Grain buyers have the unenviable task of sorting through today’s news and determining what it means for tomorrow’s prices. Experienced buyers have plenty of tools to help with their decisions, but the volatility experienced in 2022 may be embedded for the near future. Talk of a global recession may soften commodity prices initially, but just as quick, geopolitics can reverse any downward trend as we’ve seen the last two weeks.

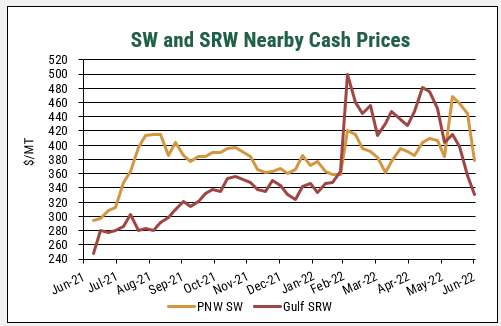

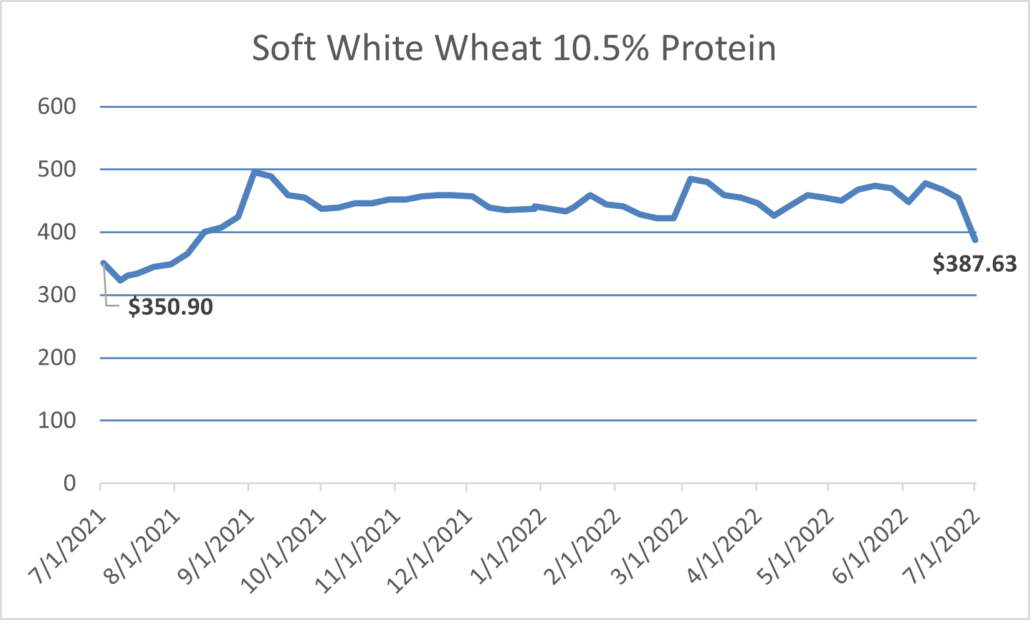

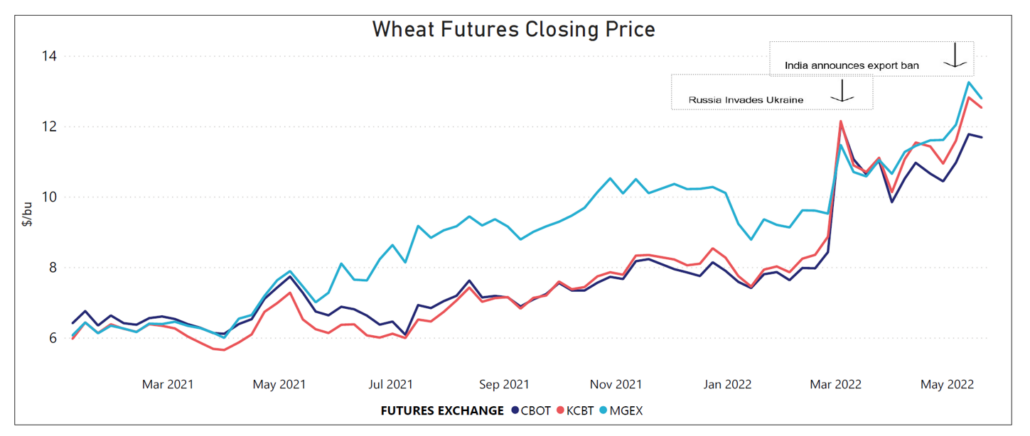

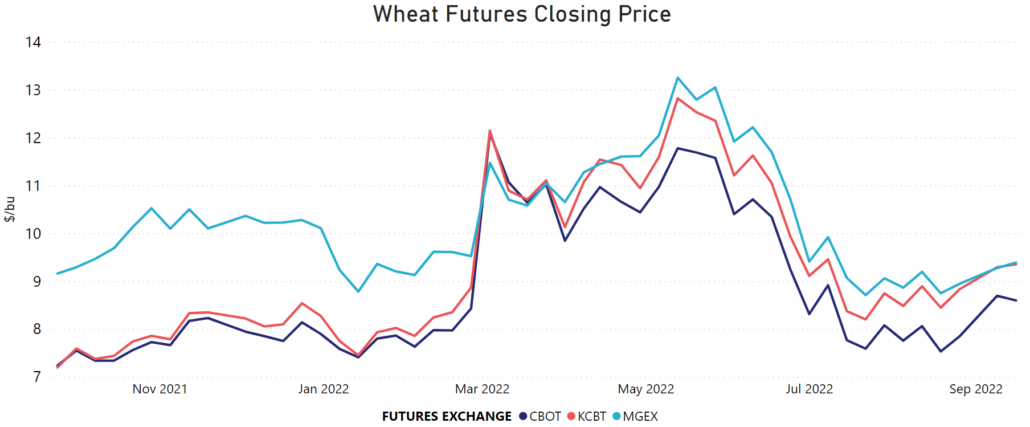

Volatility seems to be the new normal in global wheat markets. U.S. wheat futures prices over the past year clearly demonstrate that condition.

Global Supply

The global balance sheet for wheat is down 10.0 MMT in 2022/23 compared to 2021/22 at 1.06 billion metric tons (MT). Beginning stocks this season are the lowest since 2017/18 while ending stocks are expected to be the tightest since 2016/17. Despite Russia’s huge wheat crop and rebounds in production for both the U.S. and Canada, reductions in the European Union (E.U.), Argentina, and Ukraine are helping to keep prices firm.

