News and Information from Around the Wheat Industry

Speaking of Wheat

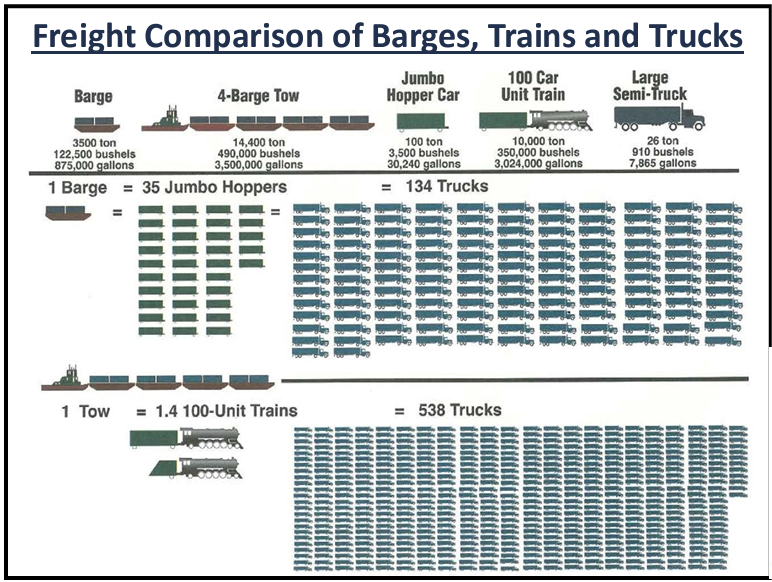

“Locks and dams on the Lower Snake River and the Columbia River provide essential infrastructure for moving U.S.-grown wheat to high-value markets around the world. We cannot overstate the positive value they create for U.S. farms, [the] economy of the Pacific Northwest and far beyond.” – From USW letter to House subcommittee hearing on the Columbia Snake River System

Happy Chinese New Year!

The U.S. Wheat Associates (USW) Beijing office sent the digital “Happy Chinese New Year” card at the top of the page. We all hope “The Year of the Dragon” is safe and prosperous for the U.S. friends we represent, for our customers, and for our USW colleagues!

Past Chair Brian O’Toole Honored

Brian O’Toole, a past USW chairman and a partner in the sixth-generation T.E. O’Toole Farms has been named to the North Dakota Agricultural Hall of Fame. O’Toole served for 12 years on the North Dakota Wheat Commission, chaired the North Dakota Crop Improvement and Seed Association. He served for 16 years at the Wheat Marketing Center in Portland, Ore. During his years of service, O’Toole promoted North Dakota and U.S. wheat on trade missions to 23 countries. He has received Outstanding Young Farmer, Master Farmer, and Premier Seed Grower Awards. Congratulations, Brian, and thank you for your service! Read more here.

