The popularity of non-traditional baked goods like chewy breads, cookies and fluffy cakes is rapidly growing in the People’s Republic of China. To help build a preference for flour from U.S. wheat classes among aspiring Chinese baking companies, USDA Foreign Agricultural Service cooperator U.S. Wheat Associates (USW) has expanded its technical capabilities through staffing and an exceptional training activity.

USW hired Dr. Ting Liu in September 2016 as Technical Specialist to provide support and training to demonstrate the performance of U.S. wheat in the new baked goods as well as traditional Chinese wheat based products. Dr. Liu works from USW’s Beijing office and regularly travels across China to provide baking demonstrations, technical seminars and promote practical application of U.S. wheat performance results. Staff administrative expenses for Dr. Liu and her experienced marketing colleagues in China are supported by the Foreign Market Development (FMD) program with development activities funded by the Market Access Program (MAP).

Because there is intense interest in professional baking expertise, especially in scaling up industrial sized operations, USW decided to invest some of its activities funding to send Dr. Liu to the 192nd Baking Science and Technology course at AIB International in Manhattan, Kan., from January through May 2018. This is an internationally respected, 16-week program combining science, hands-on lab work and baking tradition in its course work. With her expertise in food science and cereal chemistry, Dr. Liu was well prepared for this training — but she far exceeded expectations.

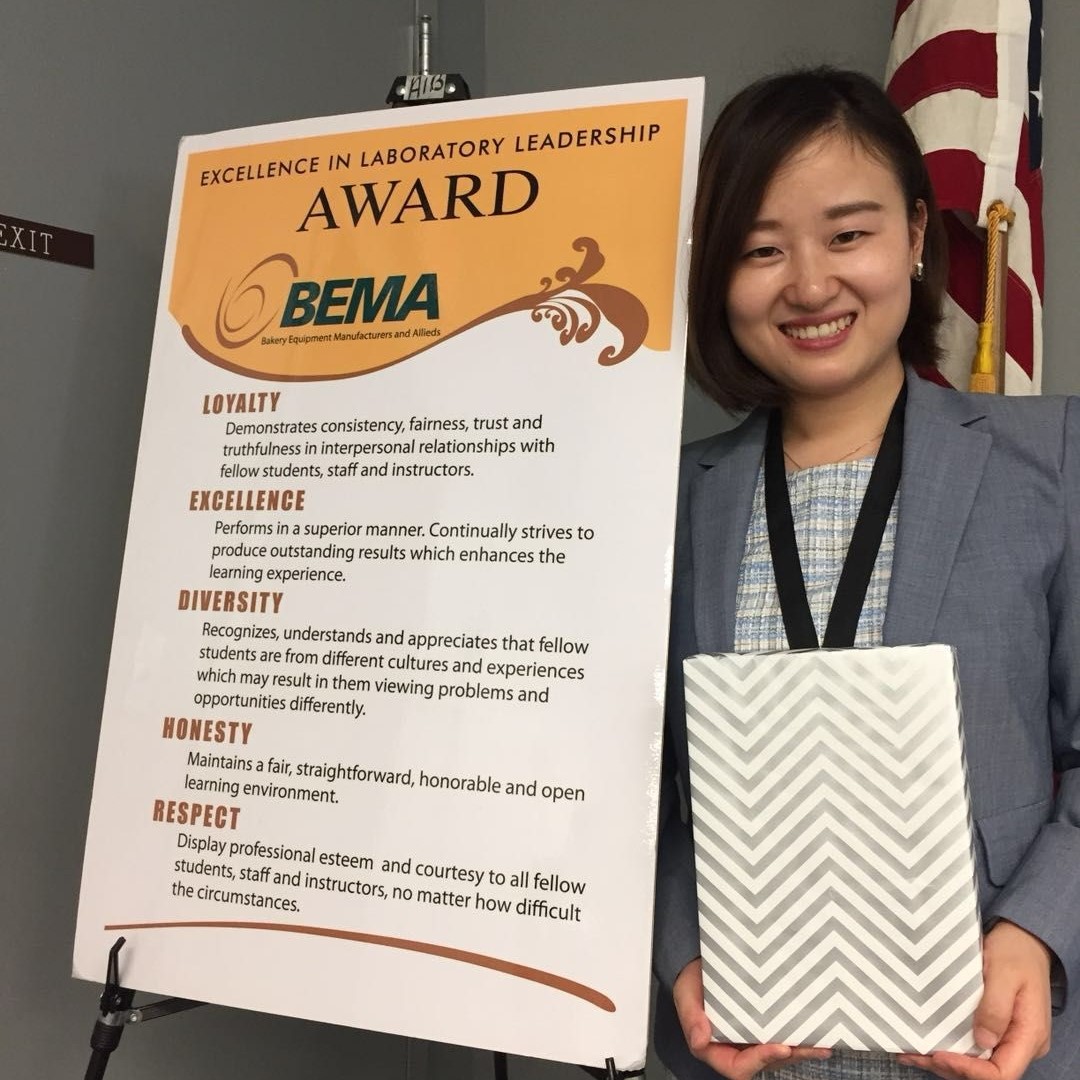

Dr. Liu represented herself, USW and the U.S. wheat farmers she represents with distinction, earning honors as the course’s top student and an “Excellence in Laboratory Leadership” award for her participation in the course. Now she will apply this advanced knowledge to effectively stress that flour which performs its intended functions enables Chinese bakers to produce higher quality, better tasting wheat foods, and that U.S. wheat flours are essential ingredients on which bakers can rely for consistent results.

Though China’s centrally planned food and trade policies create substantial barriers to export growth, the increased ability to train the industrial bakeries that must meet consumer demand is pulling in high protein U.S. hard red spring (HRS) and hard red winter (HRW) wheat for bread products and soft white (SW) for cakes and cookies. In marketing years 2016/17 and 2017/18, China imported an average of 843,000 metric tons (MT) of HRS, 163,000 MT of HRW and 318,000 MT of SW per year, valued at about $324 million per year for farmers and wheat supply participants in the Pacific Northwest and Northern Plains.