As we continue a series of articles on U.S. supply chain logistics, rail is arguably the most important mode of transporting wheat for export.

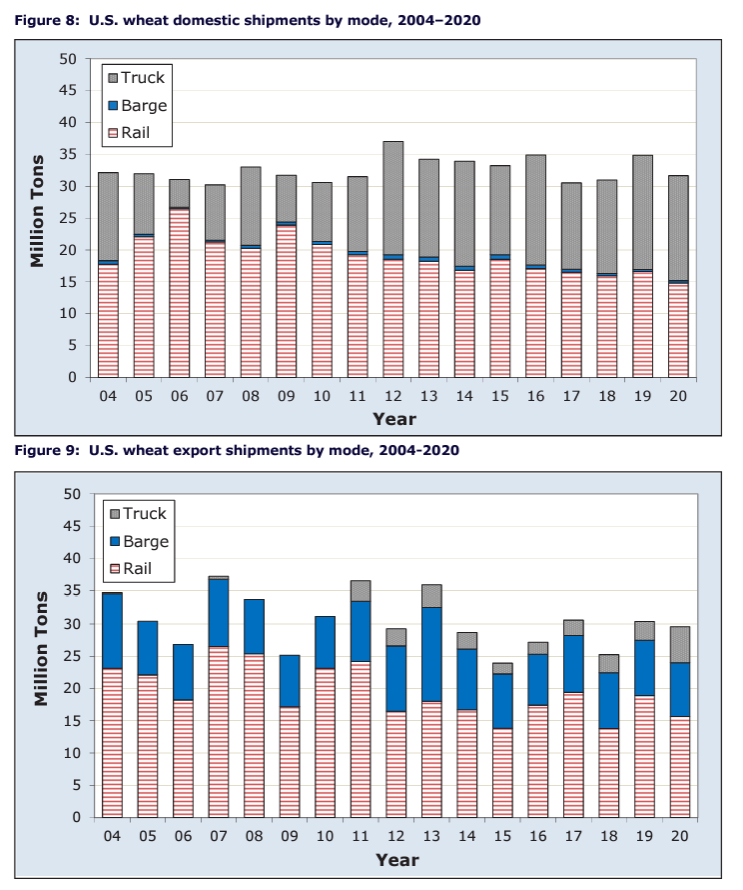

According to a recent USDA Modal Share Analysis Study, rail accounted for an average of 59% of inland transportation for wheat exports between 2016 and 2020, or an average annual total of 17.0 million metric tons. This article will focus on the importance of rail freight in wheat exports and address current trends in rail performance.

Rail and barging are the main modes of transportation for wheat exports, as they can handle large volumes of grain over long distances. Together, they transport 89% of the total wheat export shipments. Source: USDA Modal Share Analysis Study.

An Interesting Year

In 2022, increased demand for railcars and performance issues sent U.S. rail rates soaring, with Secondary Railcar Auction Market Bids hitting their highest since 2014. Since then, rail rates have eased drastically. From March 2023 to July 2023 secondary bids for railcars have been negative, indicating that the current supply of railcars is sufficient for meeting the needs of shippers.

Decreased volumes and the subsequent decrease in rail tariff rates and Secondary Railcar Market Auction Bids have added additional pressure to already low basis levels, helping boost the competitiveness of U.S. wheat to importers. However, as the 2023 soy and corn harvest progresses, we can expect rail rates to rise due to increased demand and a higher volume of grain moving via rail.

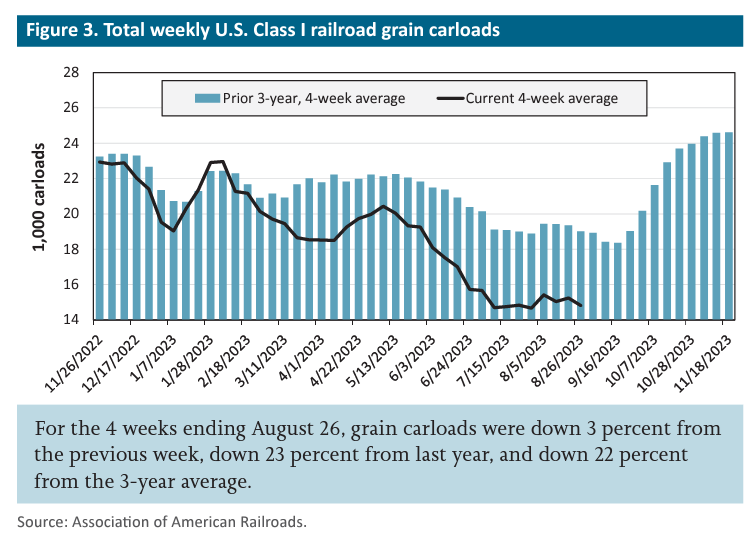

According to the latest Grain Transportation Report, grain carloads (corn, soybeans, and wheat) moved by Class I railroads were down 3% from the previous week and are sitting 22% below the three-year average. The current decreased volume alleviates pressure on basis as rail companies have a sufficient supply of cars to meet the current demand. Source: September 3, 2023 USDA Grain Transportation Report.

Even so, the outlook for fall logistics appears positive. In a recent interview with “Freightwaves,” transportation export Jay O’Neil indicated that “Weather is always a question mark that makes it [performance] impossible to predict. But overall, I think the railroads… have some excess capacity because of [reduced grain export volumes]. I think [railroads] are very much looking forward to the harvest season … So, I don’t see any particular influences right now that should get in their way and prevent them from providing a decent service for harvest.”

Part of a Reliable System

U.S. Wheat Associates (USW) is committed to sharing transparent and pertinent information to customers about inland logistics issues. It is beneficial for U.S. wheat importers to be aware of transportation trends, as seasonal shifts and potential issues have a direct influence on export basis and the Free-on-Board export price.

Encompassing the largest share of inland logistics, the railroads are a critical component for moving U.S. wheat to export. After last years’ service disruptions, steps have been taken to help address the root issues such as hiring additional crew and investing in infrastructure. U.S. railroads are committed to moving U.S.-grown commodities. With diverse origination options and numerous modes of transportation, regardless of the class or export point, rail helps U.S. wheat remain the most reliable choice for world importers.

This article is part of a series outlining the inland logistics for U.S. wheat, highlighting barge freight, the railroads, infrastructure investments, and maritime transportation trends.

By USW Market Analyst Tyllor Ledford