In late May, U.S. Wheat Associates (USW) reported on bullish wheat market sentiment, driven by adverse weather and changing supply and demand conditions. Since then, the volatility that has remained a constant in wheat markets for more than two years returned. From May 24 to June 21, CBOT, KCBOT, and MGEX wheat futures dropped 69 cents, 55 cents, and 58 cents, respectively.

Until global supply and demand is more defined, markets will remain sensitive to changes in weather, perceived consumption, and supply shifting events. However, the recent volatility may help illuminate unexpected buying opportunities for U.S. wheat.

Markets have been volatile over the last few months. From May 24 to June 21, CBOT, KCBOT, and MGEX wheat futures dropped 69 cents, 55 cents, and 58 cents, respectively. Source: U.S. Wheat Associates Price Report.

A Series of Trend Reversals

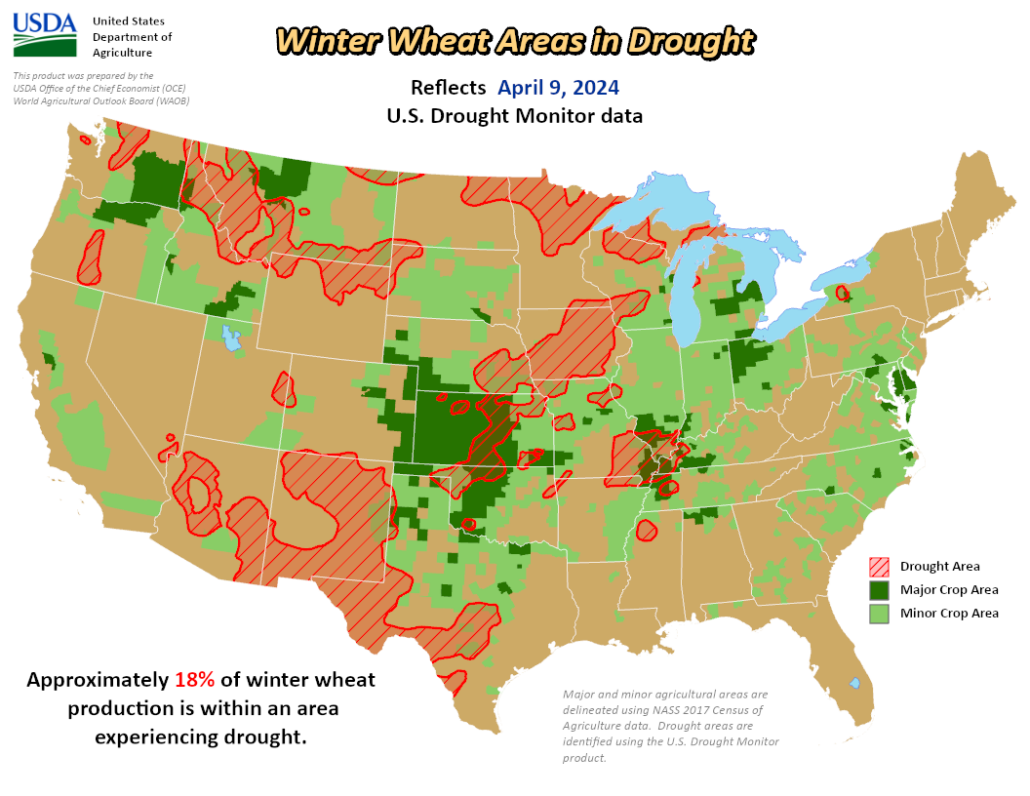

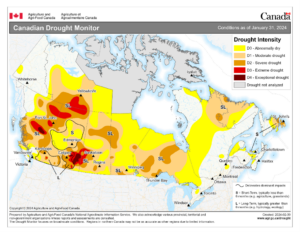

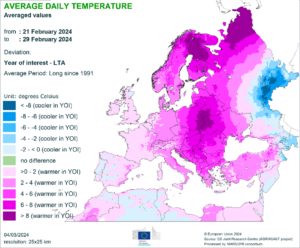

In March 2024, markets hit multi-year lows as ample wheat stocks from Russia and record Black Sea exports weighed on global wheat prices. Starting in April, the market’s “weather eye” saw drought conditions and severe frost damage in central and southern Russia prompting a reversal and prices rallied back to 2023 levels. Confirmed by the June World Agricultural Supply and Demand Estimates (WASDE), the Russia production estimates decreased by 8.5 MMT on the year to 83.0 MMT, the lowest level since 2021/22. Likewise, persistent wet, cool weather and flooding decreased the European Union (EU) planted area and diminished French and German yield potential, resulting in a yearly decrease of 3.7 MMT to 130.5 MMT.

The June WASDE decreased Russia production estimates by 5.0 MMT to 83.0 MMT, due to drought conditions and severe frost damage. Like wise, persistent wet, cool weather and flooding in the EU prompted USDA to decrease production by 1.5 MMT to 130.5 MMT. Source: USDA Wheat Outlook.

The June WASDE decreased Russia production estimates by 5.0 MMT to 83.0 MMT, due to drought conditions and severe frost damage. Like wise, persistent wet, cool weather and flooding in the EU prompted USDA to decrease production by 1.5 MMT to 130.5 MMT. Source: USDA Wheat Outlook

Adding further strain on the market, rumors began circulating that India may begin importing wheat, with stocks sitting at 7.5 MMT, the lowest in 16 years. In response to supply strains, wheat futures prices climbed throughout April and May, touching levels not seen since Fall 2023 and adding support to world cash values.

