Ocean Freight Rates Revert to Pandemic Lows

As the COVID-19 pandemic fades into a not-so-distant memory, one can remember a time when “Supply Chain Disruptions” made every headline and container backlog in the Port of Long Beach required direct intervention from the U.S. government. Since the highs hit in the fall of 2021 freight prices have dropped to lows not seen since June 2020. Coupled with a recent break in wheat prices, decreased ocean freight costs have helped turn the tides back in the importers’ favor.

As Jay O’Neil of HJ O’Neil Commodity Consulting says, “the current outlook is not bullish, but vessel owners believe things must go up, as they don’t believe they can go lower…”

On February 6, the Baltic Dry Index hit 621, a level not seen since June 2020. The index has fallen 88% from its peak in October 2021. Source: Tradingview.com.

The China Effect

In recent years, dry bulk freight and Chinese economic growth have become interconnected. Dry bulk vessel sizes known as Handy (25,000 to 39,000 deadweight tons (dwt)), Handymax (40,000 to 49,999 dwt), and Panamax (60,000 – 78,999 dwt) that carry wheat and other grain cargos are also used to ship iron ore. And, according to S&P Global Commodity Insights, China accounts for almost 60% of dry bulk demand to help supply the country with over 1.1 billion MT of iron ore.

Until recently, however, China’s Zero Covid policy severely impacted economic growth. In 2022 China’s GDP growth slowed to 2.8% from 8.1% in 2021, thus diminishing iron ore demand by 2% as steelmaking slowed. With decreased Chinese vessel demand, freight rates have plummeted. As the seasonal lulls in economic activity around the Chinese Lunar New Year holiday dissipate, China remains a wildcard in global shipping as the country relaxes its COVID-19 restrictions, potentially opening the door for accelerating growth and industrial activity.

Congestion

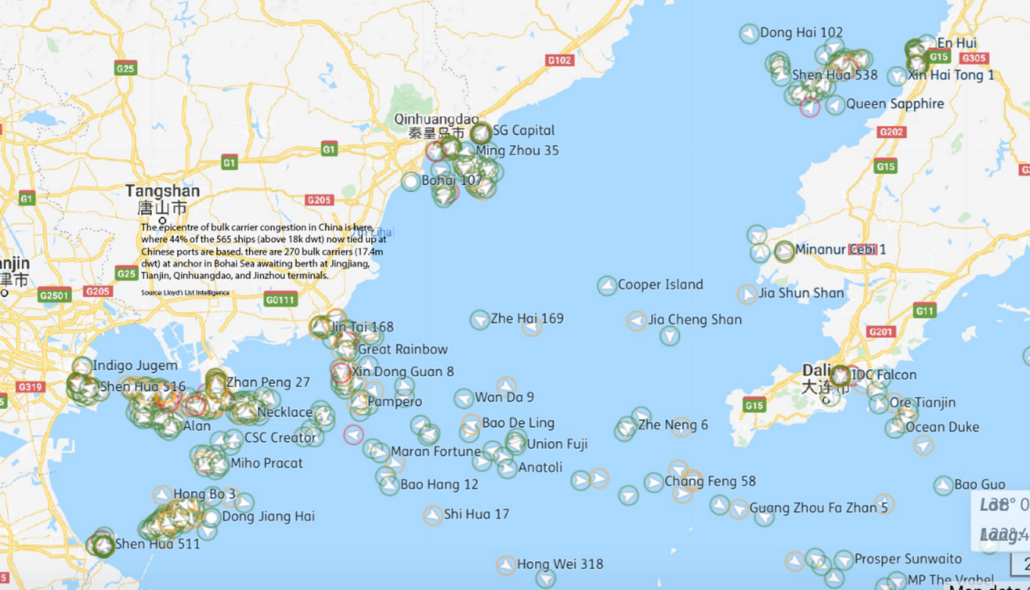

According to Lloyd’s List, in the fall of 2021, 5.7% of the world’s bulk fleet was anchored off Chinese ports due to strict quarantine requirements. As the global economy started its recovery from the pandemic, immense port congestion tied up hundreds of vessels, sending dry bulk freight soaring. Easing congestion in Chinese ports is expanding dry bulk capacity and will continue to play an essential role in freight markets in 2023, especially as China lifts more COVID-related restrictions.

Port congestion in China supported the bulk carrier rates in 2021, with upwards of 600 vessels queued to load or discharge cargo. Source: Lloyds List Maritime Intelligence.

Vessel Supply and Demand

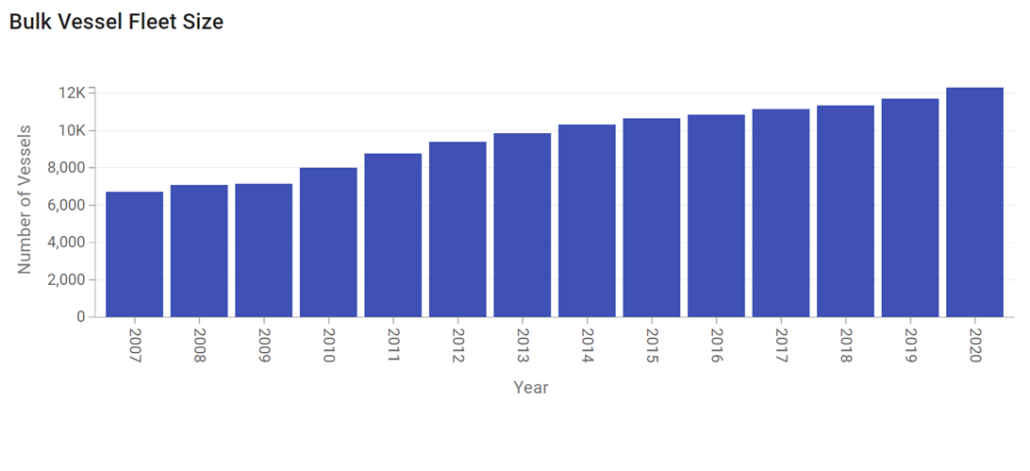

Over the last 13 years, the dry bulk vessel fleet has increased steadily, marking an average yearly increase of 4.8%, total growth of 53.8% since 2010. In 2022 dry bulk fleet growth slowed to 2.8% and is forecast to slow to 2.3% in 2023 (S&P Global, HJ O’Neil Commodity Consulting). Meanwhile, dry bulk demand declined by 1.9% in 2022 due to low iron ore and reduced grain shipments. If vessel supply continues to outpace demand, the downward pressure will continue to impact ocean freight.

The bulk vessel fleet size had grown by 53.8% on a steady pace over the last decade. Source: Drewry Shipping Consultants Ltd.

Oil Prices

After Russia’s invasion of Ukraine in February 2022, oil prices skyrocketed as sanctions were placed against Russia, the world’s second largest oil produce. As oil prices increase, the fuel input cost for dry bulk vessels also increase, supporting freight prices. In the year since the invasion, oil prices have normalized, taking pressure off the market.

Will This Pattern Hold?

As the freight market continues in freefall, importers and exporters must ask if this pattern is sustainable. According to Breakwave Advisors “one of the slowest weeks of the year for Chinese activity is now behind us” as we move into February and past the Lunar New Year festivities. Vessel supply and demand, port congestion, oil prices, and the on-going supply chain disruptions will continue to impact the market as economies normalize post-COVID; however, China remains in the driver’s seat of global freight. The resilience of the Chinese economy will be put to the test as economic activity increases post COVID, but for now, the world is waiting and all eyes are on China.

By Tyllor Ledford, USW Market Analyst