By Stephanie Bryant-Erdmann, USW Market Analyst

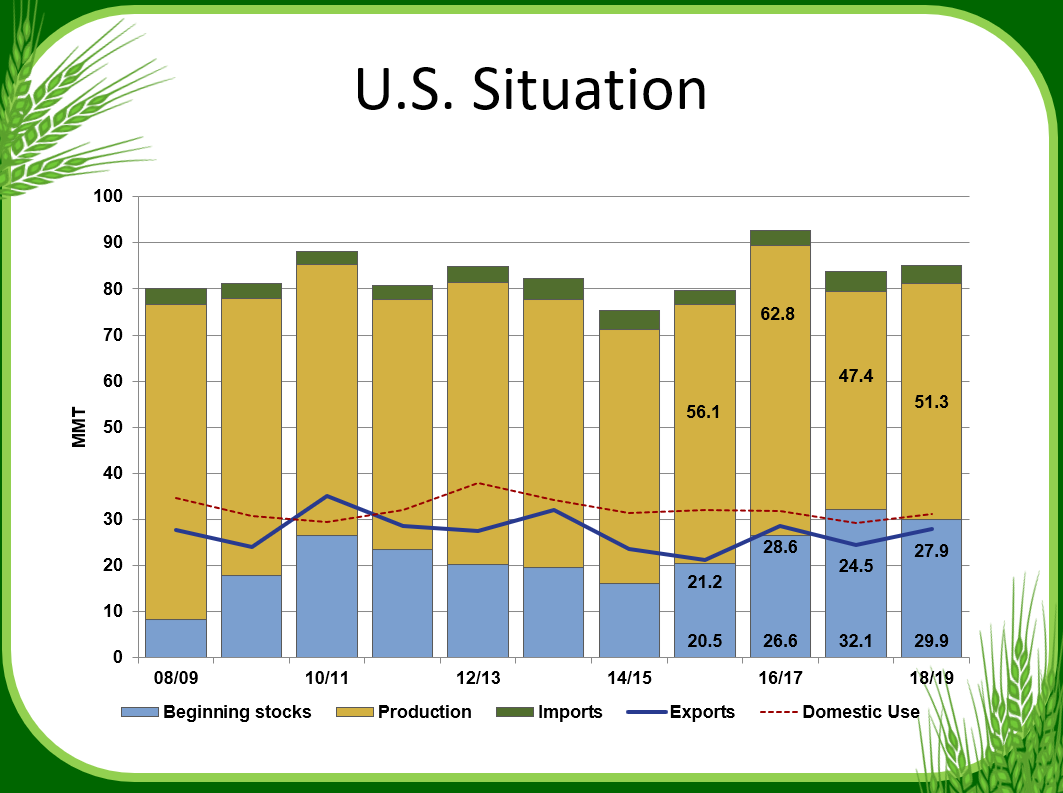

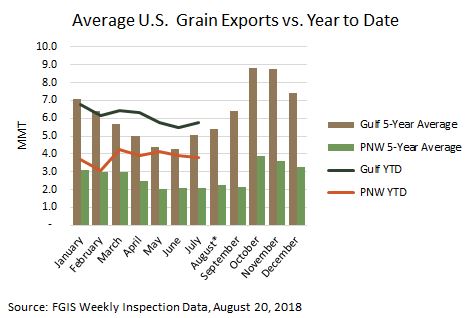

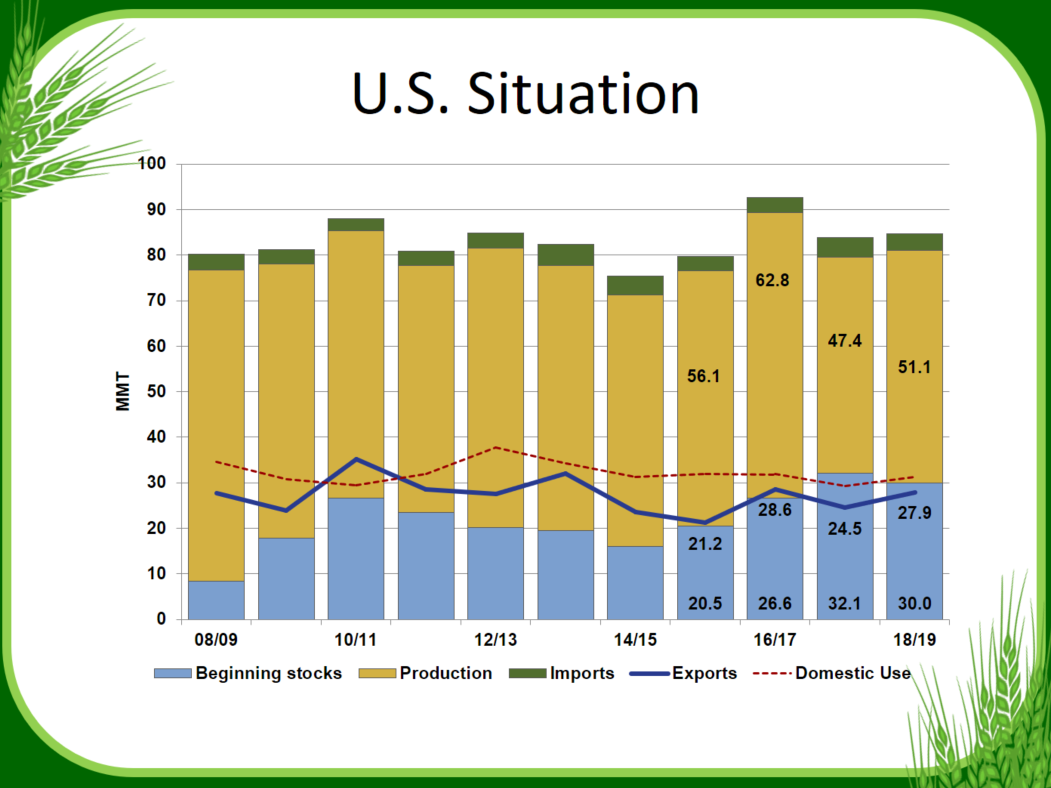

The expected turn to U.S. wheat supplies appears to be underway.