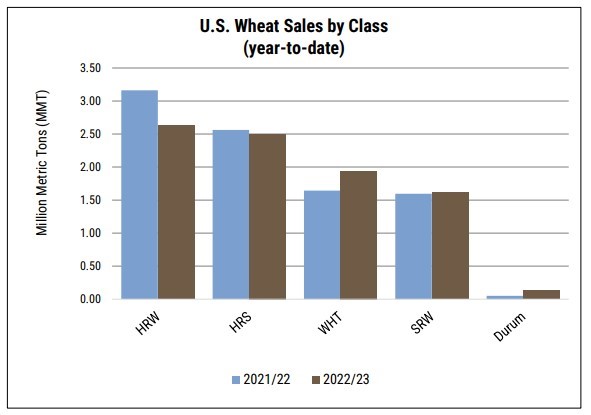

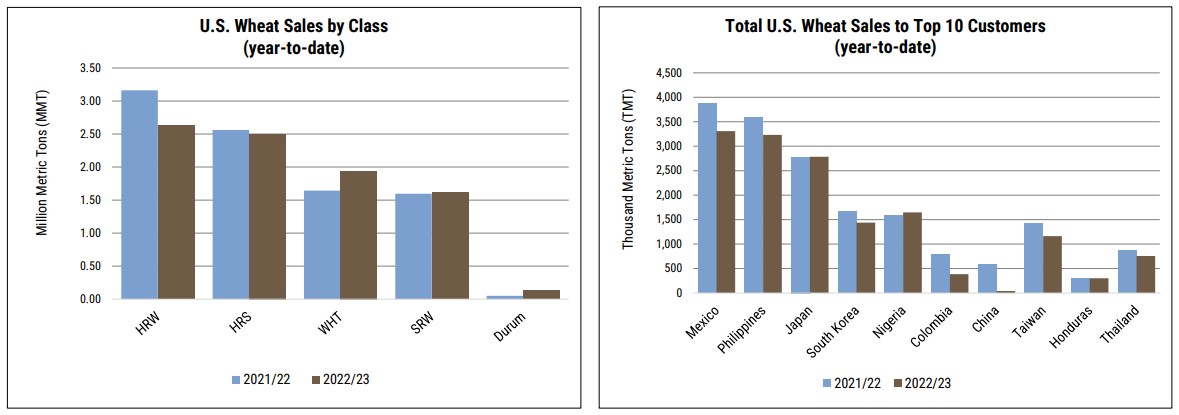

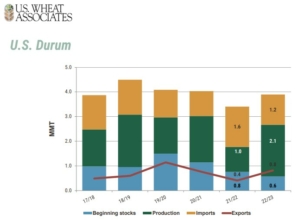

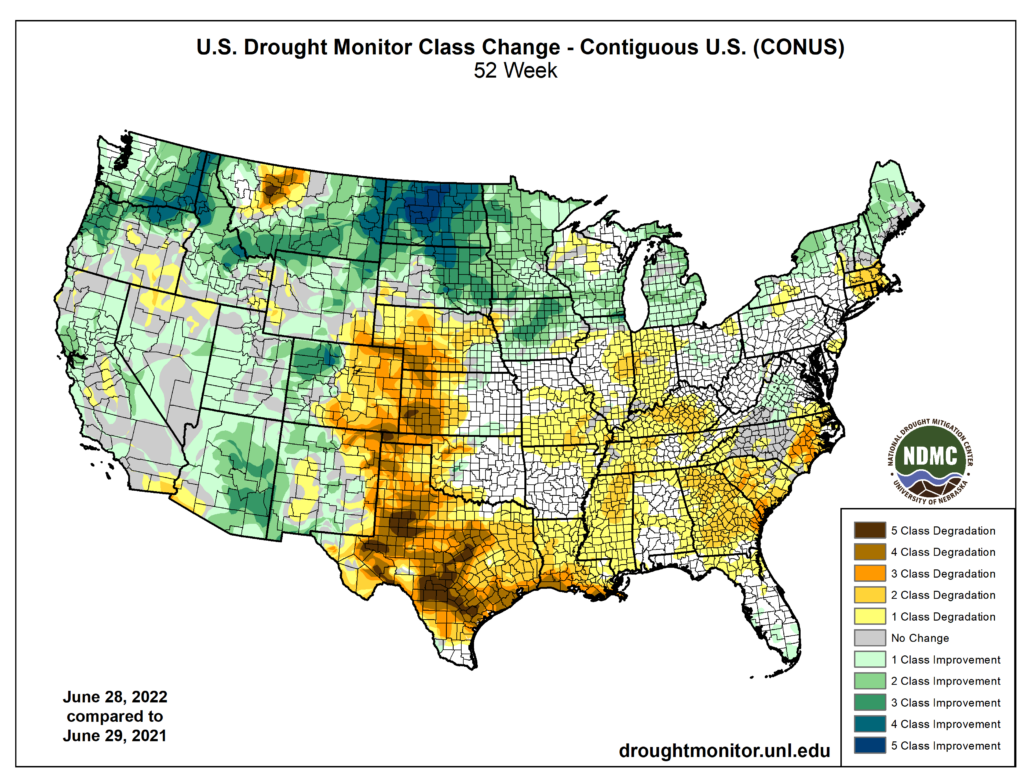

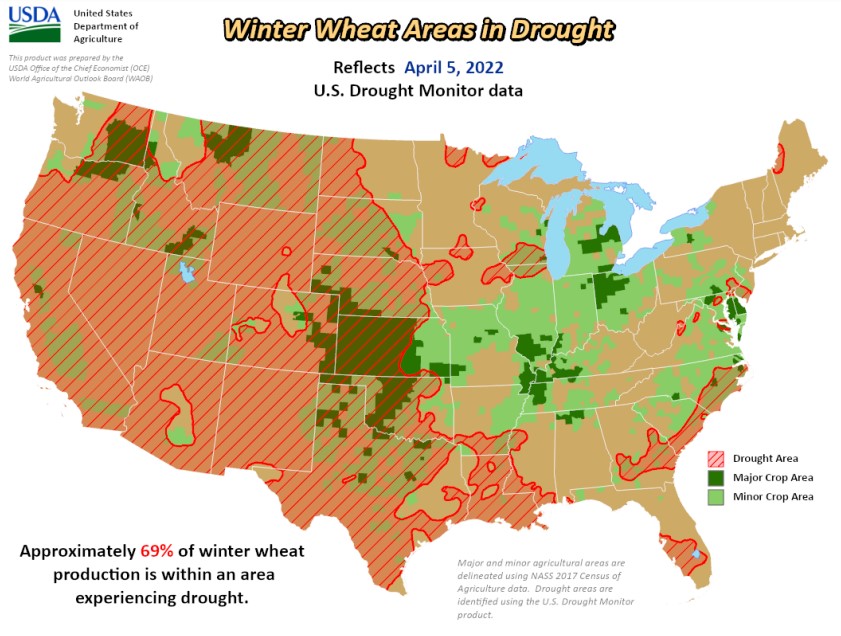

U.S. wheat production is up this year, increasing almost 4 MMT to 48.5 MMT according to USDA. Exports are expected to increase slightly to 22.5 MMT. According to the latest world agricultural supply and demand estimates (WASDE), production for all classes of U.S. wheat is expected to increase this year except for hard red winter (HRW) wheat which is estimated down 21%. Kansas, the primary HRW growing state, remains dry even as winter wheat planting is underway.

Black Sea Grain Corridor

Russia’s invasion of Ukraine has had the biggest effect on upending the global wheat market. The United Nations brokered an agreement to establish a grain corridor in the Black Sea. As a result, Ukraine has shipped more than 7 MMT of grain since July, when the agreement was signed according to APK. However, Putin’s criticism of the grain deal and escalation of the war on his neighbor have once again roiled markets and sent futures higher.

The multilateral agreement establishing the grain corridor will expire in November. Given the Russian president’s unpredictable actions so far, there is no guarantee that the agreement will be renewed.

Russian Potential

Russia has produced its largest wheat crops ever. The USDA forecasts Russian wheat production at 91 MMT this month while the European Union’s crop monitoring service, MARS, projects the Russian wheat crop will total 95 MMT. The USDA predicts exports could reach 42 MMT. But Russian exports so far this season have been slow to move. According to IKAR, a Russian analyst, Russian wheat exports are expected to reach 4 MMT in September, well behind the 4.7 MMT exported a year ago. Russian wheat exports are not under any western backed trade sanctions, but shipping companies, insurers, and banks are still cautious to do business with Russia.

