Wheat Prices Trend Lower Even As Uncertainty Continues

Following a year of dramatic volatility, several factors have pressured global wheat prices back to levels last seen before Russia’s invasion of Ukraine in early 2022. There are several factors behind this trend. In this article, U.S. Wheat Associates (USW) examines the tenacity of world wheat trade even in the face of serious market uncertainty.

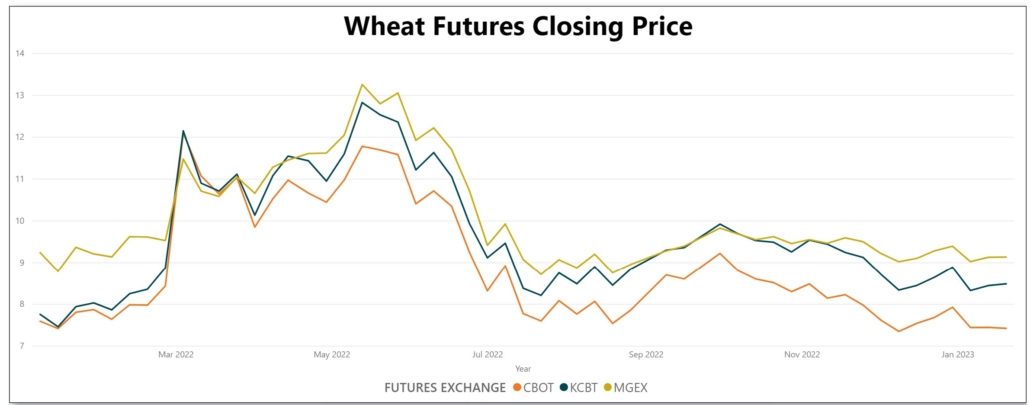

In February 2022, Russia’s unprovoked invasion shook world markets, launching a season of unprecedented volatility and record prices across the agricultural sector. In response to Putin’s war, nearby Chicago Board of Trade (CBOT) wheat futures soared to $14.25/bu. Combined with record global consumption, production shortfalls, and a tightening global balance sheet, the war cast a shadow of uncertainty over the grain industry.

In May 2022, the market rallied yet again when India banned wheat exports, just days after Indian government officials assured world buyers that India would lead the charge to offset the supplies from the Black Sea and help tamp global food price inflation. CBOT wheat futures once again touched record highs of $12.77/bu.

Volatility has been apparent in CBOT Wheat futures, Kansas City Board of Trade (KCBOT) Hard Red Winter wheat futures, and Minneapolis Grains Exchange (MGEX) Hard Red Spring wheat futures since the invasion. Source: U.S. Wheat Associates Price Charting Tool

A Black Sea Breakthrough

Flash forward to July 2022, when Russia and Ukraine, with support from the United Nations and Turkey, agreed to the Black Sea grain corridor and created the Joint Coordination Center (JCC) to facilitate exports for the region. The agreement allowed supplies trapped in Russia and Ukraine to re-enter the world market, and in response, wheat futures eased 37% from the spring’s highs.

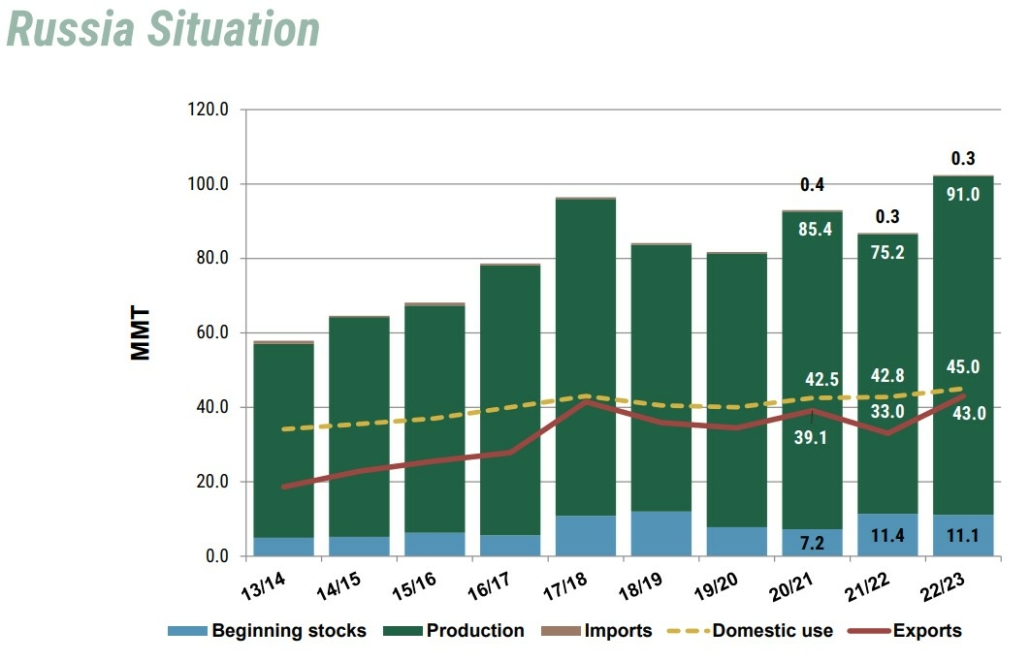

Russian wheat production increased by 21% from 2021, and exports are expected to increase by 30% on the year. Source: U.S. Department of Agriculture (USDA) World Agricultural Supply and Demand Estimates.

