Over the last few weeks, we have explored all the major modes of the U.S. supply chain, evaluated recent trends, and highlighted how each type of transportation plays an integral role in the U.S. supply chain. Barging, rail, and oceangoing vessels work together to create the dependable supply chain importers of U.S. wheat expect. In periods of increased risk and volatility, a trustworthy, reliable supply chain is essential for providing customers with the wheat they need.

In the final installment of this series, we will explore the continued investment into the U.S. supply chain and highlight recent projects planned to keep the U.S. inland logistics system running efficiently and effectively.

This Just In

On Nov. 6, the U.S. Department of Transportation’s Maritime Administration (MARAD) recently announced that more than 40 ports across the United States will receive $653 million in funding for improvement projects that will help with the movement of grain. Under the Port Infrastructure Development Program, the funding will help grow capacity and increase efficiency at coastal seaports, Great Lakes ports and inland river ports.

Stakeholder Commitment

With private companies owning and operating grain export infrastructure and assets, the U.S. supply chain benefits from significant commercial investment to ensure the effectiveness of the logistics system. Holding one of the largest stakes within inland transportation, the U.S. Class I railroads value the system’s reliability and understand its importance to wheat buyers worldwide.

One of the latest examples of continued private investment in the U.S. supply chain is the newly constructed rail bridge at Sandpoint Junction in the Burlington Northern Santa Fe (BNSF) rail network. On August 7, the inaugural trip on the new Sandpoint Junction Connector rail bridge occurred, representing the official opening of two-way traffic crossing Lake Pend Oreille in northern Idaho. This junction is crucial because it is a merging point between the BNSF and Montana Rail Network and serves as the primary gateway that links grain grown in the Northern Plains to port access in the Pacific Northwest (PNW).

The new Sandpoint Junction Connector rail bridge will allow two-way traffic across Lake Pend Oreille in Idaho, helping improve efficiency for wheat and other grain moving by rail from the Northern Plains to the PNW for export. Source: BNSF.

CPKC Network

Another noteworthy project is a $100 million investment commissioned by Kansas City Southern in October 2022 (now part of the Canadian Pacific Kansas City rail network) to construct a new international rail bridge connecting Laredo, Texas, U.S. to Nuevo Laredo, Tamaulipas, Mexico. The bridge expansion will allow trains to operate in both directions simultaneously, granting more economical access to the U.S. supply chain for Mexico, the largest importer of U.S. wheat.

Another noteworthy project is a $100 million investment commissioned by Kansas City Southern in October 2022 (now part of the Canadian Pacific Kansas City rail network) to construct a new international rail bridge connecting Laredo, Texas, U.S. to Nuevo Laredo, Tamaulipas, Mexico. The bridge expansion will allow trains to operate in both directions simultaneously, granting more economical access to the U.S. supply chain for Mexico, the largest importer of U.S. wheat.

Government Investment

Complimenting private investment into the domestic logistics systems, the U.S. federal government provides significant support to the U.S. grain supply chain to uphold its safety and dependability.

In September, the Department of Transportation Federal Railroad Administration granted $1.4 billion to finance 70 rail improvement projects through the Consolidated Rail Infrastructure and Safety Improvements program. The largest grant (nearly $73 million) is for the Palouse River and Coulee City Railroad (PCC) improvements by the Washington State Department of Transportation. The PCC, a regional shoreline railroad, carries wheat traffic in major wheat-growing counties in eastern Washington, and the upgrades will help improve wheat shipments to elevators and seaports in the PNW by allowing for higher speeds and larger railcars.

Prevention Is the Best Medicine

While capital investment and improvement are vital to maintaining the efficiency of the U.S. rail systems and promoting wheat exports in the face of strong global competition, the U.S. supply chain benefits most from continuous investment in maintenance and repairs by private companies and state and federal governments. The backbone of a dependable, reliable system lies in the safety and proper function of the infrastructure and assets that make up the supply chain.

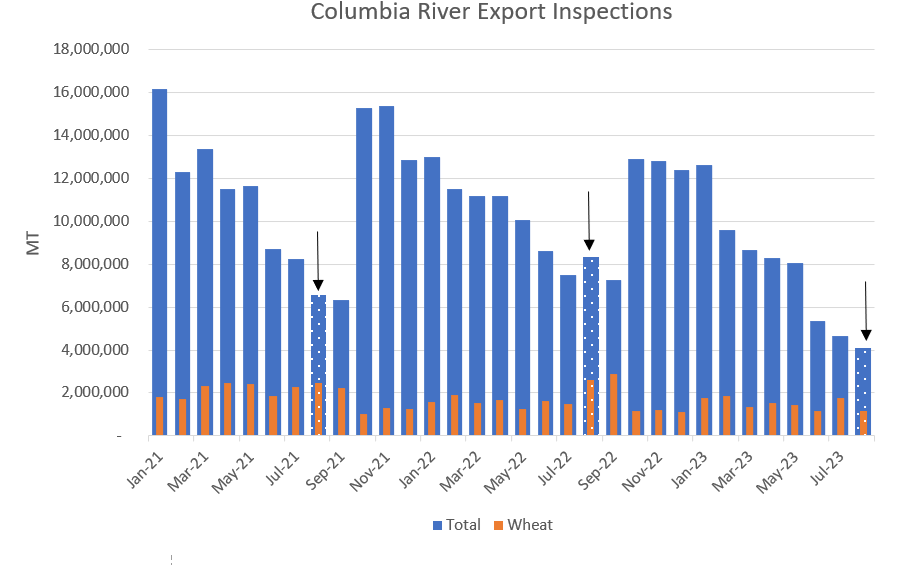

An important example of the commitment to preventive maintenance is the upcoming lock and dam closure on the Columbia Snake River System. In January 2024, the Army Core of Engineers will be performing maintenance on major components at the John Day and McNary dams on the Columbia River and at the Lower Monumental, Little Goose, and Lower Granite dams on the Snake River, resulting in an extended river closure from January 14 to March 29, 2024. This maintenance represents a forward-thinking investment by the U.S. Army Corps of Engineers (USACE) to ensure this critical waterway remains operational for decades to come.

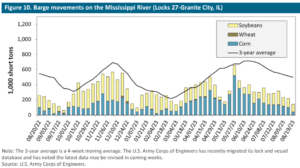

Mississippi River Study

In addition, USACE is conducting a 5-year, Lower Mississippi River Comprehensive Management Study that it says will yield recommendations for effective and practical management of the Mississippi River from Cape Girardeau, MO, to the Gulf of Mexico, a key U.S. supply chain serving growing export demand for U.S. soft red winter wheat.

According to the USACE, the purpose of the study is to identify recommendations for the comprehensive management of the region across multiple purposes, including navigation, flood risk management, and environmental restoration.

The combined impact of preventive maintenance, efficiency improvements, and significant capital investment are key components that differentiate the U.S. wheat supply chain and help the U.S. wheat export supply system remain the most reliable in the world.

By USW Market Analyst Tyllor Ledford