As the geopolitical conflict between Russia and Ukraine comes back into focus following the attacks on port infrastructure in the Ukrainian Black Sea ports of Odesa, Chornomorsk, and the terminals along the Danube River, wheat market volatility remains an ever-present risk.

Despite the recent swings, export basis trends can help provide clues to potential buying opportunities for U.S. wheat classes. In recent months, we have seen Pacific Northwest (PNW) hard red spring wheat (HRS) export basis erode from $1.75 per bushel ($64.30 per metric ton) in November 2022 to $0.80 ($29.40) in July 2023. Considering the recent drifts, this article will investigate the PNW HRS basis trend and provide additional context around the weakening basis.

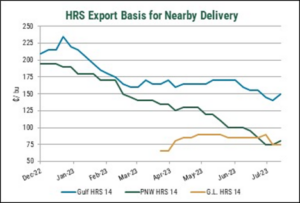

PNW HRS basis has drifted down since the start of 2023, recently hitting lows not seen since 2007, hovering 90 cents below last year’s level. Below average basis poses a unique opportunity for those interested in purchasing PNW HRS. Source: U.S. Wheat Associates Price Report.

Slow Demand Meets Seasonal Weakness

Otherwise known as the difference between the free on board (FOB) cash price and the futures price, export basis encompasses transportation costs, storage, and supply and demand at the regional level (e.g., farmer sales, local demand), and can fluctuate based on seasonality. In the pre-harvest months, basis generally weakens as the market looks to the influx of new crop stocks. Though a weaker basis is common for this period, unique to this year, the pace of farmer selling has remained slow. Throughout 2023, exporters noted low farmer sales, and USDA’s June Grain Stocks report noted on-farm stocks increased 34% from the year prior. In the last few weeks, farmer sales increased with the increased volume helping drive down basis.

Meanwhile, demand for U.S. wheat has also been relatively light. In 2022/23, commercial U.S. wheat sales were 20.7 MMT, down 4% from the year prior. So far in 2023/24, the U.S. export pace remains slow, tracking 32% behind last year at the same time.

The combined impact of seasonal weakness, the release of farmer-held stocks, and slow export demand have quickly eroded basis. Last week’s basis level of $0.75 ($27.56) signifies the weakest PNW HRS basis since July 2007. For this time of year, the current basis level is 51% below the ten-year average and down 90 cents per bushel from last year. The historically low basis level presents an opportunity for U.S. wheat importers to make purchases of HRS from the PNW or to lock in a low basis contract.

Wheat futures continue to fluctuate based on the global supply and demand situation and the erratic influences of geopolitics, weather. The most recent example is the response to the airstrikes in Ukraine last week. CBOT futures closed limit up at $7.57/bu; however, by the end of the week, CBOT futures were down 53 cents at $7.04/bu. Source: U.S. Wheat Associates Price Charting Tool.

With Proper Risk Management Opportunity Awaits

Despite the historically low basis, volatility presents a risk in the market. On July 24, Chicago Board of Trade (CBOT) wheat futures were limit up in response to the airstrikes in Ukraine, closing at $7.57/bu; however, by the end of the week, CBOT futures were down 53 cents at $7.04/bu.

Every marketing year presents new challenges and opportunities for buyers of U.S. wheat, and this year is no exception. Markets are volatile, but unique buying opportunities continue to arise. With proper risk mitigation, U.S. wheat importers can capitalize on opportunities for purchasing U.S. wheat and maximize the value of U.S. wheat classes, even in unpredictable times. Contact your local U.S. Wheat Associates office for more individualized information on risk mitigation strategies for your business and opportunities for U.S. wheat.

By U.S. Wheat Associates (USW) Market Analyst Tyllor Ledford.