Return to Pre-War Prices

In the months since the corridor was implemented, wheat futures have continued falling to pre-war levels. The downward pressure of steady, low-priced Black Sea wheat exports remains the primary driver. According to JCC data, since the corridor’s inception, 5.1 MMT of wheat have been shipped from Ukraine. As for Russian exports, the January U.S. Department of Agriculture (USDA) World Agricultural Supply and Demand Estimates pegged Russian wheat production at 91.0 MMT, though some private sector forecasts are upwards of 104.0 MMT. With record production, Russian exports are expected to reach 43.0 MMT, 17% above the five-year average.

A record crop from Australia has also helped ease some global supply concerns. The Australian wheat crop is rumored to reach nearly 42.0 MMT, though USDA estimates hover at 36.6 MMT.

On the domestic front, the USDA Winter Wheat and Canola Seedings Report increased 2023 winter wheat acres by 11% from 2022 to 14.9 million hectares. The combined impact of the ample Black Sea supplies and improved outlook in several major exporters has helped turn the wheat market back to buyers.

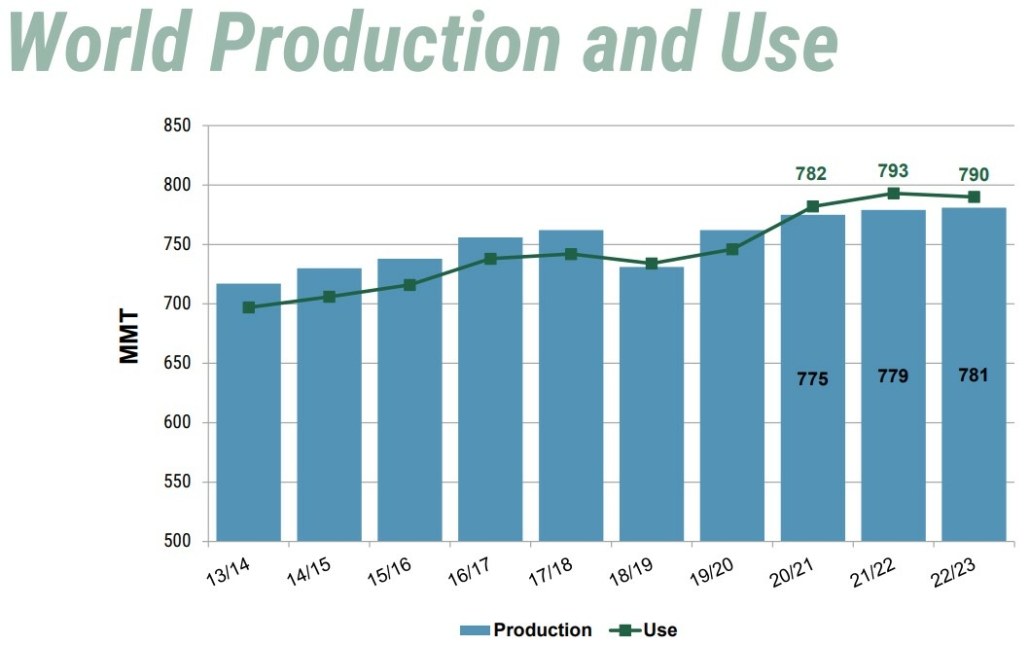

For the third year in a row, world wheat consumption has outpaced production, even though global wheat production hit a record 781.3 MMT in 2022/23. Wheat is drawn from ending stocks to meet global demand. Source: U.S. Department of Agriculture (USDA) World Agricultural Supply and Demand Estimates.

What Comes Next?

Market sentiment has become increasingly bearish and prices have significantly dipped in the buyer’s favor; however, many unknowns linger in the market. The underlying uncertainty of Putin’s war will continue to support the market. As seen in October, when Russia threatened to pull out of the Black Sea Grain initiative, prices spiked in response to the threat. In more recent news, on Jan. 25 a Russian missel struck a Turkish cargo ship in the port of Kherson in Ukraine, also sending futures momentarily higher. Volatility is a concern for as long as the war continues. Global balance sheets will also remain tight into the new crop year, and global wheat consumption continues to outpace production. Another factor, though not unique to this year, the weather will continue to play a significant role in prices as markets closely monitor the drought afflicted Argentine wheat crop and HRW conditions in the U.S. Central and Southern Plains.

By USW Market Analyst Tyllor Ledford