News and Information from Around the Wheat Industry

Speaking of Wheat

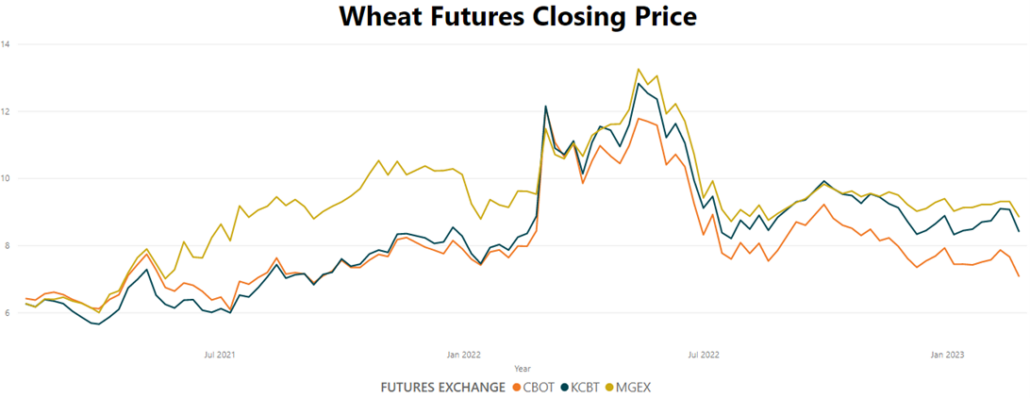

“Until some of these geopolitical conflicts are resolved — it’s difficult to envision a return to the level of free trade we enjoyed through the late 20th and early 21st centuries. Difficult as it may be, governments must resist the urge to limit or ban grain exports unless the food security situation in their countries is truly dire. The fate of a growing number of food insecure people on this planet — estimated at nearly 350 million people (more than the population of the United States) in 2023 by the World Food Programme — depends on it.” – Arvin Donley, Editor, World Grain. Read more here.

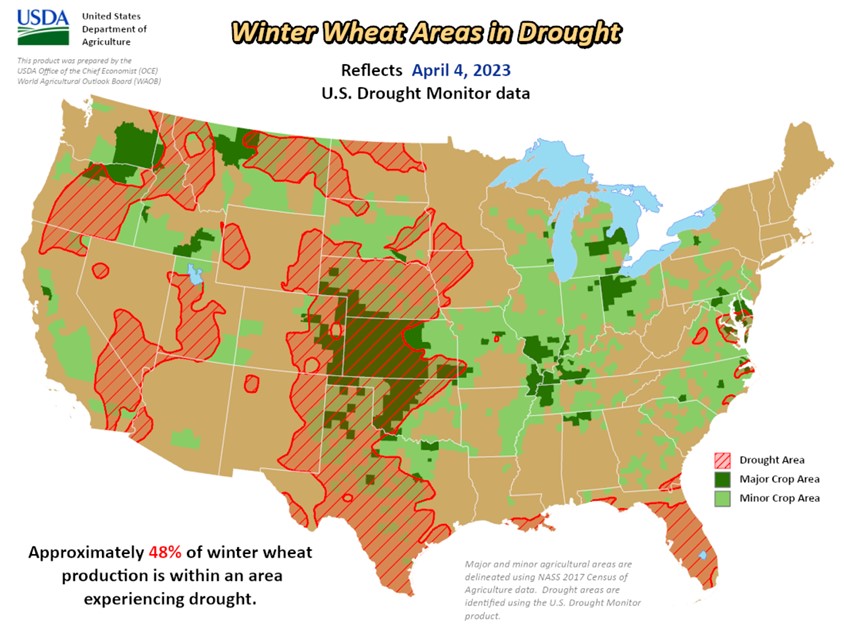

SW Kansas: “One of the Worst Wheat Crops in 50 Years”

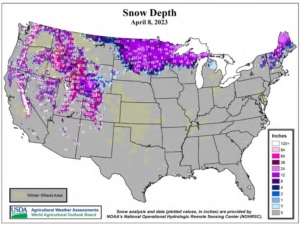

That is how wheat farmer and agricultural journalist Vance Ehmke described the situation in the southwestern corner of Kansas. Ehmke said there will be “no dryland [winter] wheat at all” this year there and extending about 160 kilometers into the Texas and Oklahoma Panhandles and southeastern Colorado. “I looked at 30 to 35 years of Kansas wheat crops and abandonment runs about 10%. I could see 25% abandoned here this year with very low yields on the rest,” he wrote in The Hutchinson News. See also Bloomberg News’ video summary here.

