Noodles are the staple product in South Korea that represent more than 50 percent of Korean wheat food consumption. For many years, manufacturers have preferred Australian wheat to produce noodle flour, and specifically “Australian Noodle Wheat” that helps produce an end product with the color favored by consumers. USDA Foreign Agricultural Service cooperator U.S. Wheat Associates (USW) is addressing the competitive advantage and increasing market share by providing technical service funded by the Market Access Program (MAP) and the Foreign Market Development (FMD) program.

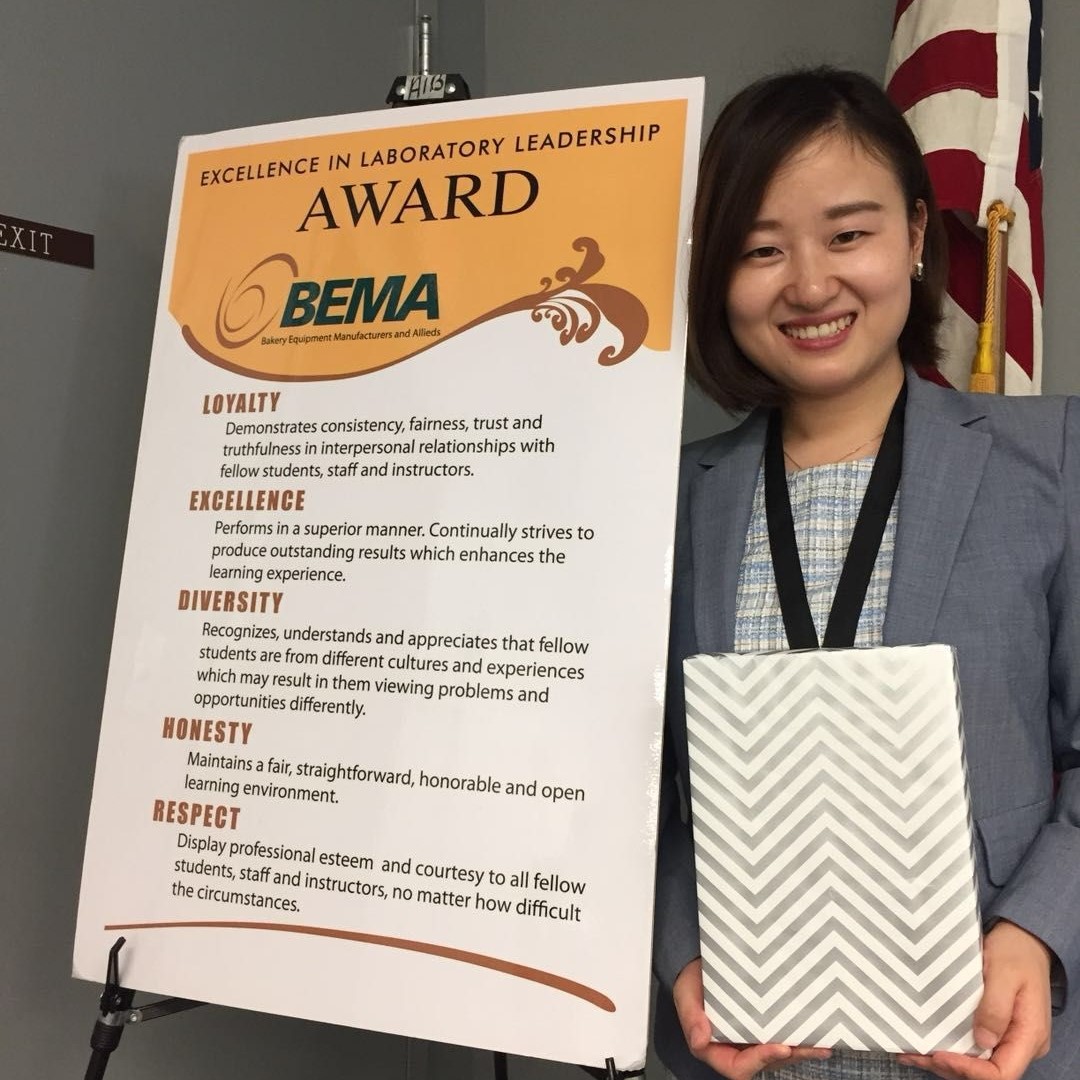

Every year since 2015, the USW Seoul Office conducts a Korean Noodle Flour Development short course at the Wheat Market Center (WMC) in Portland, Ore., and a Noodle Flour Blending Seminar in Seoul to demonstrate the advantages of blending with U.S. wheat.

Representatives from one noodle manufacturer and two mills from Korea attended the 2017 course, where they researched flour blends using an increased percentage of U.S. wheat flour in instant noodle products. The participants concluded that using more U.S. wheat still allowed them to maintain the preferred product color and quality while reducing input costs. Blends include varying percentages of flour from U.S. soft white, hard red spring and hard red winter wheat classes.

In December 2017, USW shared the course results and reviewed quality parameters with Korean noodle manufacturers and flour millers. A highly regarded local expert presented information on quality parameters affecting noodle flour functionality. Because of this, one company said that they intend to use HRS for a new end-product line in 2018. Another company reported that they increased U.S. wheat percentage in their noodle formulation from 50 percent in CY15 to 90 percent in CY17, and is also using U.S. wheat flour in their export product portfolio, which increased by 20,000 metric tons (MT) in CY17. And a third company reported that they also increased U.S. wheat in their blends in CY17, absorbing 10,000 MT of additional U.S. wheat flour. All participants reported that the seminar provided a valuable opportunity to share information on improving noodle quality.

Despite lacking a single U.S. wheat class with optimal noodle quality, USW’s efforts — funded by state wheat commissions, MAP and FMD — have helped secure a 20 percent share of the wheat imported for the Korean noodle market. The top four instant noodle manufacturers in South Korea consistently now use more than 45 percent U.S. wheat, up from less than 25 percent in 2009.