Farm Progress Survey Points to More Wheat, Corn, Soybean Acres

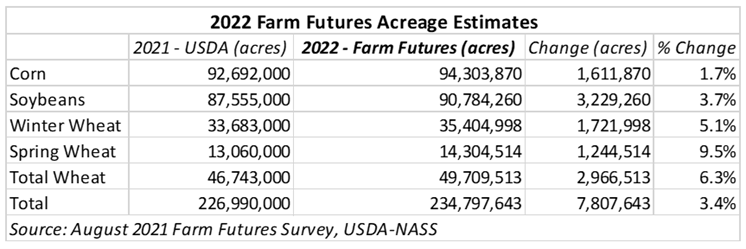

An August 2021 survey of 737 farmers across the United States conducted in late July by Farm Progress Publications suggests that wheat, corn and soybean planted area will be up for 2022.

Jacqueline Holland, writing in www.farmprogress.com, said the surveyed farmers estimated they will plant a total of 46.7 million acres of wheat. Farm Progress also noted recently that, if realized, 46.7 million acres of wheat would exceed “the smallest wheat acreage in history in 2020…by an astounding 5.4 million acres.”

USDA’s National Agricultural Statistics Service (NASS) will release it’s annual Small Grains Summary report including wheat acreage, area planted and harvested, yield and production on Sept. 30, 2021.

Even with a potentially large 2022 U.S. wheat crop, the Farm Progress survey showed why wheat stocks could actually decline slightly through the next marketing year. The publication said it estimates 2022/23 U.S. wheat usage at just under 58 million metric tons (2.13 billion bushels) in part because of “higher export targets.” That would be the highest usage rate since 2016/17 and “consume all new production that comes online” in 2022 and, if realized, create the lowest stock-to-use percentage since 2013/14.

The planted area estimate of 94.3 million acres of corn and 87.6 million acres of soybeans from the survey would mean the combined total planted area with wheat would be the third largest combined acreage on record.

Where Will Those Acres Come From?

Ms. Holland suggested that farmers in the Plains have some flexibility to change their crop rotations compared to farmers in the Eastern U.S. Corn Belt. She added that cattle herd numbers are down which could allow a shift from forage crops. And double-cropping wheat after soybeans remains a profitable choice.

The writer goes on to describe reasons why these rather bullish estimates may be tempered. For wheat, as for corn and soybeans, the estimates from the survey assume optimal weather conditions. Too many U.S. wheat farmers know optimal conditions are rare. In fact, the threat of continued drought through the winter wheat planting season will have an impact on seeded area for 2022.

China’s Influence

The author also noted that China will continue its outsized influence on global wheat, corn and soy supply and demand. Export demand levels could grow if China’s livestock feed demand grows and that will affect U.S. grain production profitability.

“Global livestock rations will likely waver between wheat and corn depending on market prices,” Ms. Holland wrote. “Any potential usage shifts could have significant impacts on pricing and acreage allocations in the 2022/23 marketing year.”

The rising cost of production inputs may also come into play as U.S. farmers make their cropping plans and weigh heavier on decisions should crop prices start to fall back.

Wheat Will Compete

Ms. Holland’s final point about the survey estimates is important for the world’s wheat buyers.

“…With winter wheat sowings just around the corner and wheat futures trading at lucrative prices,” she wrote, “expect wheat to be a strong competitor against corn and soybean in the 2022 acreage battle.

By Michael Anderson, USW Market Analyst