The purchase by China of 1.12 million metric tons (MMT) of U.S. soft red winter (SRW) wheat for delivery in 2023/24 between Dec. 4 and 8 is a significant and, in terms of its volume, somewhat unexpected factor in the current market. The buyers clearly took advantage of a price opportunity, yet there are other influencing factors behind this buying surge to consider.

Already in the Market

China is in a wheat-buying phase driven in part by reported damage to its 2023 crop from rain at harvest. USDA expects China to exceed its WTO-agreed 9.6 MMT tariff rate quota again in 2023/24. By late November, China had already purchased a total of 1.01 MMT of four U.S. wheat classes, including 789,000 MT of SRW in 2023/24.

The U.S. Wheat Associates (USW) Price Report on Nov. 22 estimated SRW FOB export price out of the Gulf at $250 per MT, and on Nov. 30 at $258 per MT, a very competitive price relative to other wheat origins.

After the recent deals through Dec. 8, total 2023/24 SRW commercial sales to China to date now exceed 1.9 MMT. As a result, USDA raised its Dec. 8 estimate of total SRW sales in 2023/24 by about 817,000 MT to 4.76 MMT. If realized, that would be the largest volume of SRW exports since 2013/14.

A Trusted Source

Jeff Coey

Why so much SRW? USW Regional Vice President Jeff Coey suggests that China’s buyers and flour millers are very familiar with this soft wheat class grown in the eastern third of the United States.

“It is a story that goes back decades,” said Coey. “First, our SRW is closest to the wheat grown in China. And the investment U.S. wheat growers have made in USW’s trade and technical service over many years has given Chinese buyers the confidence to import SRW, and other classes, when the opportunity arises.”

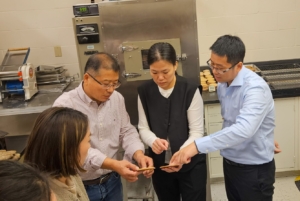

Coey said maintaining that education process was the goal behind USW’s investment of Agricultural Trade Promotion (ATP) program funds to bring a team of Chinese buyers to the United States in early November 2023. The visit included in-depth time with Federal Grain Inspection Service inspectors at an export elevator in Houston, Tex., as well as time with a SRW farmer and officials at USDA’s Agricultural Research Service (ARS) Soft Wheat Quality Lab (photo above) in Ohio.

“Those visits in particular were instructive,” said Coey. “Understanding the third-party inspection and certification process and the testing demonstrated at the ARS lab gave the buyers a sense of the design behind the quality data we share with them.”

Quality testing at the USDA-ARS Wheat Quality Lab in Wooster, Ohio, includes cookie spread testing, demonstrated during a November visit for a Chinese wheat buying team.

On the Ground Input

Ohio farmer and USW director Ray Van Horn was in the middle of his corn harvest when the Chinese buyers visited his farm.

“Ray and representatives of our member state wheat commission Ohio Corn and Wheat hosted the team on a crisp, clear afternoon in one of Ray’s fields with a beautiful, new stand of soft red winter wheat. It was a perfect place to share information about the wheat production decisions he makes and how that may affect buyers,” Coey said.

In a field seeded with a 2024 soft red winter wheat crop, Ohio farmer Ray Van Horn (right) discusses how he makes decisions and manages his crops with members of a Chinese wheat buying trade team sponsored by USW and hosted by Ohio Corn & Wheat in early November.

Adding value to this buying opportunity is the fact that U.S. farmers produced two large SRW crops with excellent quality in 2022 and 2023.

“Together all these factors helped build the confidence that these buyers can select U.S. soft red winter this year and have a deep supply of consistent quality with a ready domestic market,” Coey concluded.

By USW Vice President of Communications Steve Mercer

United Grain Corp. (UGC) announced this week it will acquire Grain Craft’s Pendleton, Ore., grain elevator, more than 19,000 square feet of warehouse and accompanying property. The sale follows a fire last year that destroyed Grain Craft’s flour mill on that property. UGC says the Pendleton acquisition will support UGC’s McNary River Terminal by acting as a wheat satellite and positioning the company for growth in existing and new product lines. Read more

United Grain Corp. (UGC) announced this week it will acquire Grain Craft’s Pendleton, Ore., grain elevator, more than 19,000 square feet of warehouse and accompanying property. The sale follows a fire last year that destroyed Grain Craft’s flour mill on that property. UGC says the Pendleton acquisition will support UGC’s McNary River Terminal by acting as a wheat satellite and positioning the company for growth in existing and new product lines. Read more