Following is USW Market Analyst Tyllor Ledford’s report on her participation in the 2023 Crop Quality Seminars. She appears on the left in the photo above with Regional Vice President for South and Southeast Asia Joe Sowers and Assistant Regional Director Joe Bippert at the Crop Quality Seminar in Bangkok, Thailand.

For many, the month of November includes preparations for an upcoming holiday season and a time of reflection as many cultures around the world look ahead to a new year. At U.S. Wheat Associates (USW), the month of November marks Crop Quality Seminar season, a time when USW staff from around the world inform customers about new wheat crop quality characteristics, provide insight on current market conditions, and highlight opportunities for customers as they make purchasing decisions into the coming year.

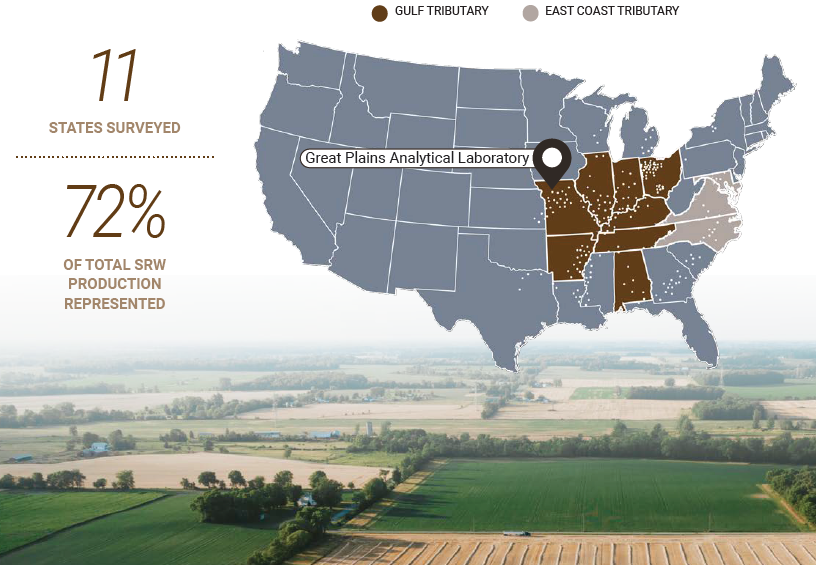

Download the 2023 U.S. Wheat Crop Quality Report here.

From November 6 to 10, I had the pleasure of joining a team of USW staff, state wheat commission staff, partner organizations, exporters, and wheat farmers on the Southeast Asia Crop Quality tour in Manila, Philippines, Jakarta, Indonesia, and Bangkok, Thailand. The seminars represent a cumulation of the years’ work, from when the winter wheat crop was planted in 2022 through spring fieldwork, harvest, rigorous quality testing, and finally, the compilation of the 2023 crop quality booklets.

A Unique Gathering

Differing from other USW sponsored events, the Crop Quality seminars provide an annual opportunity for representatives from across the U.S. wheat supply chain to gather in one location with major flour milling stakeholders from the region. Attendees included a mix of producers, country elevator managers, U.S. export companies, flour mill staff, and end product manufacturers. With a wide range of representation from across the supply chain, this year’s event provided the opportunity to address special topics of concern, including how farmers make planting decisions and the future of wheat acreage, new technology implementation by wheat producers, and the grain origination process from a country elevator point of view. The U.S. supply chain is large and complex; therefore, perspectives from different aspects of the supply chain help bridge the gap between the producers of U.S. and the end users.

In our region alone we reached over 250 customers from Thailand, Malaysia, Myanmar, Singapore, Vietnam, the Philippines, and Indonesia throughout three seminars. It was enlightening to witness firsthand the great relationships USW has with the flour milling industry in the region and reconnect with familiar faces that have visited farms in the U.S. or participated in other USW sponsored activities and events.

Nearly 150 flour mills staff, end product manufactures, and industry stakeholders gathered at the 2023 USW Crop Quality Seminar held in Bangkok, Thailand.

Timely Information Aids in Future Planning

Throughout the week, a common focus of questions and hallway conversations centered on future purchasing decisions, potential threats, and the key question of “where will prices go next?”

Market sentiment is ever changing and now more than ever, lurking factors that are not yet reflected in current market prices continue to play a role in wheat market dynamics. Even in years with less variability, accurately predicting price direction is a challenge, but this year, with many more unknowns than knowns in the market, making predictions is more difficult than ever.

Nevertheless, the questions and conversations highlight the continued need for information sharing as customers navigate the complexities of the world wheat market. Regardless of the year, crop conditions, and market outlook customers rely on USW to provide accurate, timely, and transparent information, in addition to the high-quality wheat on which customers know they can rely.

The final northern durum weekly report showed that compared to the prior week, wheat moisture increased to 11.4%, falling number increased to 416 sec and HVAC decreased from 81% to 80%. Compared to 2022, protein content, 1000-kernel weight, and percent damaged kernels were higher while falling number, test weight and shrunken and broken kernels were lower. The overall grade remained U.S. No. 1 Hard Amber Durum (HAD).

The final northern durum weekly report showed that compared to the prior week, wheat moisture increased to 11.4%, falling number increased to 416 sec and HVAC decreased from 81% to 80%. Compared to 2022, protein content, 1000-kernel weight, and percent damaged kernels were higher while falling number, test weight and shrunken and broken kernels were lower. The overall grade remained U.S. No. 1 Hard Amber Durum (HAD).