Harvest and Much Improved Conditions Pressure U.S. Soft White Market

Volatility remains the key word when looking at wheat prices, and the soft white (SW) market is no exception.

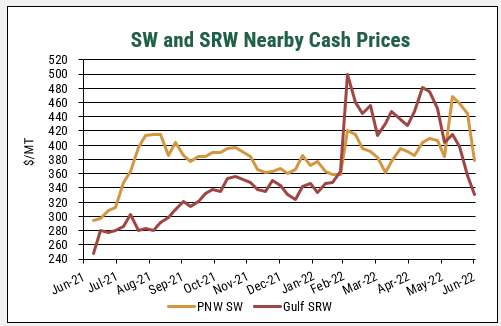

From their rapid increase following the severe drought in 2020/21 and the Russian invasion of Ukraine in March 2022, U.S. wheat futures have declined recently and were down more than 4% on July 5, hitting a multi-month low. While SW does not trade on a futures exchange, as a soft wheat, it reflects the CBOT soft red winter (SRW) futures price that settled July 5 at $8.07, the lowest level since February 18, before the invasion. On July 6, the July contract SRW contracted slipped further, falling below $8.00/MT.

Source: USW Price Report

New Crop Arriving

The U.S. SRW and hard red winter (HRW) wheat harvests are underway, helping push futures and SW prices down as the market takes in news about crop conditions and yield potential. An additional bearish factor is improved crop conditions boosting confidence for this year’s hard red spring (HRS) crop.

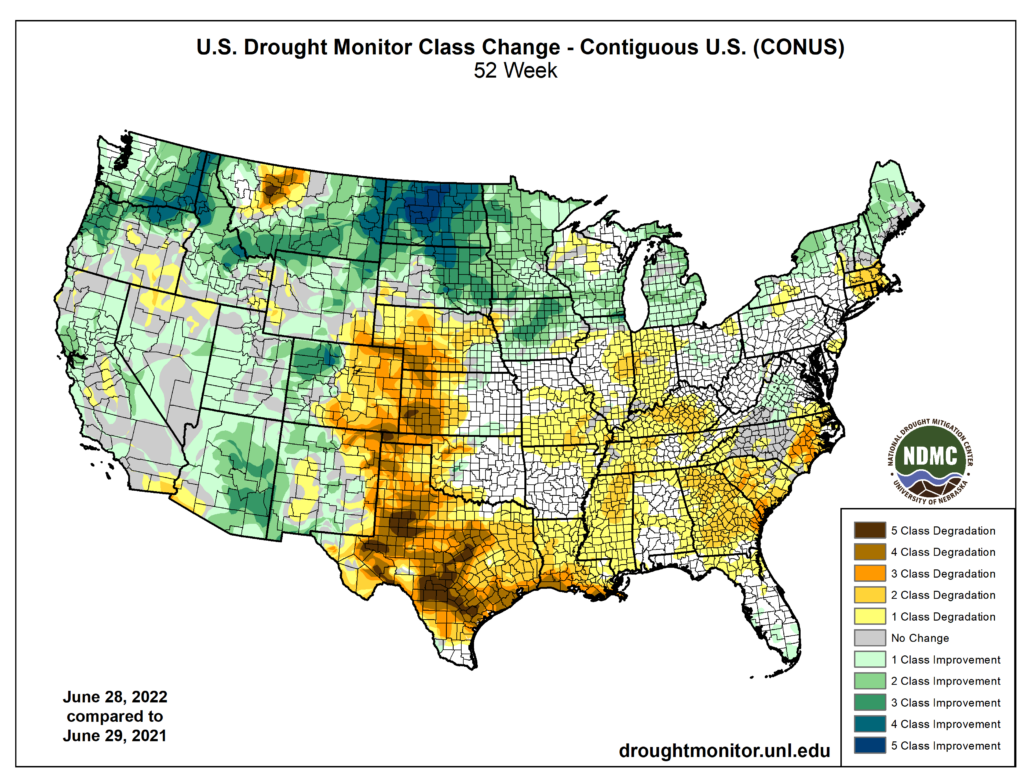

Abundant moisture and cooler temperatures this growing season have benefited the SW crop but also slowed crop progress, causing a slight delay in this summer’s harvest.

