Weather Disrupts Nearby PNW Basis; Outlook for April and May Improving

By Claire Hutchins, USW Market Analyst

Late winter conditions can make March a difficult month for wheat export supply logistics across the central and northern United States, and the seasonal effects on basis this month were even more challenging.

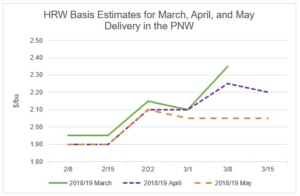

Drifting snow, bitter cold, and high inland water levels that actually increased into early March spiked export basis for nearly all classes of U.S. wheat out of the Pacific Northwest (PNW) for March and April delivery months. The latest estimate of April basis for hard red winter (HRW) of $2.20 per bushel (/bu) for PNW ports is the highest March estimate since 2015. Traders quickly responded the the conditions by only offering PNW basis estimates for April and other deferred months for the U.S. Wheat Associates (USW) Price Report.

Basis Spike. This month, PNW traders estimated the highest April basis for hard red winter (HRW) exports since 2015.

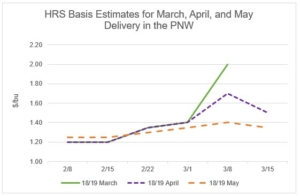

USW is more optimistic about export conditions into April and May when basis typically eases. Last week, the April export basis estimate for HRW in the PNW fell slightly from $2.25/bu to $2.20/bu. The same estimate for hard red spring (HRS) in the PNW fell 20 cents to $1.50/bu, which is the second lowest April basis since 2016. Looking ahead to May’s delivery estimates, traders expect HRW and HRS export basis in the PNW to stabilize at around $2.05/bu and $1.35/bu, respectively.

Spring Wheat Basis to Ease. The current estimated April export basis for hard red spring (HRS) in the PNW is the second lowest basis since 2016.

As long as the country’s challenging weather conditions do not continue late into the spring, USW expects export basis for all classes in the PNW to decline into and after April and May. This seasonal easing of basis should give customers improved import opportunities before the end of marketing year 2018/19 on May 31.