Wheat Exporting Countries Control Just 18% of Global Stocks

By Michael Anderson, USW Market Analyst

As the U.S. wheat 2021/22 marketing year reaches its halfway point, U.S. Wheat Associates (USW) summarizes market factors affecting global wheat supply and demand with its farmer board of directors. The data comes from USDA’s October reports, which will be updated on November 9. We want to share some information here, focusing on key wheat exporting countries.

USDA pegs 2021/22 world wheat production at a record 776 million metric tons (MMT), up 1.0 MMT from last year and 2% above the 5-year average of 757 MMT. Total global supplies are forecast to reach 1,064 MMT, 1% less than last year.

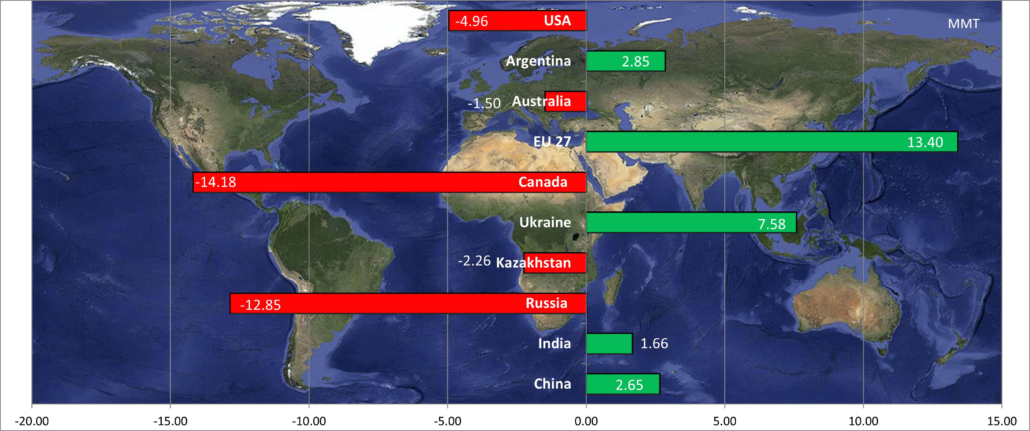

Significantly lower production is expected in the United States, Canada, Russia, Kazakhstan and a slight drop in Australian production, all exporting countries.

Among wheat exporting countries, the United States, Canada, Russia, Australia, Kazakhstan and Australia saw wheat production decline for 2021. All wheat exporting countries now hold 18% of world wheat stocks.

USDA estimates 2021/22 world wheat ending stocks will reach 277 MMT, down 4% from last year and 2% less than the 5-year average. A closer look at stocks held by exporting countries reveals that USDA now expects exporters to control just 18% of world wheat stocks, including Black Sea exporters. When exporters hold so few stocks, a bullish market and volatility result.

Following are USDA estimates for selected exporting countries, except where noted.

United States

- U. S. wheat production will total 44.8 MMT, down 10% from last year and 15% below the 5-year average;

- Persistent, severe dryness significantly cut hard red spring (HRS), soft white (SW) and Northern durum production;

- Total U.S. wheat exports will reach 23.8 MMT in 2021/22, 12% less than last year and 10% less than the 5-year average.

Canada

- Canadian 2021/22 wheat production will reach 21.0 MMT, 40% lower than last year and 35% less than the 5-year average of 35.4 MMT;

- Spring wheat production is projected to decrease 40% on the year to 15.3 MMT due to extended dry weather Agriculture and Agri-Food Canada (AAFC) reported;

- According to Statistics Canada, Canadian durum production is forecast to be 3.5 MMT in 2021/22, 46% less than last year on significantly drier growing conditions;

- Total Canadian wheat exports will decrease 43% from last year to 15.0 MMT, 36% less than the 5-year average.

Russia

- Total 2021/22 Russian wheat production decreased 15% on the year to 72.5 MMT;

- According to SG, Russian planted area was down 1%, and average Russian wheat yield decreased 10% from last year to 39.55 bu/acre;

- The imposition of a government export tax has slowed international demand for Russian wheat;

- Total Russian wheat exports will fall 9% from last year to 35.0 MMT, 2% less than the 5-year average of 35.6 MMT.

Ukraine

- USDA estimates total Ukrainian wheat production rose 30% from 2020/21 to 33.0 MMT;

- SG predicts the total Ukrainian average wheat yield was up 18% from last year to 66.7 bu/acre;

- Total Ukrainian wheat exports will rise 39% from last year’s record to 23.5 MMT in 2021/22.

Australia

- Australian wheat production will fall 5% on the year to 31.5 MMT, although this is still a large crop with significant exportable supplies;

- Increased average yield was lower despite a 7% increase in harvested area of 34.1 million acres;

- Total Australian exports will be 23.5 MMT, 0.5 MMT down from 2020/21.

European Union

- Total European Union (EU) wheat production is up 11% on the year to 139.4 MMT;

- SG estimates that total EU non-durum wheat will be 129.5 MMT, up 9% from last year;

- Heavy rain during harvest in both France and Germany challenged milling wheat quality and, as a result, 65% of EU non-durum wheat, or 80.8 MMT, meets millable grade;

- Total EU wheat exports will increase 20% on the year to 35.5 MMT, 20% above the 5-year average.

Argentina

- Total Argentinian wheat production will rise 14% from last year to 20.0 MMT following good growing conditions this season;

- Total Argentinian wheat exports are expected to increase to 13.5 MMT in 2021/22, 23% more than last year and 8% greater than the 5-year average.

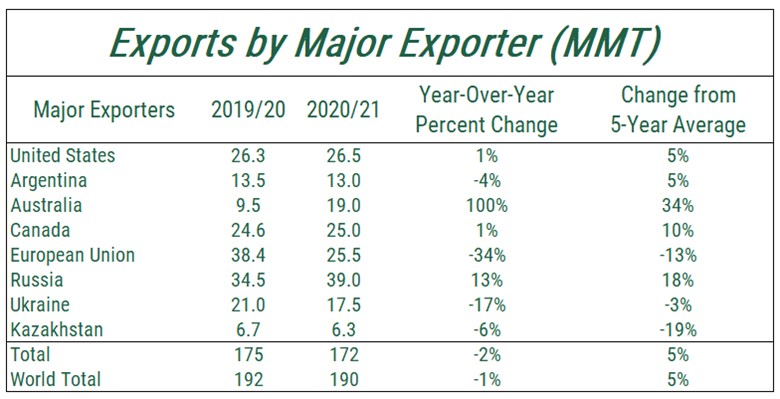

USDA expects 2021/22 world wheat trade to fall slightly from last year’s record to 200 MMT. If realized, that would be 6% greater than the 5-year average of 189 MMT. Total global wheat use is forecast at 787 MMT in 2021/22.

According to USDA’s trade forecast, the United States will have a 12% market share in the world wheat trade at 23.8 MMT, in line with last year’s market share.