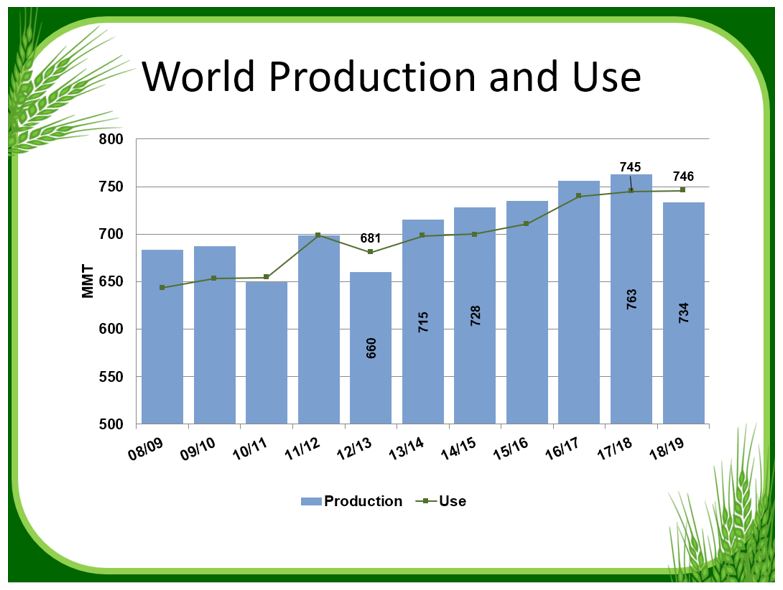

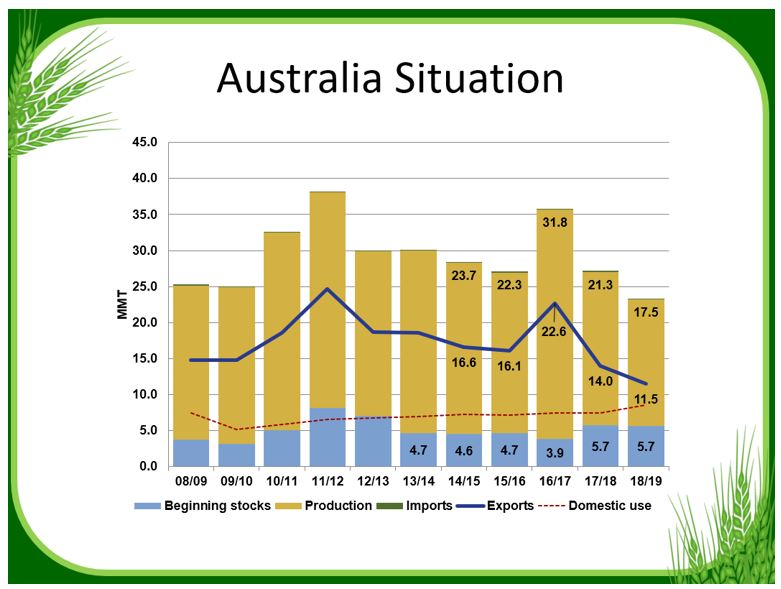

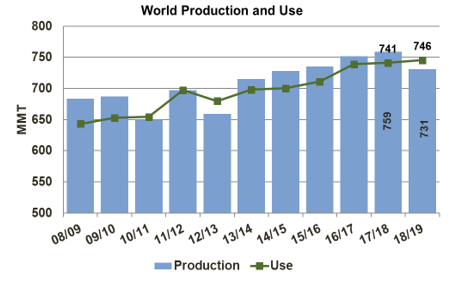

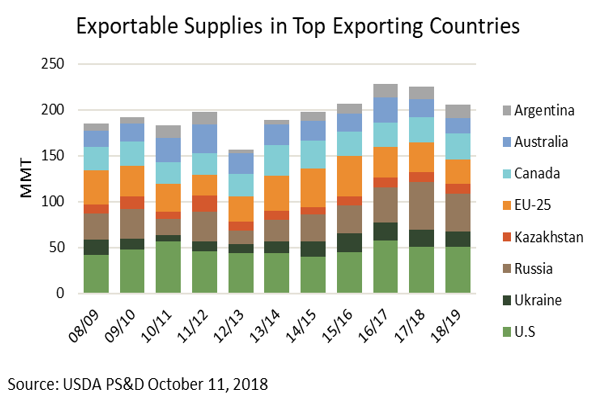

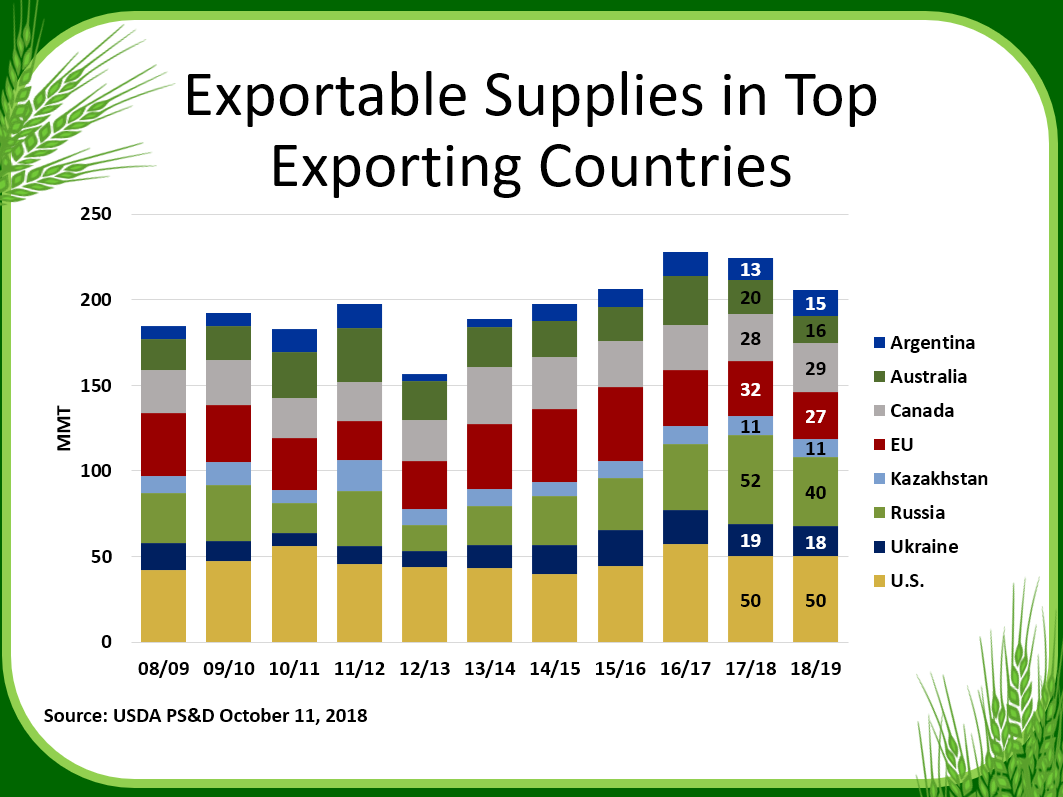

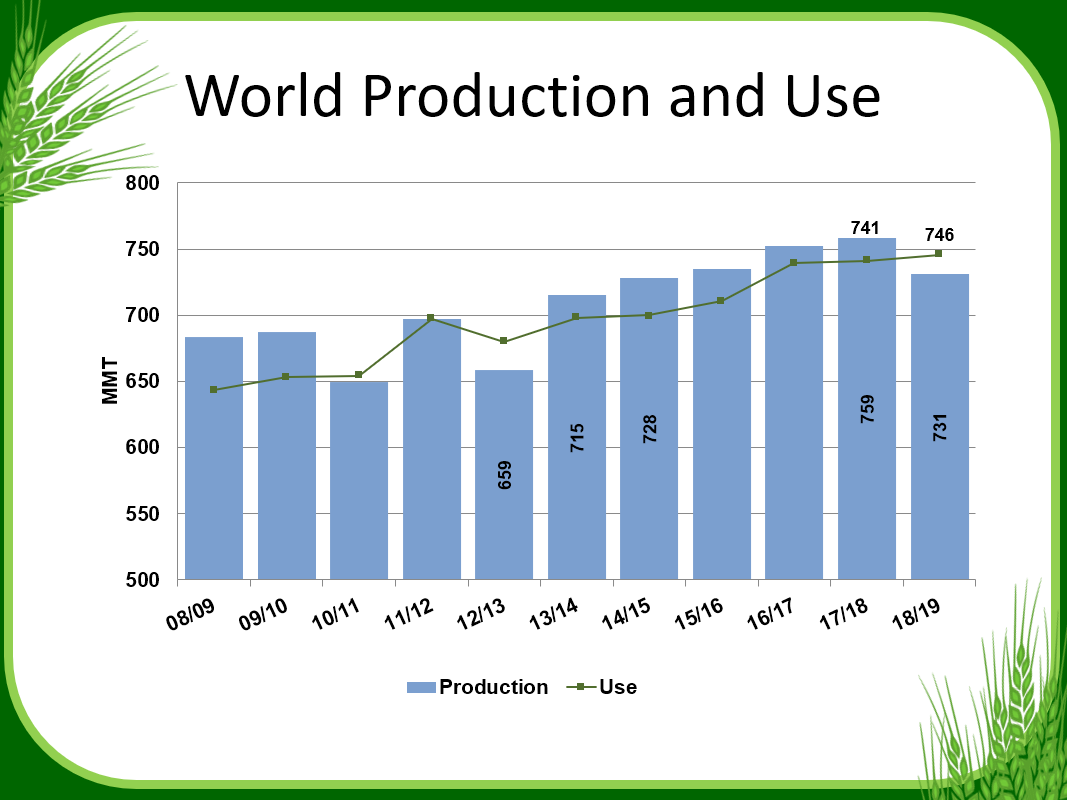

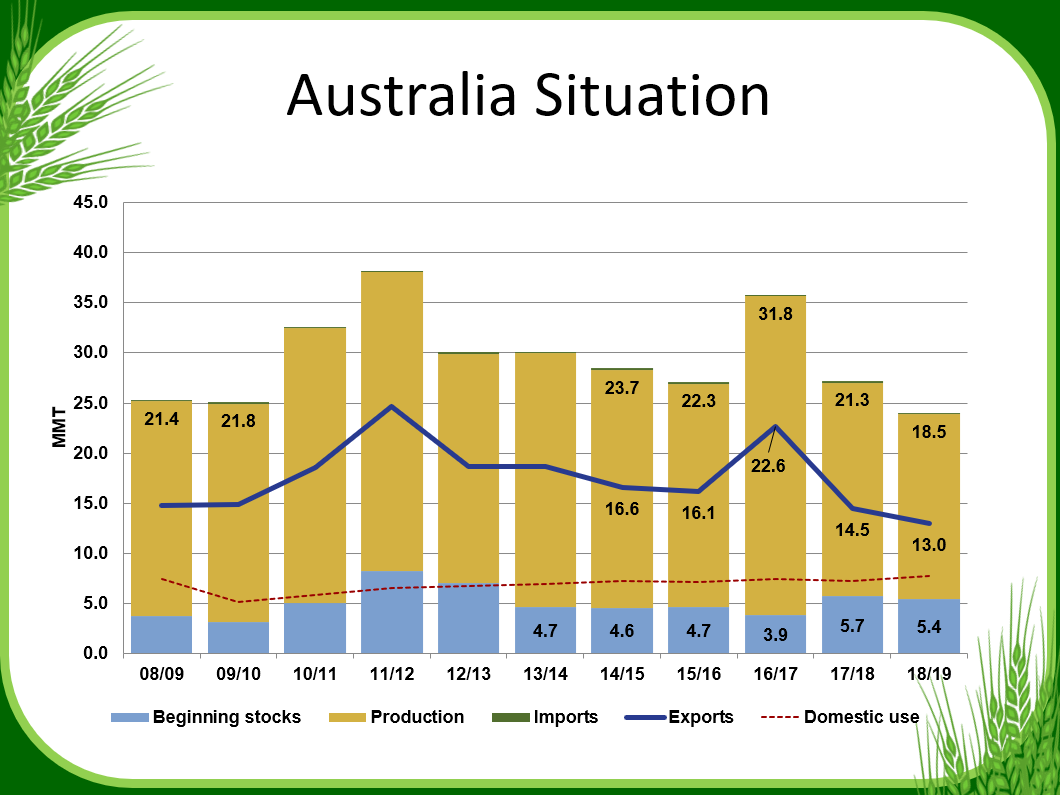