Winter Wheat Conditions Still Lower

Farm broadcaster Ron Hays’ Oklahoma Farm Report notes the April 10 USDA NASS Crop Progress Report shows U.S. winter wheat conditions are tied with 1996 for the lowest rating in 40 years. Nationwide, winter wheat is 27% good to excellent. That is down one point from the previous week and compares to 32% good to excellent at the same time in 2022. Read more here.

The Passing of Joe Kejr

U.S. Wheat Associates (USW) joins so many others in our industry in expressing our condolences to the family of Ottawa County, Kan., farmer Joe Kejr, who passed away suddenly April 8, 2023. “Joe loved being a wheat farmer — thoughtfully growing, observing and discussing the crop throughout each unique season,” said Justin Knopf, immediate past president of the Kansas Association of Wheat Growers and close family friend. “We will miss his focus and efforts on building relationships, trust and unity throughout the industry. His example, steady presence, leadership and friendship will be sorely missed by so many of us here in his community and across the country.” Learn more about the Kejr’s farm operation here.

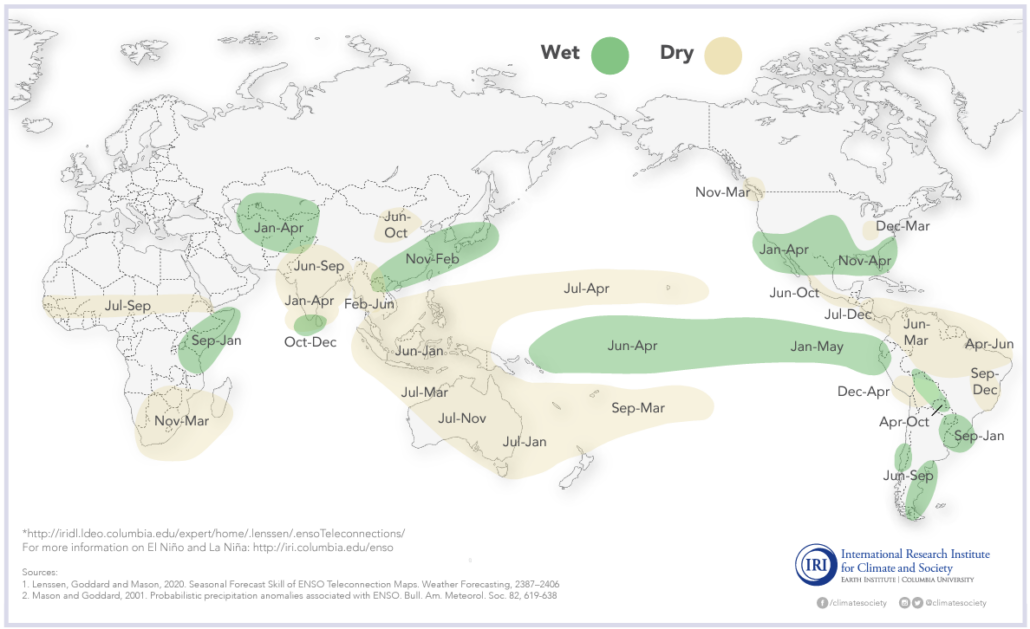

China to Lead 2022/23 Wheat Import Volume

USDA reports that Chinese wheat imports are forecast up to 12.0 million tons in 2022/23—the country’s highest level of imports since 1995/96 when imports reached 12.5 million. Domestic grain prices have remained high given the country’s minimum support price policy and reduced auction activity amidst uncertainty surrounding the government’s COVID-19 policies. Competitive pricing has prompted China to import large volumes of both milling and feed quality wheat. Australian wheat is especially competitive following 3 consecutive years of record crops. China continues to aggressively purchase Australian wheat supplies, with July-February imports up 66% compared to the previous year. Read more.

2023 Hard Winter Wheat Quality Tour Registration Ends May 1

The tour, sponsored by the Wheat Quality Council, will be May 15 to 18. Register for the Wheat Tour at wheatqualitycouncil.org. The tour brings in participants from around the world who interact with Kansas farmers, network with their peers, learn more about wheat production while they assess the condition and yield potential of the hard winter wheat crop across the state of Kansas. USW will report on tour results in Wheat Letter.

