As the southern hemisphere wheat harvest nears completion and world anticipates the next northern crop, many buyers, mill owners, and end-product manufacturers are considering purchasing decisions that will affect their businesses into the first quarter of marketing year 2024/25. With forward thinking in mind, USDA released its latest Grains and Oilseeds Outlook on Feb. 15, providing initial projections for U.S. wheat. Though subject to change, these projections help provide a baseline for future updates and a glimpse into the issues and opportunities that may emerge as the year progresses.

Preliminary Acreage, Production, and Use Outlook

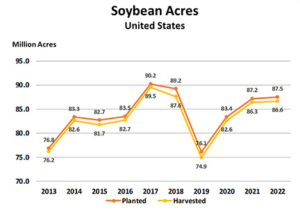

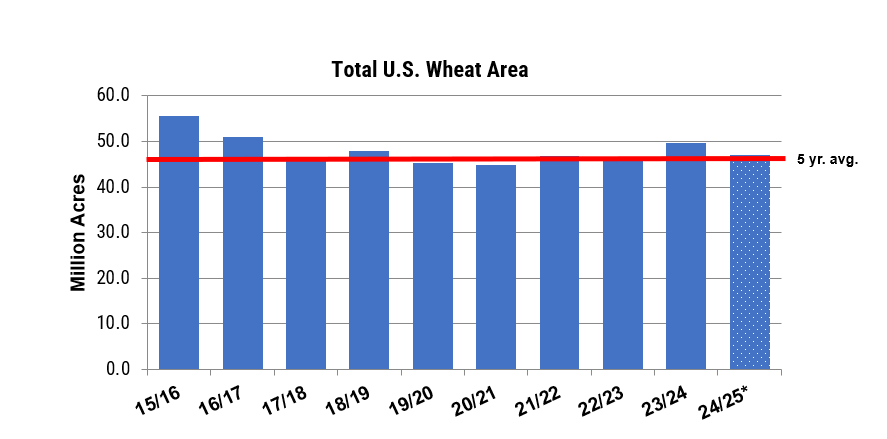

The Grains and Oilseeds Outlook projected total grains and oilseeds planted area at 225.5 million acres (91.25 million hectares), down from 227.8 million acres (92.2 million hectares) last year due to lower farm prices. USDA forecasted 2024 total wheat area at 47.0 million acres (19.0 million hectares), down from 49.6 million (20.1 million hectares) in 2023 but above the five-year average of 46.4 million (18.7 million hectares). The January Winter Wheat and Canola Seedings report estimated winter wheat area down 6% to 34.4 million acres (13.9 million hectares), leaving 12.6 million acres (5.1 million hectares) for hard red spring wheat (HRS), white spring wheat, and durum. USDA expects combined spring wheats and durum area to be slightly lower. However, private analysts and traders feel HRS acres may remain steady to slightly higher if planting conditions are favorable.

USDA forecasts wheat area at 47.0 million acres (19 million hectares), down 5% year over year but sitting just ahead of the five-year average of 46.4 million acres (18.7 million hectares). Source: USDA Grains and Oilseeds Outlook.

Despite the lower total planted area, USDA’ outlook anticipates a 2% yield increase to 49.5 bu/acre (3.33 MT/hectare). Following record abandonment in 2023, USDA’s estimated harvested area of 38.4 million acres (15.5 million hectares) is up 3%. The combined impact of improved yield and lower abandonment due to improved soil moisture conditions is expected to boost production to 51.7 MMT from 49.3 MMT in 2023/24. With the inclusion of higher beginning stocks, U.S. wheat supply estimate sits 6% higher year over year.

USDA predicts a slight decrease in domestic consumption to 30.8 MMT, marking a year-over-year reduction of 272,000 MT. In contrast, USDA expects U.S. wheat exports to bounce back to 21.09 MMT in 2024/25 on increased supplies.

A Looser Balance Sheet to Come?