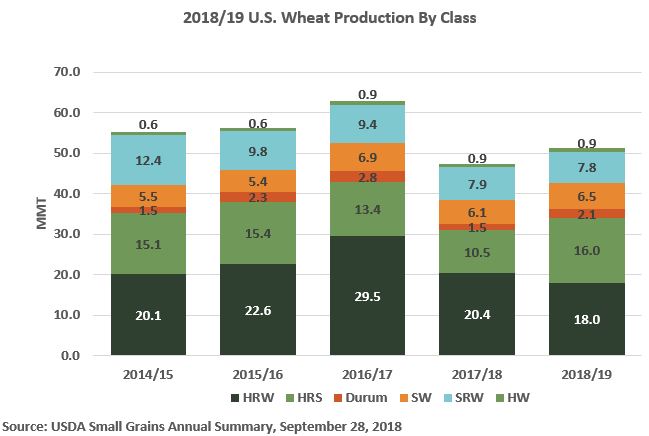

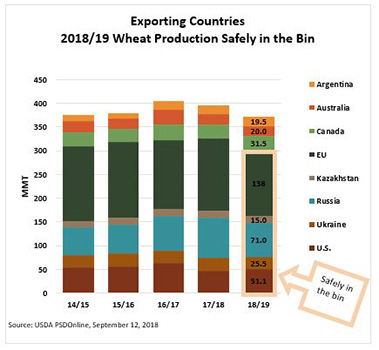

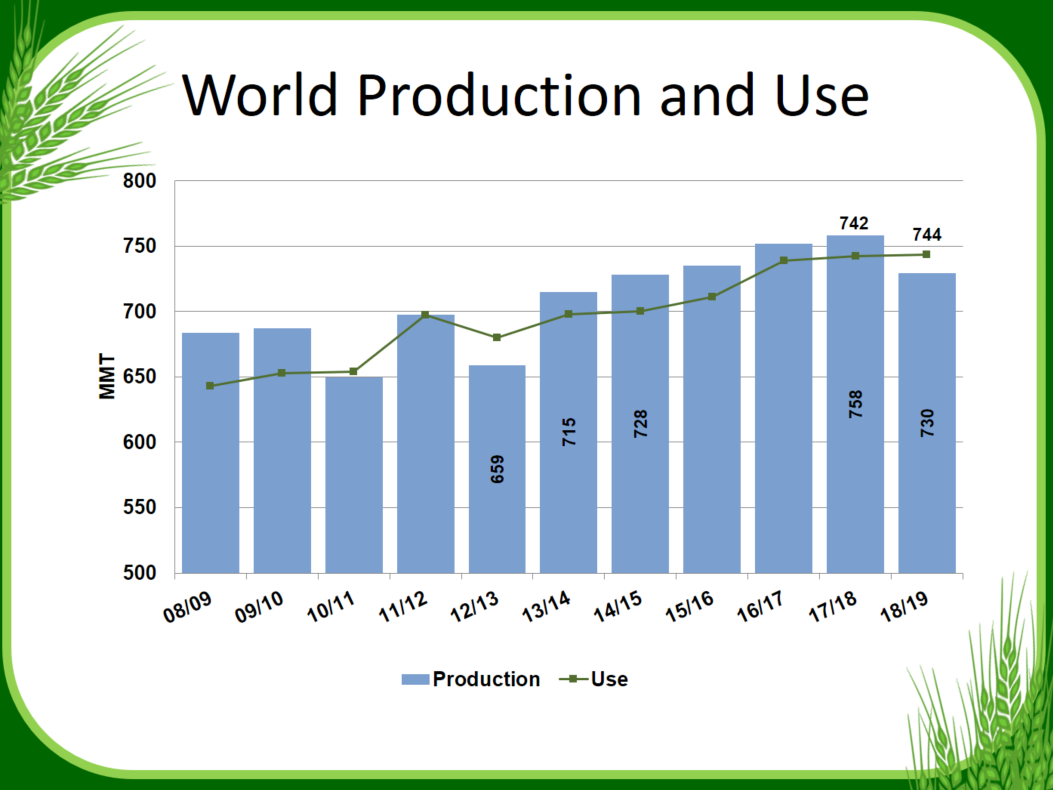

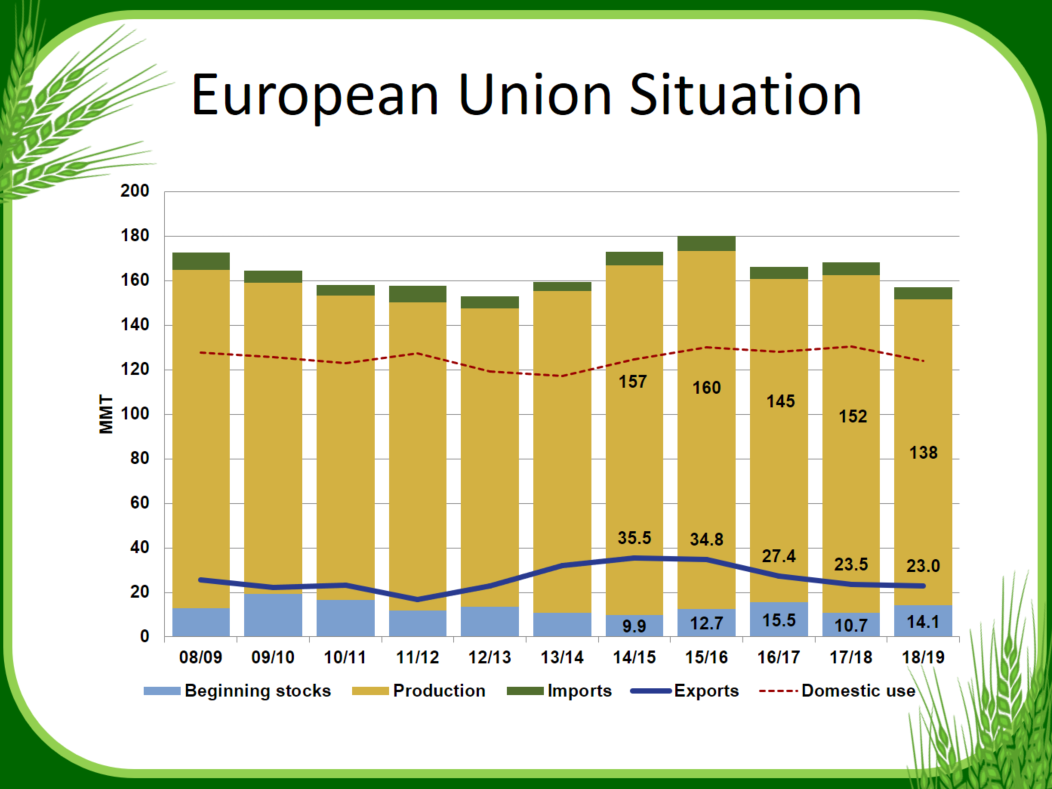

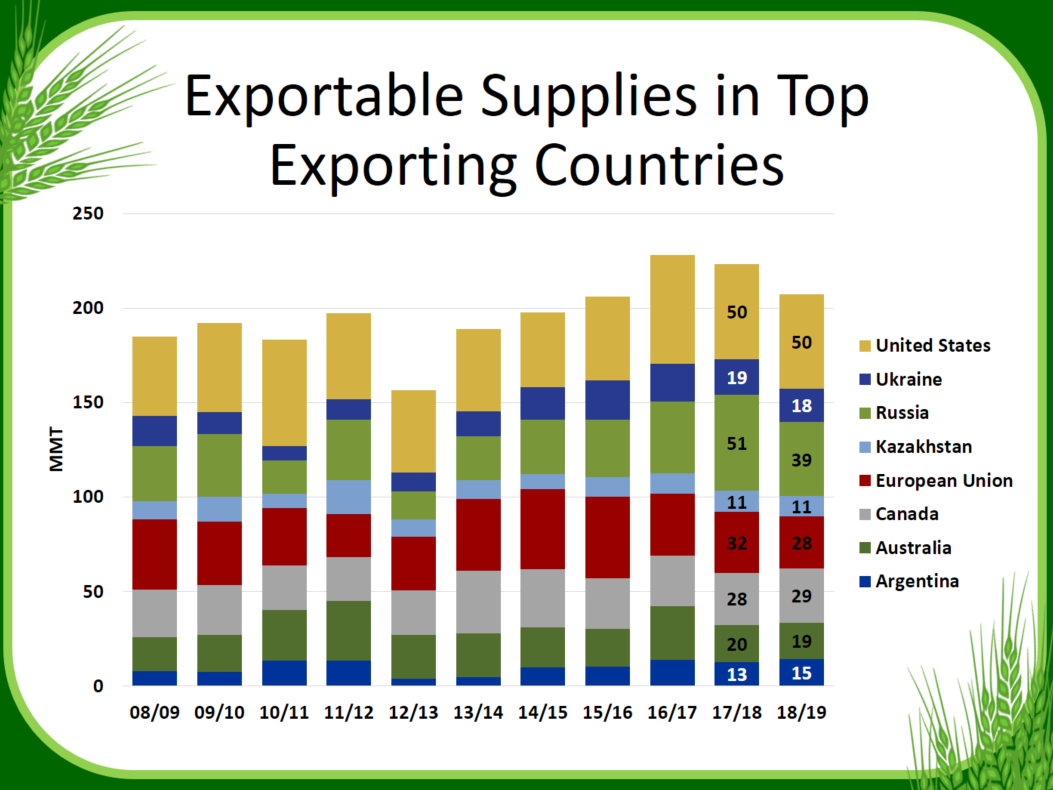

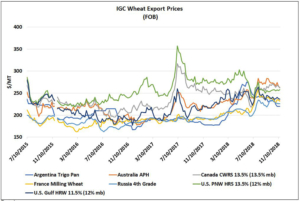

U.S. wheat exports to price sensitive markets and to typically self-sustaining markets are on the rise due to increased price competitiveness. Fueling this demand for U.S. wheat is, in part, shrinking wheat supplies, especially of high-quality milling wheat following decreased production in half of the world’s major wheat exporters — including Australia, the European Union (EU), Russia and Ukraine. The shrinking supplies in these countries have lifted their domestic and export wheat prices significantly over the past few months. At the same time, a large, high-quality crop pressured U.S. wheat prices lower, resulting in a convergence not seen for several years.