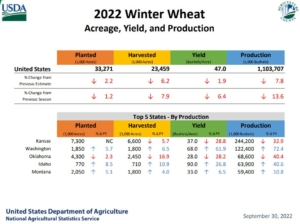

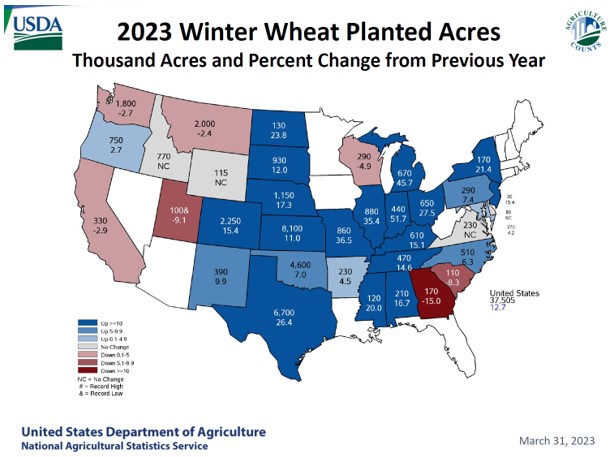

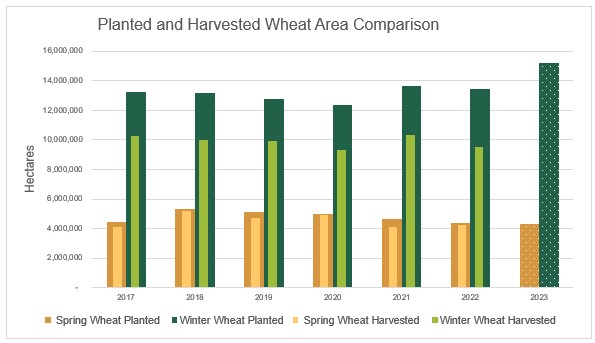

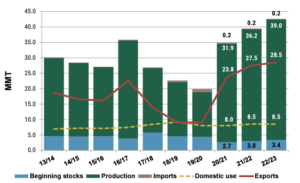

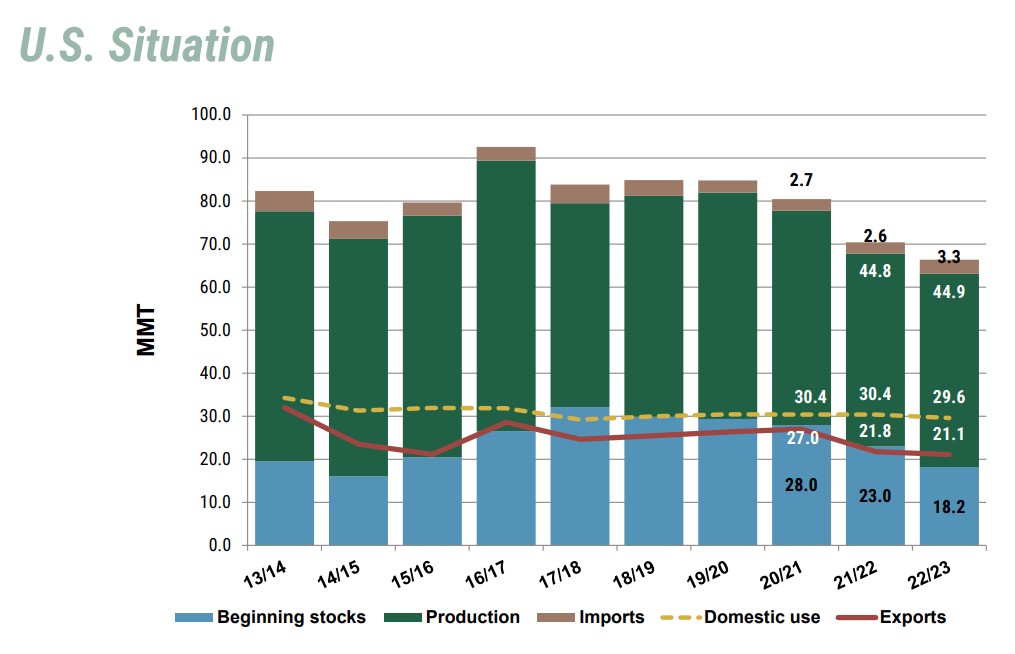

According to USDA, the total HRW planted area fell slightly to 23.08 million acres. The area harvested fell more steeply at 15.24 million acres, 1.95 million acres less than in 2021/22. Overall U.S. HRW production is 14.5 MMT, 29 percent less than last year. Kansas, the largest HRW producing state, saw production drop 119,000 bushels compared to 2021/22. Oklahoma’s production dropped 40%, at 68,600 bushels, according to the Small Grains Report. Exports of HRW are forecast at 6 MMT, 30% less than in 2021/22. Year-to-date HRW sales of 3.1 MMT are 30% less than the pace last year. The top markets for HRW are Mexico, Japan, Nigeria, Brazil, and Colombia.

