It can be an uphill battle to convince milling wheat buyers to opt for premium-priced, but better performing, U.S. wheat. Long-term investments funded by wheat farmers through state wheat checkoff programs, the Market Access Program (MAP) and the Foreign Market Development (FMD) program, however, have yielded significant gains.

In the Philippines, USW has helped flour millers and commercial food companies build and maintain a multi-year campaign to increase consumption of wheat-based foods. Over the past five years, annual per capita consumption of wheat in the island nation has increased from 23 to 29 kilograms. That is an annual demand increase of 600,000 metric tons of wheat, with an estimated 97 percent of that wheat coming from the United States.

U.S. wheat enjoys this level of market dominance because the program investments have helped USW stay “on the ground” in the Philippines and other Asian markets for decades, making trade and technical service calls and conducting wheat food production training. USW Regional Vice President Joe Sowers says the producer funds, FMD and MAP are essential to building trust with buyers and end-users who also look to USW for advice.

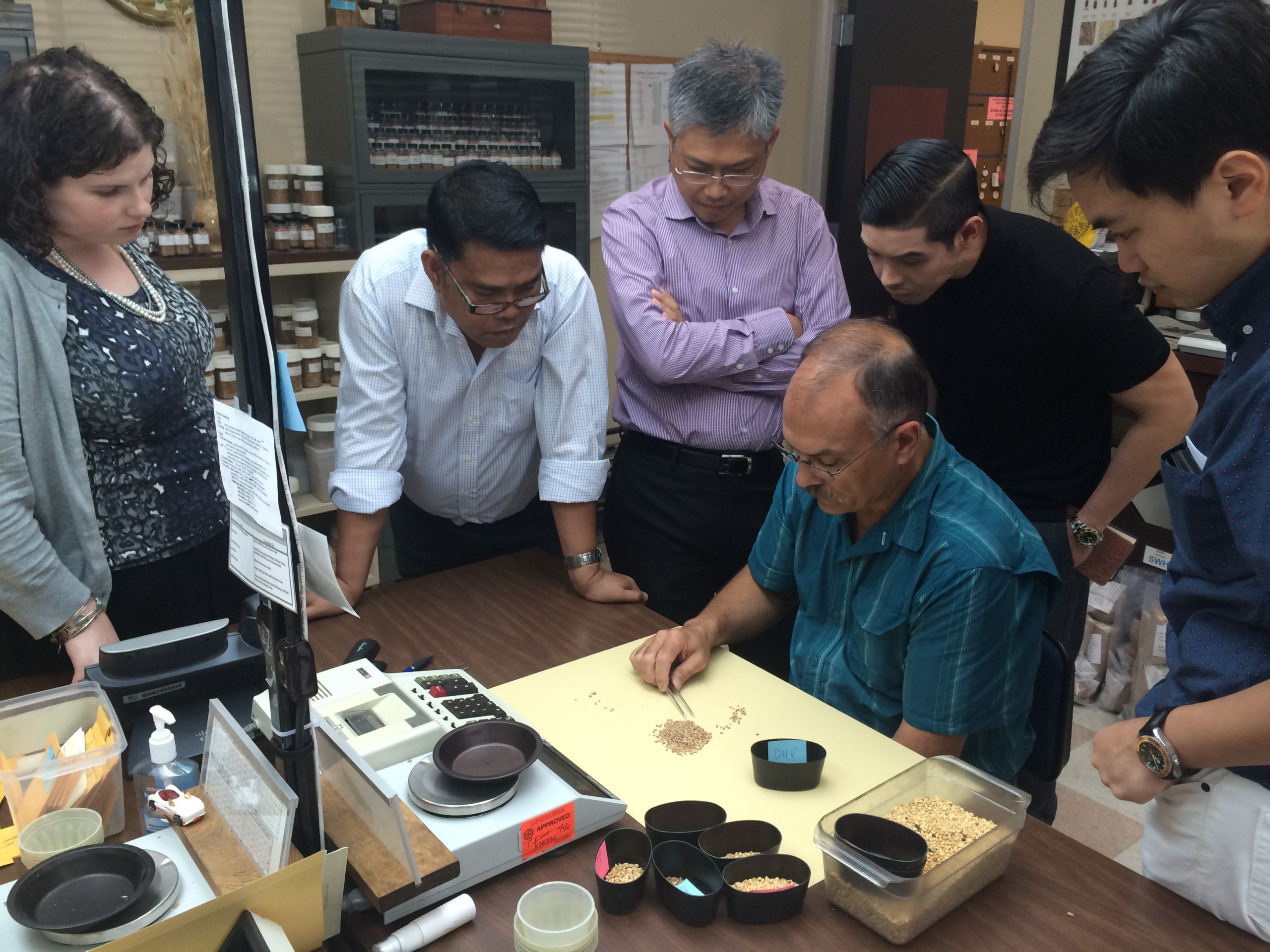

For example, a large Filipino flour miller had collaborated with USW on several activities and immediately following its participation in the Buhler-KSU Executive Milling Course at IGP Institute in Manhattan, KS, June 12 to 16, 2017, the mill started printing “Guaranteed 100% U.S. Wheat” on its flour bags. This effectively locked the mill’s 90,000 MT of annual wheat purchases into U.S. origin supplies. This change also influenced another flour mill that conducts cooperative shipping with the first mill to purchase only U.S. hard red spring (HRS) wheat even though Canadian spring wheat was offered at an FOB export price of $35 per metric ton less than U.S. HRS.

USW’s work to establish U.S. origin wheat as a quality standard for Philippine flour directly contributed to 175,000 MT of HRS sales in marketing year 2017/18 (June 1 to May 31) with an estimated FOB value of $50 million. Overall, the Philippines purchased more HRS and more U.S. soft white (SW) wheat than any other country in 2017/18.