Additionally, heavy rain in the central and southern areas of the country is delaying plantings. SovEcon reported that 8.6 million hectares (21.2 million acres) of grain had been sown so far, 1.5 million hectares (3.7 million acres) behind their pace a year ago. The consultancy added that it’s the lowest area planted since 2013.

Dependability of Supply

India also played its hand in driving global wheat futures higher. After initial pronouncements of feeding the world’s hungry, India quickly reversed course and blocked wheat exports. The country is expected to instead import 25,000 MT of wheat this year.

Input Costs

High gas prices could affect access to nitrogen-based fertilizers. Yara International, a Norwegian-based fertilizer producer warned that the gas situation in Europe could create shortages and add to risk. Gas prices on the continent have risen 45% since June when Russia curtailed shipments following E.U. sanctions. Yara said it expects to pay $1.1 billion more for natural gas in the third quarter than a year ago. Natural gas is a key ingredient for making nitrogen-based fertilizers.

U.S. Dollar Value continues to rise against many different currencies, affecting the cost of dollar denominated wheat trade. In such an uncertain global wheat market, even minor changes in the dollar index are adding volatility.

The Rising U.S. Dollar

Overall, the U.S. Dollar (USD) continues to strengthen. Yet in this environment even subtle changes up or down in USD value can move U.S. and global wheat prices.

There is no shortage of headlines that directly affect the global wheat market. It is tough to say how much the road will curve in the near term. Grain buyers will remain busy absorbing the headlines as fast as they come.

By Michael Anderson, USW Market Analyst