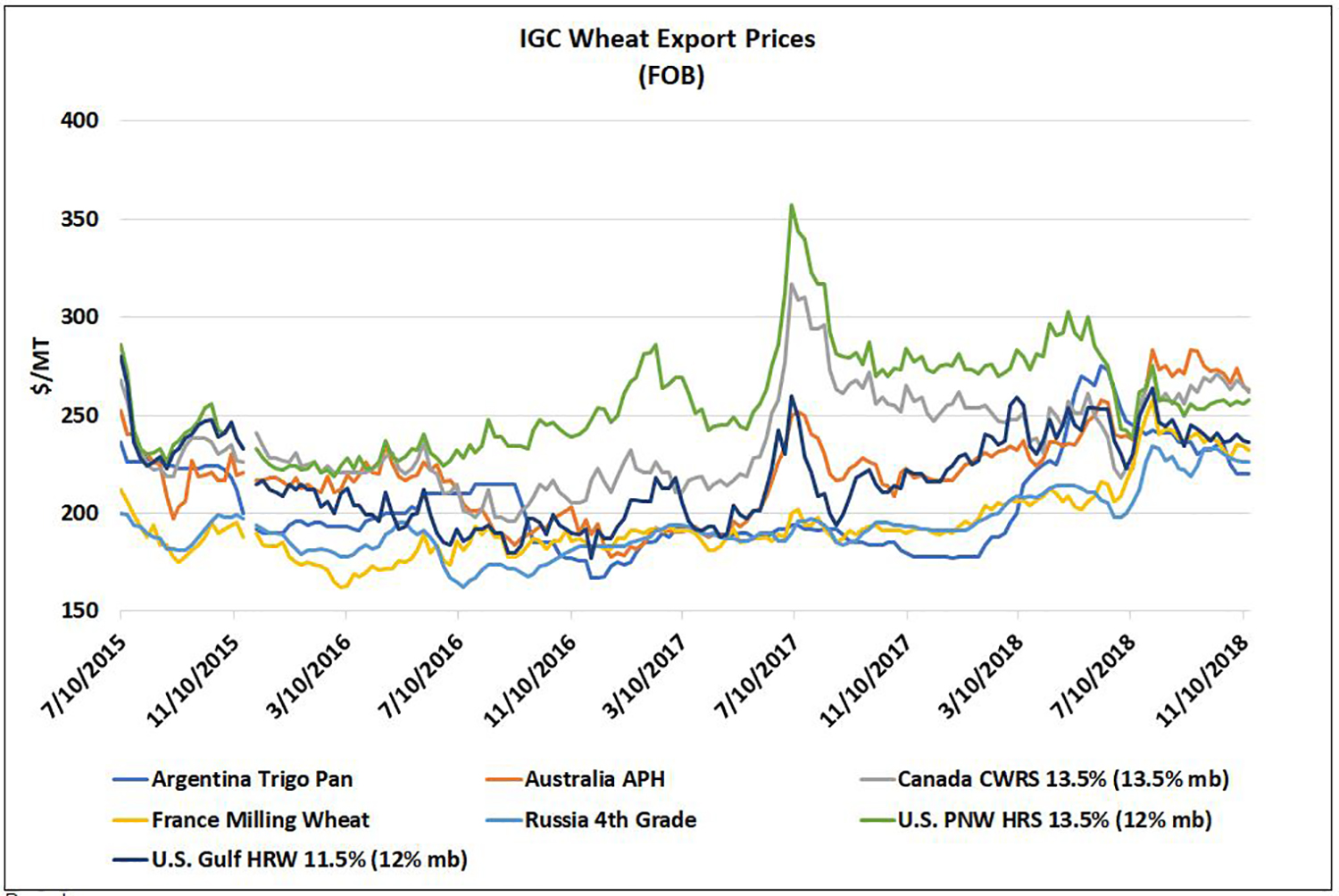

According to International Grains Council (IGC) data, free-on-board (fob) French wheat prices rose 11 percent or $23 per metric ton (MT) from the start of the 2018/19 marketing year (beginning on June 1). Russian 4th Grade fob wheat prices have increased $15 per MT, and Australian fob wheat prices have increased an average $13 per MT. IGC data shows U.S. fob wheat prices slipping an average 8 percent due to the large, high-quality crop.

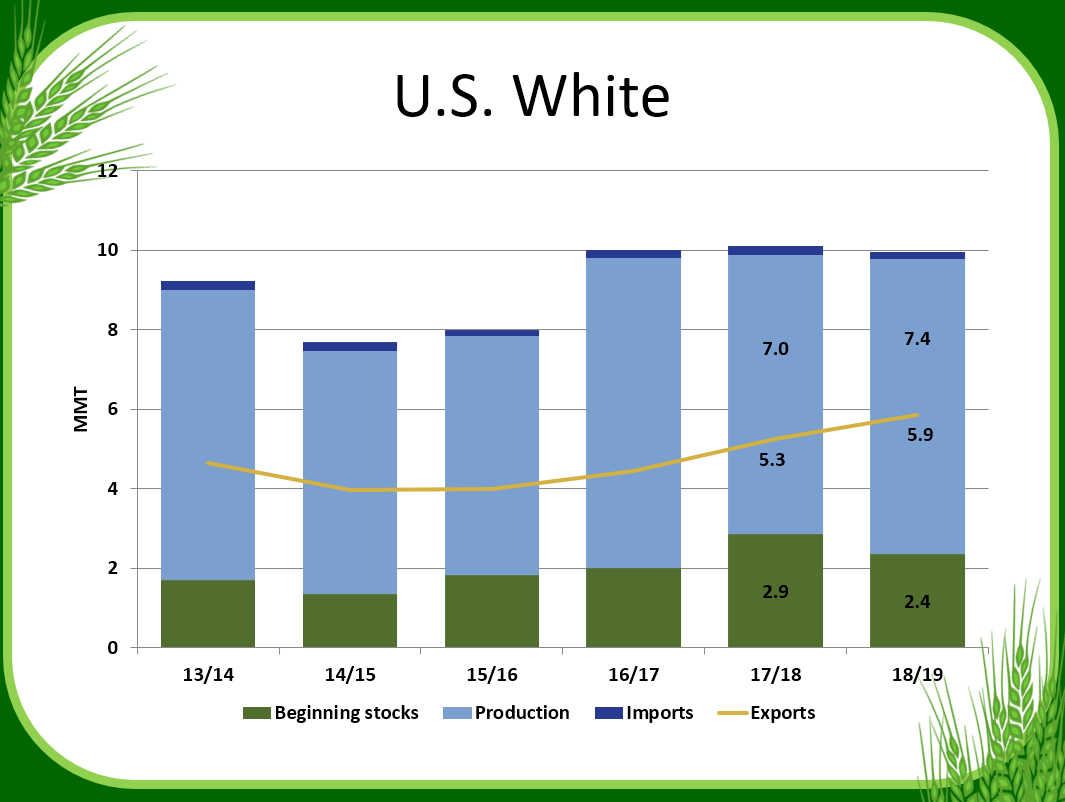

As of Nov. 22, IGC data shows U.S. wheat is now at a better value than all the major competitor pairings. U.S. soft red winter (SRW) is the best value milling wheat in the world at $216 per MT, $10 per MT below Russian 4th Grade wheat. U.S. 11.5 percent protein (12 percent moisture basis) hard red winter (HRW) is valued at an average $3 per MT below French wheat. U.S. 14 percent protein (12 percent moisture basis) hard red spring (HRS) from the Pacific Northwest (PNW) is an average $258 per MT, $4 per MT below Canadian CWRS from Vancouver; and U.S. SW from the PNW is an average $47 per MT less than Australian wheat, which is now the most expensive wheat in the world due to the devastating drought they have suffered.