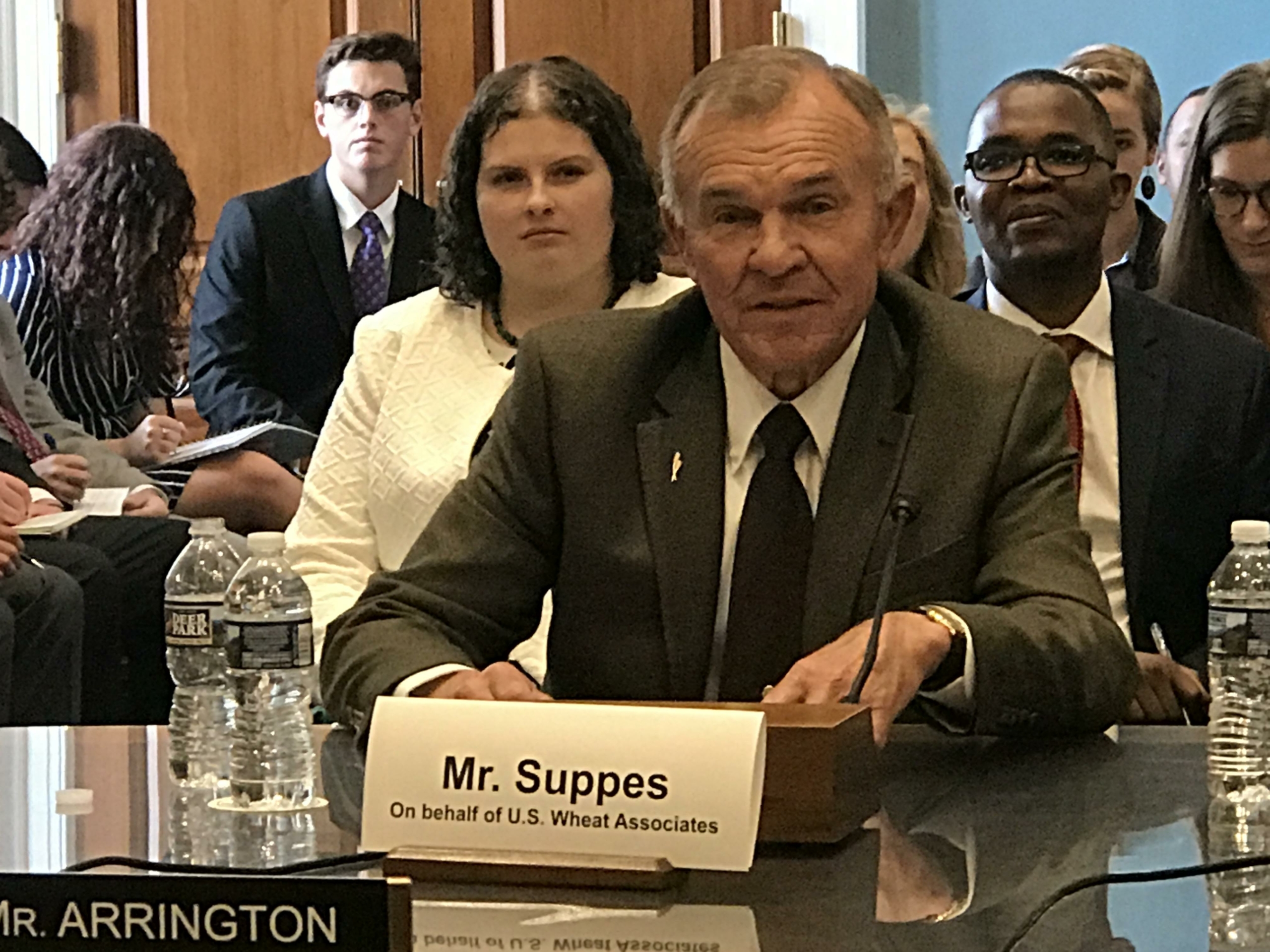

Then USW Chairman Brian O’Toole presented this gift from U.S. wheat farmers to the Japan Flour Millers Association in 2015.

Winter Wheat Serves Conservation and Food Security

Kansas Wheat shared information about the National Association of Wheat Growers (NAWG) is advocating to officially classify intentionally seeded winter wheat as a “cover crop” under USDA’s Natural Resources Conservation Service (NRCS) and other “climate-smart” programs, while not impacting its eligibility as a harvestable cash crop insurable through federal programs. “Climate-smart” activities like cover crops help farmers continue to be the best stewards of their lands, but winter wheat has been overlooked as a vital tool in both conservation and food security.

NAWG Recruiting Communications Professional

The National Association of Wheat Growers (NAWG) has a job opening for Director of Communications and Partnerships. The position’s main role is to oversee all media requests, publish the weekly newsletter and monthly podcast, communicate conference responsibilities, and help cultivate industry partnerships. Applications need to be submitted to [email protected] by Feb. 14, 2024.

February Cereal Sciences Events Calendar

Dr. M. Hikmet Boyacioglu of KPM Analytics compiles a listing of noteworthy worldwide conferences, expos, symposiums, and other events for the grains, milling, and baking industries. Visit https://lp.kpmanalytics.com/en-us/cerealgrain-science-event-calendar to download the February calendar and future posts.

NCI Announces Leadership Changes

The Northern Crops Institute (NCI) named Technical Manager David Boehm and Program Development Manager Dr. Casey Peterson as interim co-directors. The two will fill the role of Mark Jirik, who announced in December that he would step down after nearly six years heading the institute. The NCI and NDSU will begin their search for a permanent NCI director this spring. The change in leadership comes as the NCI is preparing to move into its new home at the Peltier Complex on the campus of North Dakota State University. The NCI and NDSU will begin their search for a permanent NCI director this spring. “Both David and Casey know the organization very well and will do a great job of leading the organization until a national search can be concluded,” said Matt Swenson, vice chair of the Northern Crops Council, a member of the North Dakota Oilseed Council and member of the interim search committee.

U.S. Miller Supports Soft Red Winter Wheat Development

U.S. Wheat was pleased to participate in the “Double Crop Farmers’ Forum” sponsored by the Illinois Wheat Association and the Illinois Soybean Association Feb. 5, 2024. At the meeting, the University of Illinois College of Agricultural, Consumer and Environmental Sciences announced that Siemer Milling Company, Teutopolis, IL, made a major gift to the college’s Department of Crop Sciences to, in part, fund an endowed chair in wheat breeding. Professor Jessica Rutkowski, the University wheat breeder, will be the first to hold this chair. Illinois farmers annually produce more soft red winter wheat than any other state. To see how Siemer Milling ensures the highest quality wheat for its grist, watch this video.

Announcing the Siemer Milling Company gift at the Double Crop Farmers’ Forum in Mt. Vernon, Ill., were (left to right) University of Illinois Dean Germán Bollero, Crop Sciences Department Head Adam Davis, President Richard Siemer, Siemer Milling Company, and Professor Jessica Rutkowski, small grains breeder and quantitative geneticist, who will hold the first Siemer Milling Company Professorship.