U.S. Wheat Associates (USW) is applying funds from the Agricultural Trade Promotion (ATP) program to expand its ability to conduct technical support to wheat buyers and end users in rapidly growing South Asian markets.

USW has had a long-term effort to help customers improve their products and processes through technical support, funded in part by the Market Access Program (MAP) and Foreign Market Development (FMD) program. There is a strong connection between increased imports of U.S. wheat and the investment in milling and food production support. Looking at the highly sophisticated wheat food industries in Japan, Korea and others, USW’s long-term investment has benefited consumers in those countries while establishing strong and consistent export markets for U.S. wheat producers.

In such markets as Vietnam, Malaysia, Myanmar, Thailand and Indonesia, the imported wheat customer base is expanding, and USW saw a need to increase its technical capabilities to match the growth. At the same time, USW knew that some senior technical staff were planning retirements.

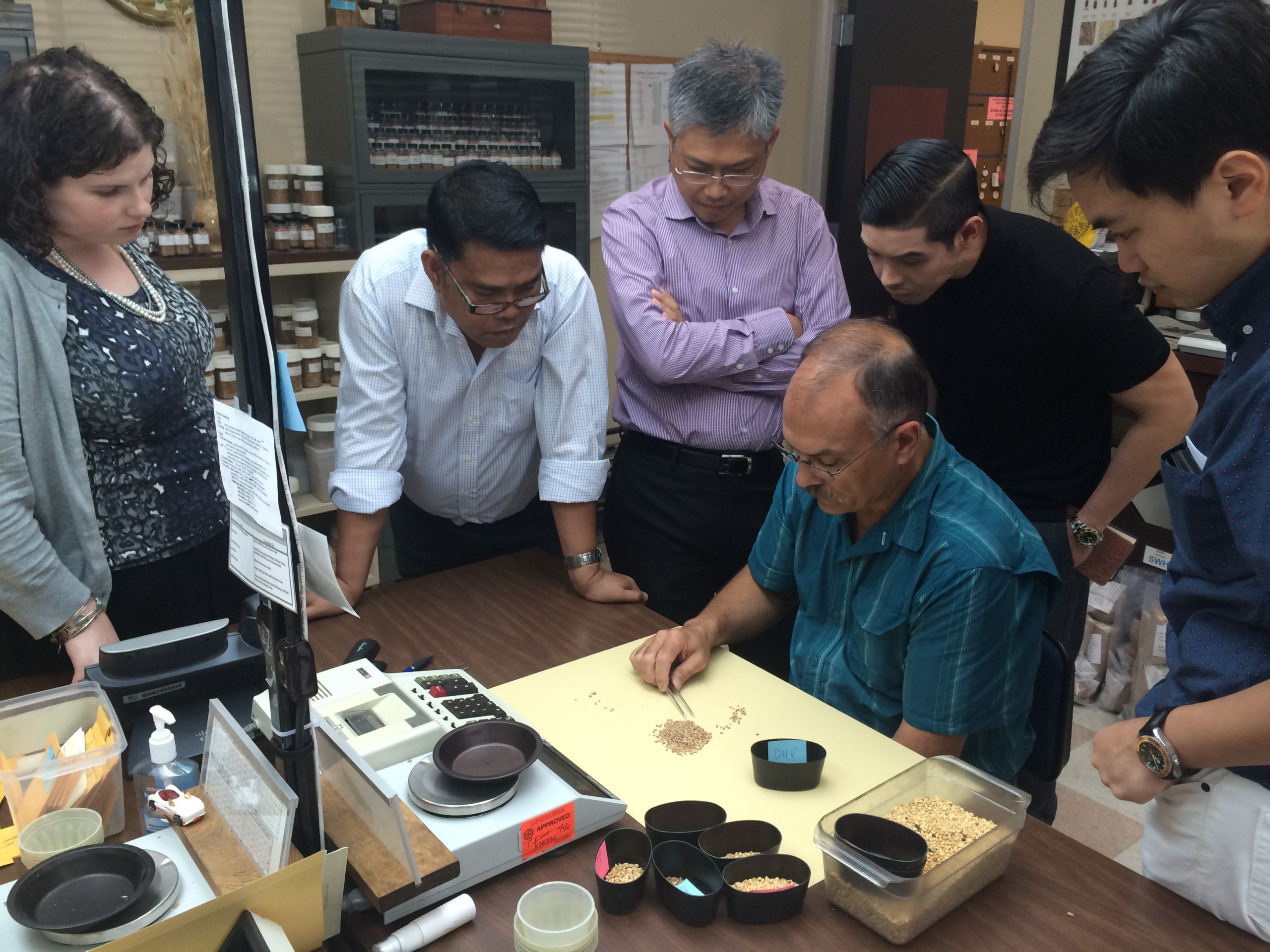

The addition of ATP funding gave USW the opportunity to add a new Bakery Technician position to work with customers across the South Asian region. Adrian Redondo, an experienced food technologist and account manager, joined USW in June 2019. He will train with his experienced colleagues and build customer contacts through 2021 when the current USW bakery consultant based in the Philippines plans to retire. Without additional ATP funding, USW would have had to fund a new technician position from a limited pool of FMD funds that would, in effect, cut its ability to fund customer activities.

South Asian imports of U.S. hard red spring (HRS), soft white (SW) and hard red winter (HRW) wheat from family farms in the Pacific Northwest to the Northern Plains have grown from an average of about 3.0 million metric tons (MMT) per year 10 years ago to about 5.0 MMT in 2018/19. Future demand for wheat foods is expected to keep growing in the region. ATP funding provides a wide range of additional opportunities to continue differentiating U.S. wheat in markets like those in South Asia, with no local wheat production and where increasing incomes and urbanization are driving a rapid expansion of wheat food demand.