The convergence in prices has resulted in increased sales of U.S. wheat as customers seek to secure supplies. Notably, on Nov. 26, USDA reported U.S. export sales of 120,000 MT of SRW to Egypt. The announcement followed an earlier General Authority for Supply Commodities (GASC) public tender where U.S. wheat was the lowest offer. Coupled with earlier sales, U.S. wheat export sales to Egypt now total 220,000 MT, almost double last year’s and the highest level since 2013/14. The United States has also shipped 64,000 MT of HRW to Saudi Arabia, with trade experts expecting additional demand from the country’s recent optional origin tender.

U.S. durum sales are also benefiting from increased price competitiveness. IGC data shows French durum and U.S. durum from the Great Lakes are now at parity at $240 per MT after French durum production was hurt by poor growing conditions. U.S. durum export sales are up 54 percent year over year at 400,000 MT with the EU being the largest buyer, followed by Algeria and Nigeria.

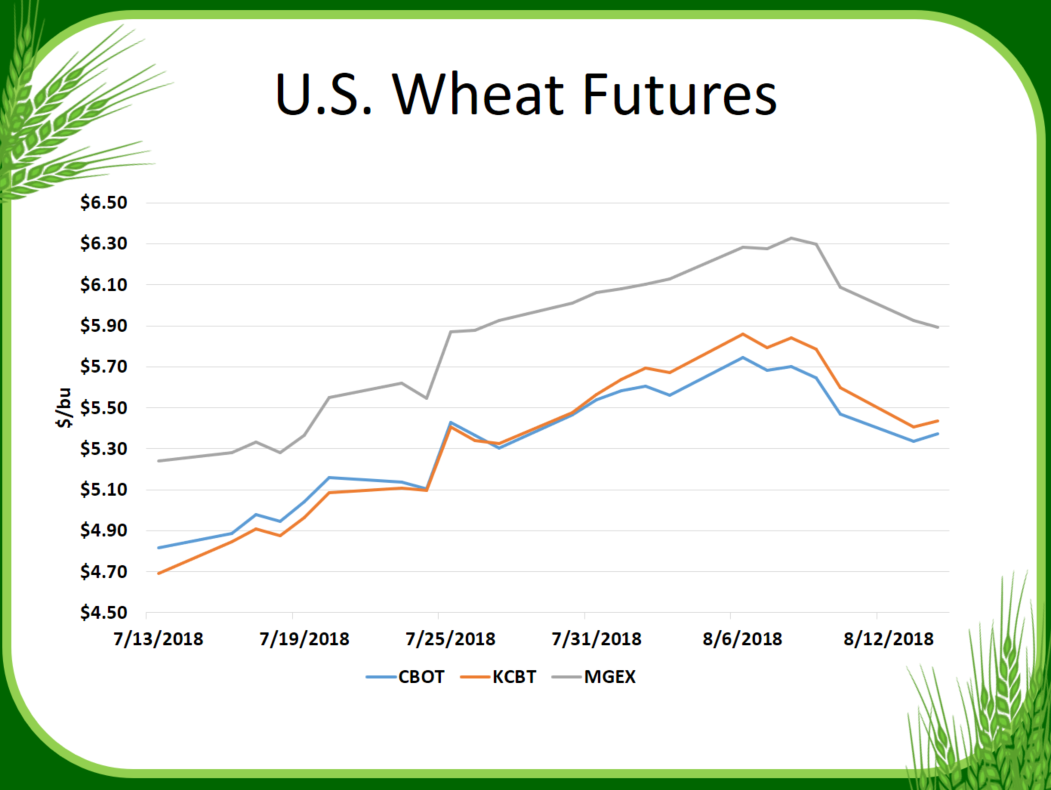

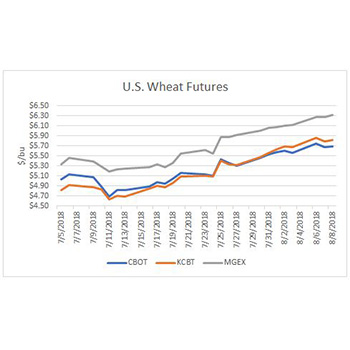

Despite the increased demand for U.S. wheat, U.S. wheat futures remain at or near marketing year lows, pressured by excellent winter wheat crop conditions and good soil moisture in the U.S. Northern Plains.

It is rare for U.S. wheat prices to be in such a competitive position, which represents an excellent opportunity for customers to lock-in their wheat futures price at these excellent levels.

To track U.S. wheat prices, subscribe to the USW Weekly Price Report.