’s Head of Key Accounts for wheat, indicates the company saw increased sales of HRW seed last season, but believes HRW acres will remain relatively steady year over year. This reinforces Gilpin’s point in an interview with The Western Producer on Jan. 10, 2019, that HRW seeded area could be flat despite original grower intentions to plant more.

Planted area for soft red winter (SRW) could land in the neighborhood of 6.02 MA according to the Reuters poll, down year over year from 6.08 MA. The Reuters poll delivered a degree of optimism for SRW seeded acres compared to other industry expectations. Morano believes that a reduction of 600,000 to 1 million acres (around 10 percent below 2018 levels) for SRW is likely due to the same wet conditions that impeded HRW planting for 2019.

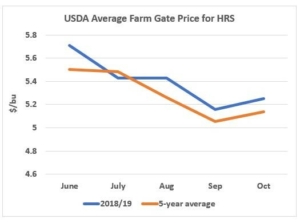

USW’s informal survey indicates that hard red spring (HRS) planted area is likely to increase over 2018 levels of 10.5 MA. These estimates fall in line with the latest USDA ERS prediction of 12.7 MA as of Dec. 12. A 17 percent increase in HRS planted area year over year is certainly possible given current market conditions and other industry indicators. HRS in the Northern Plains competes for acreage with other lucrative commodities like corn and soybeans. However, HRS becomes a more alluring alternative up north as low corn prices and volatile trade conditions for soybeans persist into 2019, while average farm gate prices for HRS hold at or above the 5-year average for the first five months of MY 2018/19.

Syngenta’s Morano cites “extremely strong demand for HRS seed this early in the year” as a good indication that growers anticipate expanding their HRS acres, barring an unforeseen weather or market event. Red River Farm Network, covering the Dakotas and northwestern Minnesota, also reported that WestBred, a division of Bayer Crop Science, has already sold out of seed for several key varieties of spring wheat earlier than anticipated.

Price uncertainty for corn and soybeans continues while HRS farm gate prices trend higher, leading most industry sources to expect 2019 HRS seeded area will increase year over year.

USW will compare the industry estimates covered here to the official USDA Winter Wheat Seedings report when, and if, it becomes available.