Over the last seven years, there has been a steady erosion of U.S. ending stocks, falling from the recent high in 2016/17 of 32.1 MMT to a low in 2022/23 of 15.5 MMT, demonstrating the tightening of the U.S. balance sheet and providing underlying support to U.S. wheat prices. U.S. stocks will end 2023/24 slightly higher that with the improved production outlook suggests continued reversal of the downward trend.

USDA forecasts 2024/24 U.S. ending stocks to increase 16% to 20.9 MMT on higher production and beginning stocks. Despite the increase, ending stocks still sit 35% below the peak of 32.1 MMT in 2016/17. Source: USDA Grains and Oilseeds Outlook and February 2024 WASDE.

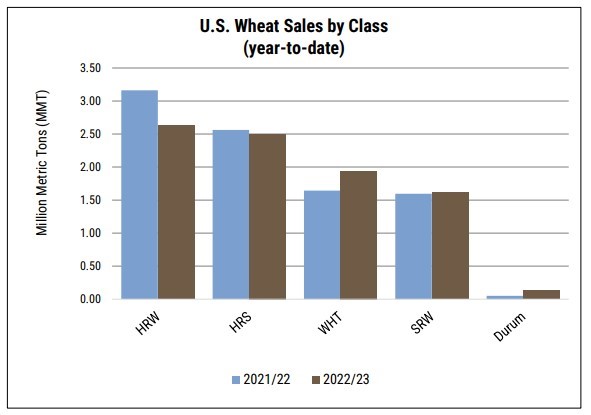

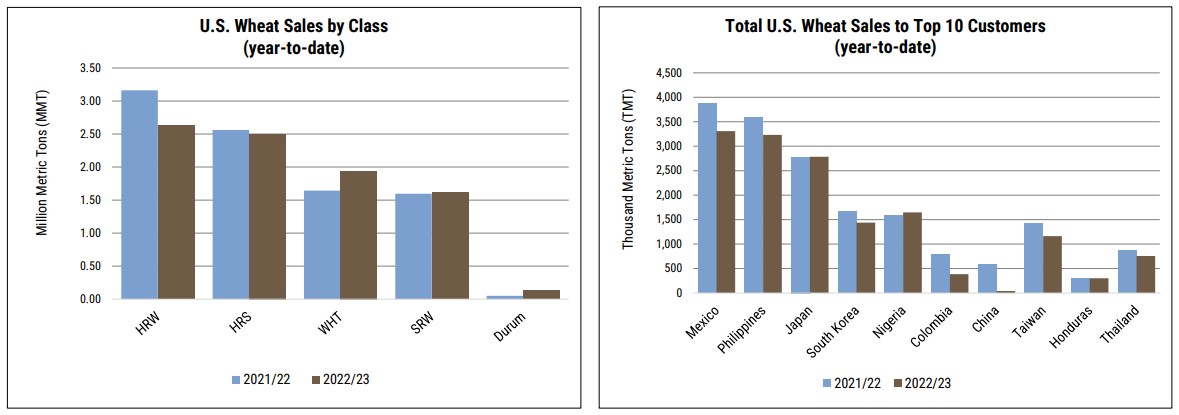

The current outlook casts a bearish tint on the upcoming crop year, but there is ample time between now and harvest for market conditions to change. For example, U.S. wheat total commercial sales and exports for 2023/24 sit at 17.6 MMT, 7% above last year’s pace and 89% of total projected exports. Crop conditions for winter wheat are much better than in the past few years but weather going forward will dictate final production.

USDA’s Prospective Plantings report, to be released on Mar. 28, and the May 2024 WASDE will provide detailed revisions for the 2024 U.S. wheat balance sheet, while Crop Progress Reports will provide updates on current crop conditions and planting progress. In the interim between harvests, world wheat markets will continue to search for new direction and shift based on emerging information. U.S. Wheat Associates (USW) will closely watch the crop and share additional information as the season progresses.

By Tyllor Ledford, USW Market Analyst