More SW to Come Slightly Late

One wheat trader shared an anecdote about harvest timing from a Washington-based wheat farmer. Each year the farmer looks to when a specific type of flower blooms to indicate when harvest will start. Usually, the flowers bloom around mid-June, and wheat typically matures about three weeks later. But this year, the flowers did not bloom until the end of June, so the farmer expects to start harvest around July 15.

This look ahead at the new SW crop also helps to explain the quick run-up in SW export prices in May when “old crop” stocks were being drawn down and in June when the price started to turn toward a middle ground.

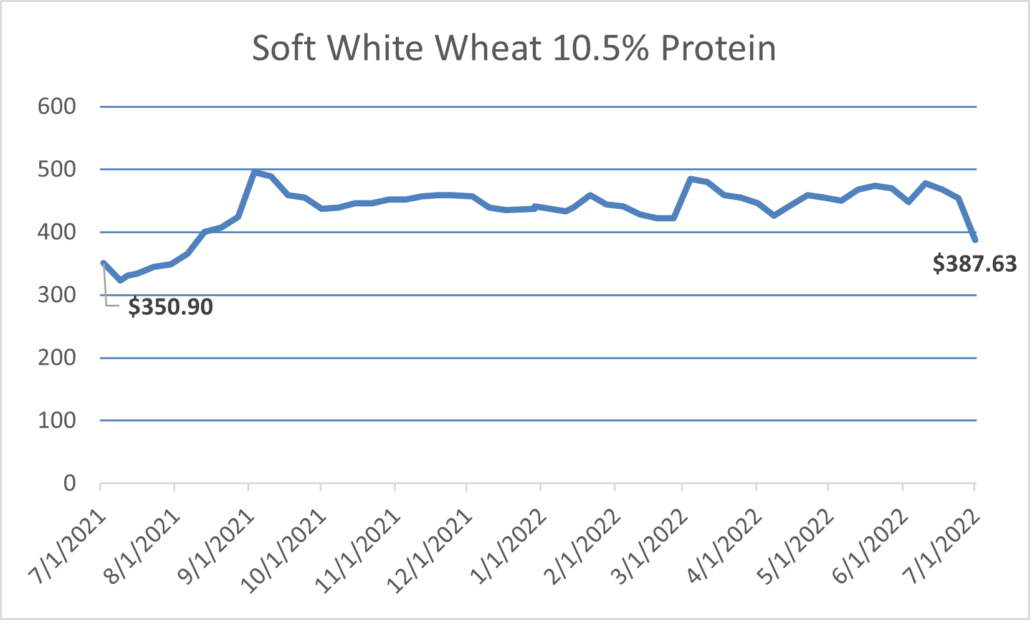

Moderating SW Prices. As the harvest of a much improved and potentially high-yielding U.S. SW wheat crop draws near, new crop prices have come down to a level similar to prices in August 2021. Source: USW.

Buyers of SW around the world are all too familiar with the impact of drought and heat on 2021 SW production and functional characteristics, as well as export prices. This year things are different.

“Much Better” Production

The U.S. Drought Monitor keeps statistics comparing changes in drought status from year to year. A recent comparison map (below) shows significant improvement in the Pacific Northwest SW and white club production region, as well as in much of the U.S. HRS and northern durum production region.

Source: U.S. Drought Monitor.

In an interview with the Moscow-Pullman Daily News, Glen Squires, chief executive officer for the Washington Grain Commission, highlighted the volatility and numerous factors that fueled and then decelerated the SW wheat market. Weather, he emphasizes, is a key part of what is behind the market right now.

“Our wheat production in the Pacific Northwest is supposed to be a much better this year,” Squires said. “If the estimates are accurate, we could have 20 million bushels (544,366 metric tons) over our five-year average. So that plays into (the market volatility) a little bit.”

Buyers can monitor U.S. Wheat Associates (USW) Harvest Reports for weekly updates on harvest progress and initial crop quality data and follow more news about the 2022 harvest through state wheat commissions and regional USW office updates.

By USW Market Analyst Michael Anderson