With funding from several state wheat checkoff programs and USDA Foreign Agricultural Service export market development programs, U.S. Wheat Associates (USW) is helping new flour millers learn how to get the wheat they need from U.S. farmers, a strategy that has built a dominant market share in this growing Southeast Asian market.

USW has for more than 50 years helped Philippine flour millers use sophisticated purchase specifications that increase value and enable the millers to import five classes of U.S. wheat. However, the industry is undergoing a generational transfer of leadership to younger family members or staff. Some knowledge gets passed down but this transition still requires significant training to assure new market participants can navigate the evolving international trading environment.

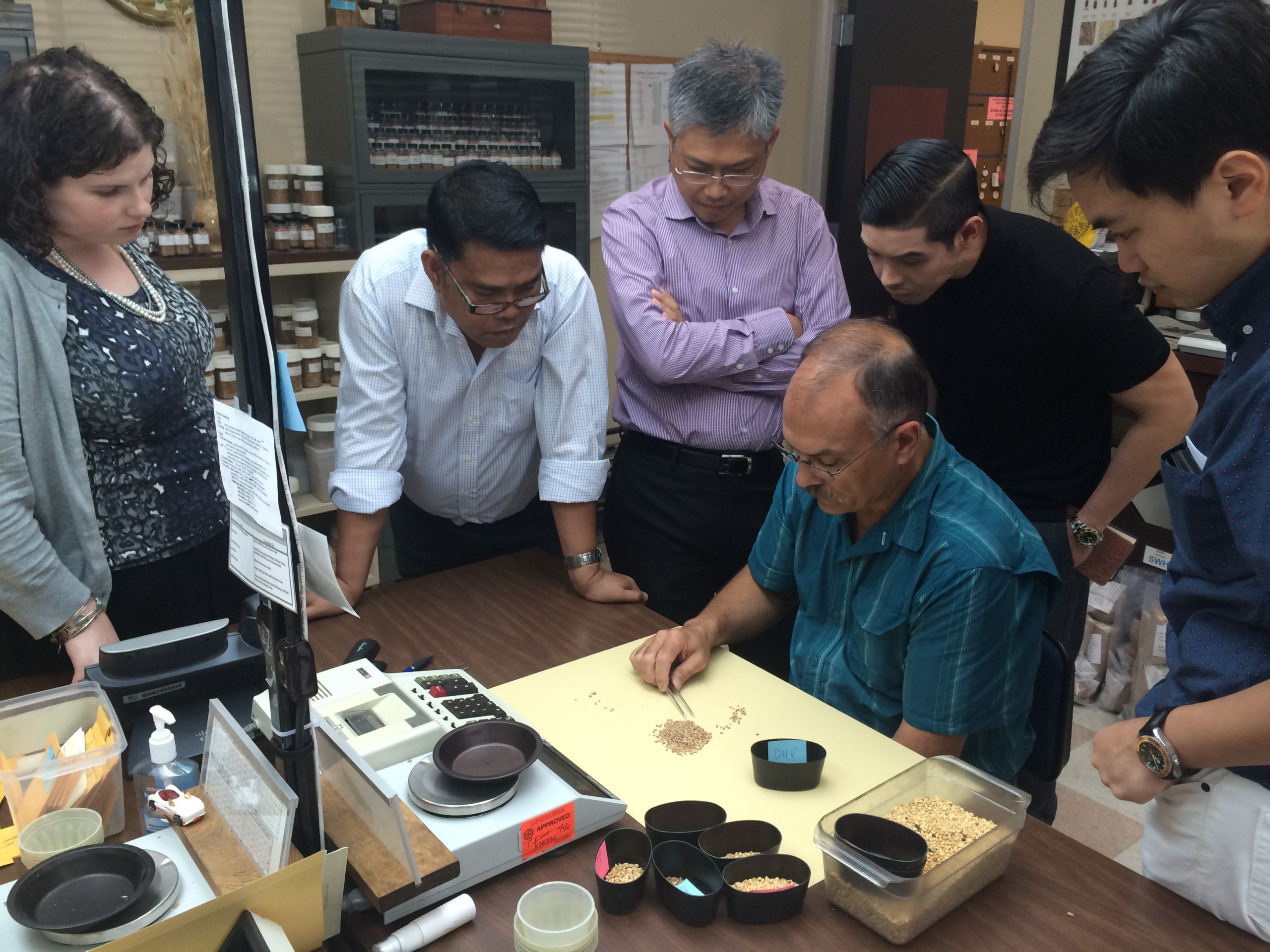

USW is addressing this transition through trade team visits to observe the U.S. wheat production and marketing systems, workshops on how to write the best U.S. wheat tenders and information on the quality and functionalities for every crop. These activities, funded by the Market Access Program (MAP) and the Foreign Market Development (FMD) program, help assure the next generation of decision-makers are familiar with the U.S. marketing system and the advantages of U.S. wheat classes in milling and end-product performance. The activities also prepare the industry for key quality concerns and opportunities in the current crop, helping them revise their specifications appropriately to maximize the value of the wheat they receive.

For example, in August 2015, USW sponsored a U.S. visit for new managers at Monde Nissin and Atlantic Milling. They learned that hard red spring (HRS) basis was at historic lows and low protein soft white (SW) stocks were very tight. As a result, these mills accelerated their purchasing pace and bought 110,000 metric tons (MT) of U.S. wheat sending substantial revenue back to the U.S. supply chain and farmers in the Pacific Northwest, Montana, North Dakota and South Dakota. This early purchase of U.S. wheat pre-empted the risk that both mills would consider purchasing lower priced spring wheat from Canada.

In October 2015, during a USW contracting workshop, market leading flour miller San Miguel used the information to revise confusing specifications in their contract language that helped reduce their import cost. This led them to make their first hard red winter (HRW) purchase in recent history. It is the fourth year in a row that San Miguel bought U.S. milling wheat exclusively, maintaining U.S. wheat as the quality standard in the Philippine market. In turn, this further reduces the chance that other mills may consider importing from other origins.

In marketing year 2015/16 (June to May), Philippine millers imported more U.S. HRS and SW wheat than any other country in the world. Its total imports of 2.164 million metric tons of U.S. wheat in 2015/16 ranks the Philippines at third among all countries. This represents more than 90 percent of total Philippine milling wheat imports and a substantial estimated return to the U.S. wheat supply chain.