News and Information from Around the Wheat Industry

Speaking of Wheat

“The ongoing fighting [in Sudan] is preventing WFP from delivering critical emergency food, providing school meals for children, or preventing and treating malnutrition. WFP also cannot carry out its work to support farmers to boost agriculture productivity in a project that aims to more than double Sudan’s annual wheat production, nor help people rebuild their livelihoods.” – UN World Food Programme (WFP) Executive Director Cindy McCain. Read more here.

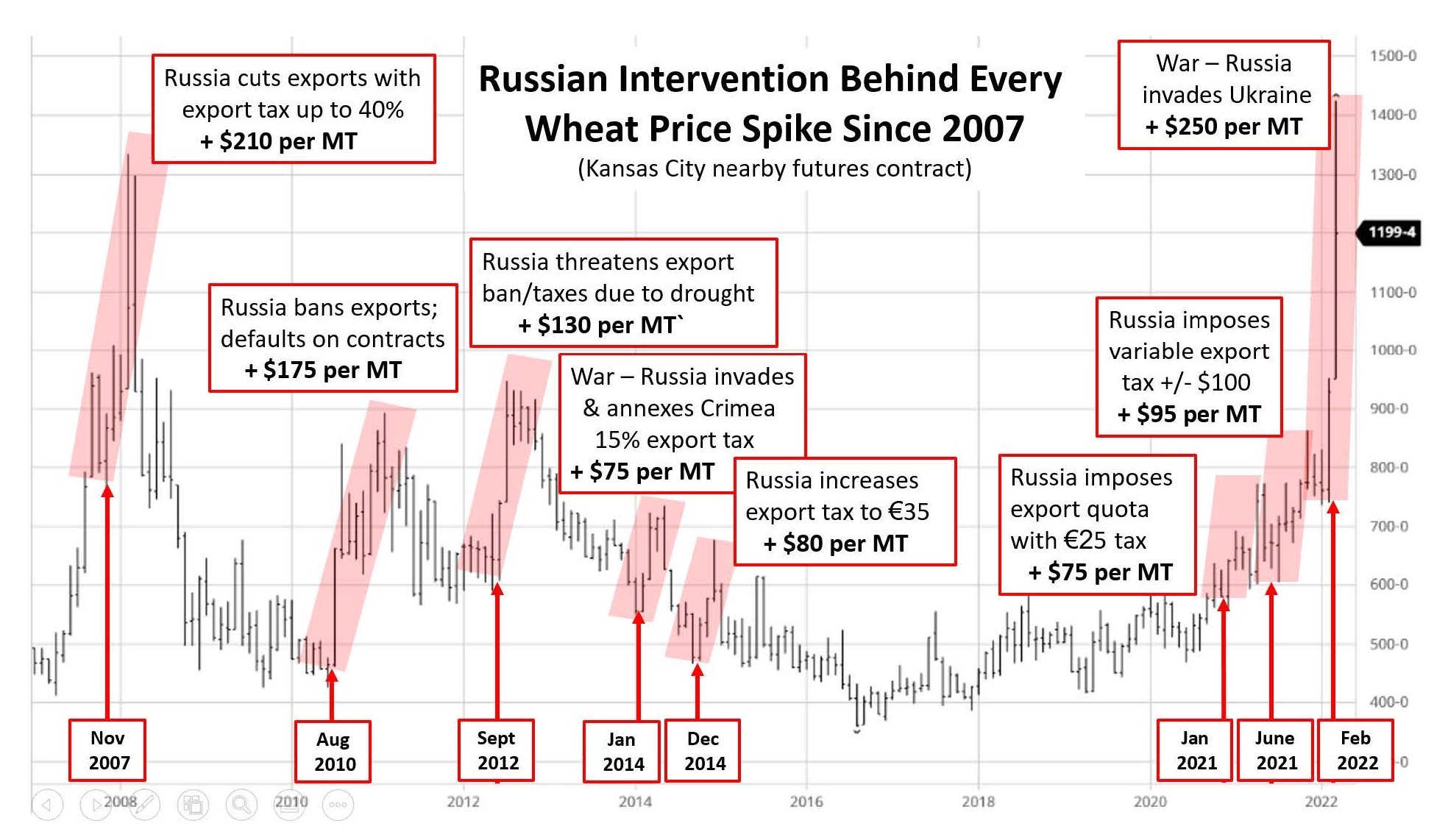

Obscuring Price Discovery

Cargill’s world trading head Alex Sanfeliu told Bloomberg recently that Russia’s increased control of its wheat exports threatens to obscure prices and curb efficiency in the global grains market. “The price discovery is going to be way more opaque,” and because Russian wheat tends to be the price setter “that puts an additional difficulty for all the wheat traders across the globe.” Read more here.