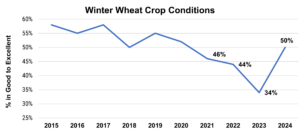

Meanwhile, on June 6, major world importer Türkiye announced a ban on wheat imports from June 21 through October to control domestic prices. Adding validity to the claims, the June WASDE reduced the Turkish import forecast from 10.5 MMT to 9.5 MMT. The announcement suggested weakened demand prospects and sent markets lower. Contributing to the new narrative, private analysts also suggested the impacts on Russian yields were not as severe as predicted. Furthermore, the U.S. production outlook now seems more favorable and harvest progress continues rapidly. As of June 23, 40% of the winter wheat crop is in the bin, while conditions in the remaining acres sit at 52%, up from 40% last year. Similarly, 71% of spring wheat rates good or excellent, a 21-point jump from the previous year.

The combined impacts of Türkiye, alleged improvements to Russia production, and the U.S. harvest has depressed prices, bringing them back in line with, or in the case of HRS slightly below, their position in March 2024.

Eyes Out for Opportunity

Despite the recent volatility, the spread between competing origins has narrowed over the last few weeks. According to AgriCensus price data, as of June 21, Russian, French, Romanian, and Soft Red Winter hovered in a narrow range between $230-$235/MT, a considerable decrease from the $17/MT spread between Russian wheat and the next cheapest origin noted in March. Likewise, Gulf HRW prices trend lower, with the June 21 U.S. Wheat Associates Price Report putting Gulf HRW with 11.5% protein at $243/MT, in line with German and Polish origins and only $12/MT above Russian prices, a much closer spread compared to a $67/MT difference observed in March 2024.

As U.S. wheat prices align more closely with other export prices, it presents a chance for international buyers to take advantage of the recent price trends. Supported by exceptional quality, a dependable supply chain, and unsurpassed customer service from USW colleagues, U.S. wheat offers an exceptional value.

The June 21 U.S. Wheat Associates Price Report put Gulf HRW with 11.5% protein at $243/MT, in line with German and Polish origins and only $12/MT above Russian prices, a much closer spread compared to a $67/MT difference observed in March 2024. Source: AgriCensus Price Data and the U.S. Wheat Associates Price Report.