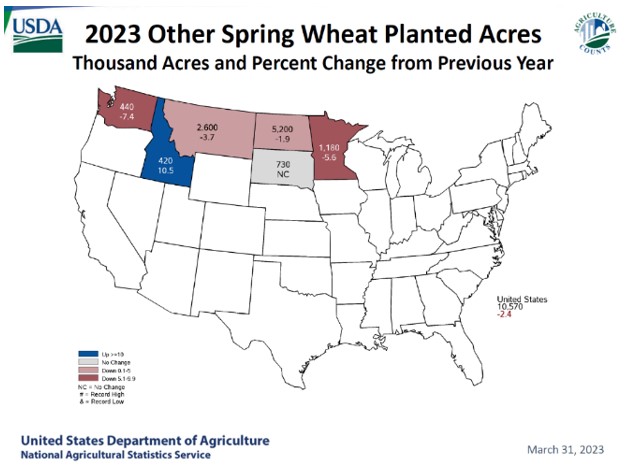

According to USDA, the total HRW planted area fell slightly to 23.08 million acres. The area harvested fell more steeply at 15.24 million acres, 1.95 million acres less than in 2021/22. Overall U.S. HRW production is 14.5 MMT, 29 percent less than last year. Kansas, the largest HRW producing state, saw production drop 119,000 bushels compared to 2021/22. Oklahoma’s production dropped 40%, at 68,600 bushels, according to the Small Grains Report. Exports of HRW are forecast at 6 MMT, 30% less than in 2021/22. Year-to-date HRW sales of 3.1 MMT are 30% less than the pace last year. The top markets for HRW are Mexico, Japan, Nigeria, Brazil, and Colombia. USDA estimates total HRS planted area in 2022 was 10.20 million acres, 390,000 fewer acres than 2021. The area harvest was up 5%, at 9.82 million acres. Heavy rain and cool temperatures early in the planting season slowed down spring wheat planting in parts of North Dakota and Minnesota. North Dakota HRS yield rebounded 49% from last year to 50 bushels per acre. USDA estimates total HRS production will rebound from last season and reach 12.1 MMT, 49% higher than in 2021. HRS exports are expected to reach 6.1 MMT, 400,000 MT higher than last season. Total HRS sales in 2022/23 were 2% higher than last year at 3.3 MMT. The top markets for HRS are the Philippines, Mexico, Japan, Taiwan, and South Korea.

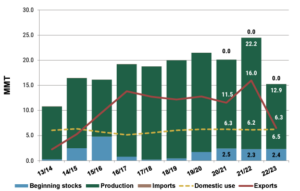

USDA estimates total HRS planted area in 2022 was 10.20 million acres, 390,000 fewer acres than 2021. The area harvest was up 5%, at 9.82 million acres. Heavy rain and cool temperatures early in the planting season slowed down spring wheat planting in parts of North Dakota and Minnesota. North Dakota HRS yield rebounded 49% from last year to 50 bushels per acre. USDA estimates total HRS production will rebound from last season and reach 12.1 MMT, 49% higher than in 2021. HRS exports are expected to reach 6.1 MMT, 400,000 MT higher than last season. Total HRS sales in 2022/23 were 2% higher than last year at 3.3 MMT. The top markets for HRS are the Philippines, Mexico, Japan, Taiwan, and South Korea.

White wheat planted area, which includes more than 99% soft white (SW), totaled 4.24 million acres in 2022. The area harvested is 4.02 million acres, nearly identical to 2021/22. Improved growing conditions in Washington and Oregon increased yields significantly. Washington yields are 61% higher than last year, while Oregon’s yields are 51% higher, according to the Small Grains Report. White wheat production is estimated at 7.4 MMT, 1.9 MMT more than in 2021/22. Exports are expected to reach 4.6 MMT. Total white wheat (soft and hard) sales in 2022/23 are 17% higher than last year at 2.5 MMT. The top markets for white wheat were the Philippines, Japan, China, and South Korea.

White wheat planted area, which includes more than 99% soft white (SW), totaled 4.24 million acres in 2022. The area harvested is 4.02 million acres, nearly identical to 2021/22. Improved growing conditions in Washington and Oregon increased yields significantly. Washington yields are 61% higher than last year, while Oregon’s yields are 51% higher, according to the Small Grains Report. White wheat production is estimated at 7.4 MMT, 1.9 MMT more than in 2021/22. Exports are expected to reach 4.6 MMT. Total white wheat (soft and hard) sales in 2022/23 are 17% higher than last year at 2.5 MMT. The top markets for white wheat were the Philippines, Japan, China, and South Korea.