A month-long effort that had U.S. wheat farmers and industry experts presenting the 2023 Crop Quality Report to customers in more than two dozen countries is winding down with a collective sense of accomplishment.

It is believed at least one attendance record was set this year.

The annual series of U.S. Wheat Associates (USW) Crop Quality Seminars, which provide crucial information to customers and provide an opportunity for wheat buyers to interact and create a dialogue about the quality of the wheat crop, began in Sub-Saharan Africa on Nov. 1. Seminars in Central America/Caribbean and South Asia beginning soon after. Seminars in South America, the European Union and North Asia wrapped up on Nov. 20.

Only two dates remain: Seminars will take place in Dubai on Dec. 5 and Casablanca on Dec. 7.

Large Attendance

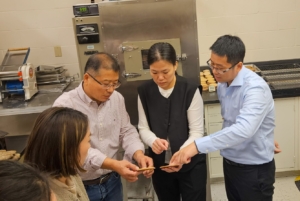

“The large attendance we saw this year highlights how much our customers value U.S. wheat’s timely and transparent information,” said USW Marketing Analyst Tyllor Ledford, who participated in her first Crop Quality Seminar. Ledford presented at the South Asia seminars (see photo above), which took place in the Philippines, Indonesia and Thailand. “Throughout the three seminars, we were able to reach customers from Thailand, Malaysia, Myanmar, Singapore, Vietnam, the Philippines, and Indonesia. The seminar in Bangkok was the largest on record, with nearly 140 participants.”

Attendance was strong throughout the 2023 Crop Quality Seminar series including here in Seoul, South Korea.

Producers Cory Kress (Idaho) and Aaron Kjelland (North Dakota) presented on New Technologies in Agriculture and Planting Decisions for Farmers. Likewise, U.S. country elevator managers Jason Middleton and Tyler Krause provided a presentation about grain origination and how it is handled at the first point of sale, in addition to by-class perspectives from exporters.

“The farmers and wheat buyers were happy to reconnect with familiar faces they had seen on trade team visits to the U.S. and other events,” said Ledford.

Positive Feedback

Erica Oakley, USW Vice President of Programs, said there has been a lot of positive feedback from each of the seven regions where Crop Quality Seminars were held.

“Our customers around the world have complimented U.S. wheat staff and presenters from our partner organizations,” said Oakley. “We had a lot of good information to share, so credit goes to the U.S. farmers who produced a high-quality wheat crop.”

Mexico

USW’s Mexico City Office hosted more than 225 participants representing flour millers and wheat buyers from Belize, Costa Rica, Dominican Republic, El Salvador, Guatemala, Haiti, Honduras, Jamaica, Mexico, Panama, St. Vincent and the Grenadines, Trinidad and Tobago, and Venezuela.

China

The North Asia Crop Quality Seminar team traveled to Suzhou, China, and presented to about 160 flour millers, wheat buyers, and baking industry representatives. Guest of note included Ms. LaShonda McLeod Harper, Director of the USDA Foreign Agricultural Service Agricultural Trade Office in Shanghai, and the senior COFCO Wheat Department Manager Mr. Sun Wei who had just participated in a USW-sponsored trade team visit for COFCO managers to the United States.

About 160 wheat buyers, flour millers, and baking industry executives participated in the 2023 USW Crop Quality Seminar in Suzhou, China.

Japan

Montana wheat farmer Denise Conover greets Japanese wheat industry executives at the 2023 USW Crop Quality Seminar in Tokyo, Japan.

In Tokyo, Japan, 130 customers attended a Crop Quality seminar. Attendees included flour milling companies from across the region, Japanese traders, grain inspectors and members of the media.

“The participants were very satisfied with the presentations and engaged them in active discussions and questions to gain a deeper understanding of the quality of this year’s U.S. wheat crop,” said Rick Nakano, USW Country Director in Japan.

South Korea

A total of 90 participants, including customers from the flour milling and food processing industries, attended the seminar held in Seoul, South Korea. It was the first in-person seminar held in South Korea in three years.

“Customers expressed great satisfaction with the on-site Crop Quality Seminar,” said USW Country Director Dong-Chan “Channy” Bae. “Notably, despite the typically reserved nature of Korean attendees, there was an engaging discussion on the market, wheat quality, and logistics during a question-and-answer session.”

South America

Seminars in South America attracted a good number of customers, reports USW Regional Director Miguel Galdos.

“In the seminar held in Cali, Colombia, participants represented 30% of total wheat imports in Colombia,” he said. “Meanwhile, in Bogota, more than 35% of total wheat imports were represented.”

USW Assistant Regional Director Osvaldo Seco welcomes participants to a 2023 Crop Quality Seminar in South America.

A seminar In Quito, Ecuador, drew companies accounting for at least 90% of U.S. wheat imports. The same can be said for seminars in Lima, Peru, and Santiago, Chile – both saw more than 90% of U.S. wheat purchases represented.

Sub-Saharan Africa

USW’s Cape Town Office conducted Crop Quality seminars in Nairobi, Kenya; Lagos, Nigeria; and Cape Town, South Africa. Presenting quality data from the 2023 harvest were Dr. Senay Simsek, Department Head for Food Science at Purdue University; Charlie Vogel, Executive Director of the Minnesota Wheat Research and Promotion Council; and Royce Schaneman Executive Director of the Nebraska Wheat Board.

Simsek presented on Solvent Retention Capacity (SRC) and industry analyst Mike Krueger presented via video on the world supply and demand situation for grains.

In Nairobi, USW also conducted a demonstration at the African Milling School using soft red winter (SRW) and hard red winter (HRW) for local products, such as chapati and mandazi.

By Ralph Loos, USW Director of Communications