Bearish News

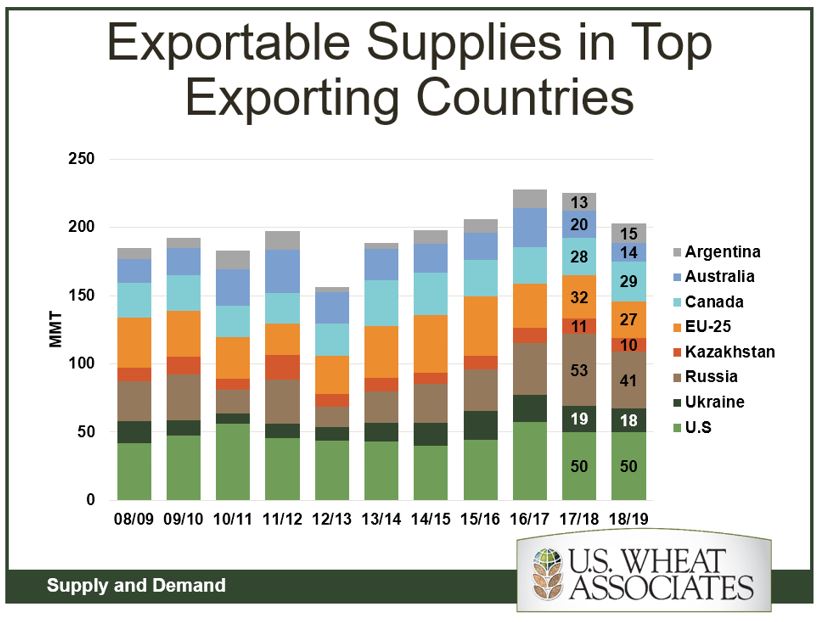

Barchart Analyst Sean Lusk noted three bearish market factors for wheat this week: rain (finally) in the parched Southern Plains; Canadian spring wheat planting intention estimate coming in above trade expectations; and a UN-confirmed Russian export deal that may have side-stepped Western sanctions. Lusk also commented that “managed funds have pushed out to a net short of approximately 130,000 contracts…that seems to be nearing the record managed short of 171,000 last decade.”

Canadians to Seed More Wheat

Statistics Canada reported this week that farmers will seed 26.968 million acres of wheat, up 6.2% from 2022, the largest area since 2001, if achieved. Spring wheat area is expected to increase 7.5% to 19.39 million acres, durum wheat is expected to edge up 0.9% to 6.06 million acres, while winter wheat area (mostly soft red winter in eastern Canada) is forecast up 12.7% to 1.52 million acres. Mike Jubinville with MarketFarm said, “The gain in spring wheat was anticipated. The one surprise … is a rise rather than slight decline registered in this report on durum acres.” Read more here.

Striking Workers Target Canadian Port

The Wheat Growers Association has called for the Canadian government to allow outside workers to weigh and inspect grain at a Vancouver port as a massive strike by public sector workers threatens shipments. Unionized inspectors at the Cascadia Terminal have purposely targeted the port, according to a news release by the group, which advocates for farmers. The protests could further tighten global supplies already affected by the war in Ukraine.

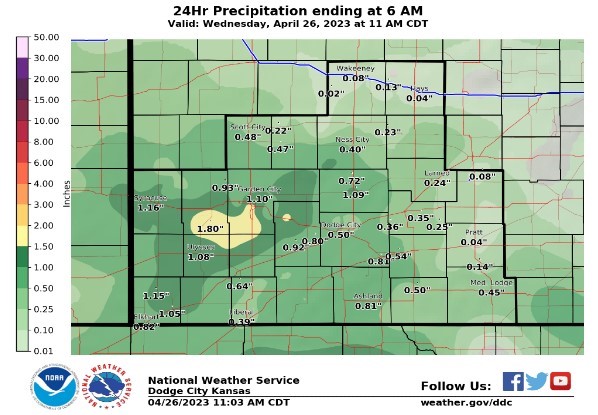

Rain Arrives; Too Late for Regional HRW Wheat?

Local media are reporting on a good, soaking rain over much of the exceptional drought areas in Kansas, Oklahoma, Texas, and Colorado this week. Southwestern Kansas farmer and U.S. Wheat Associates (USW) director Gary Millershaski told Brownfield Network rain is “going to help me plant some dryland corn and a lot of milo [sorghum],” but it will not help his winter wheat. In Okarche, Okla., northwest of Oklahoma City, wheat farmer and USW Vice Chairman Michael Peters said rain this week will help with grain fill and could help push his winter wheat yields up to an average of about 25 bushels per, lower than normal but more than expected before the rain.

Rain At Last. Substantial rain fell in southwestern Kansas April 26, the literal center of an area of exceptional drought. The rain was welcome but mainly as an opportunity to plant spring crops like corn or grain sorghum (milo).

Subscribe to USW Reports

USW publishes various reports and content available to subscribe to, including a bi-weekly newsletter highlighting recent Wheat Letter blog posts and wheat industry news, the weekly Price Report, and the weekly Harvest Report (available May to October). Subscribe here.

Follow USW Online

Visit our Facebook page for the latest updates, photos, and discussions of what is going on in the world of wheat. Also, find breaking news on Twitter, video stories on Vimeo and YouTube, and more on LinkedIn.