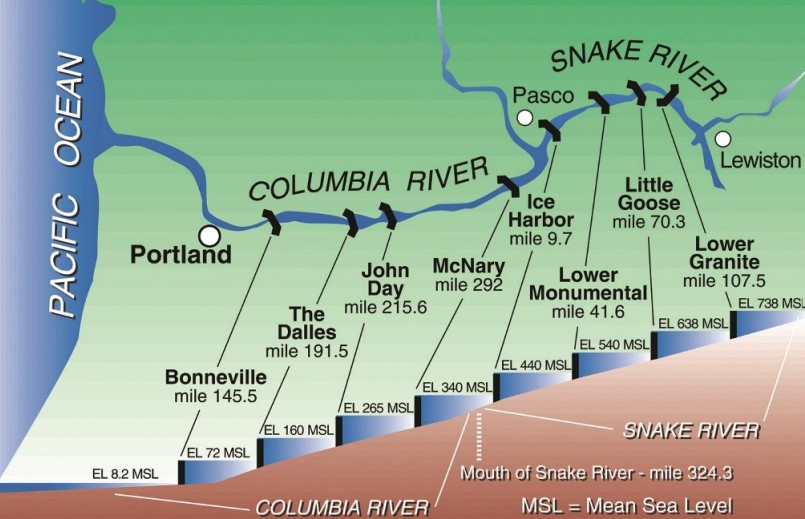

Last month, World Food Program USA reported that in 2022, for the third consecutive year, “the U.S. shipped over 1 million tons of wheat to global hunger relief efforts. The 1 millionth ton of wheat was loaded aboard the African Halycon cargo vessel and left Washington state on Saturday, November 26.”

As that shipment of donated U.S. soft white (SW) arrives in Yemen this month, USAID has issued two new food aid tenders for about 170,000 metric tons of U.S. hard red winter (HRW) to be donated to Ethiopia.

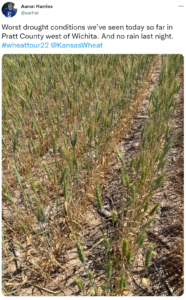

Six Years of Drought

“Years of drought in the Horn of Africa has created a serious food insecurity situation in Ethiopia and other countries,” said Peter Laudeman, Director of Trade Policy with U.S. Wheat Associates (USW). “The donated wheat will be distributed to local flour mills then to the Ethiopian people.”

A large portion of U.S. food aid is managed by USAID’s Food for Peace office primarily as emergency food assistance. USAID purchases U.S commodities at market price and donates them to meet the immediate nutritional needs of those facing hunger. In other cases, USAID will purchase and donate local or regionally grown commodities or provide market-based food vouchers and cash.

Right Food at the Right Time

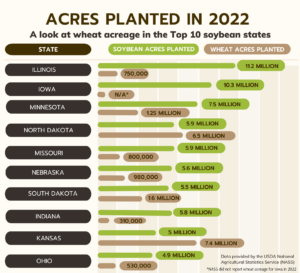

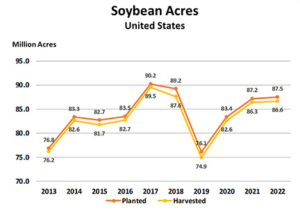

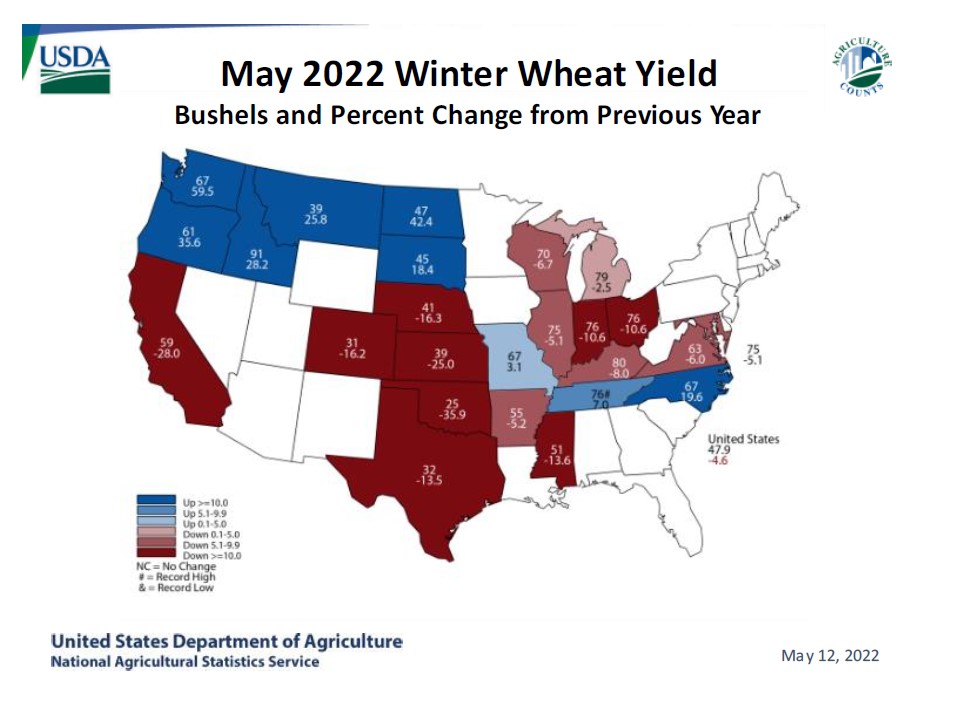

The type of assistance varies based on local circumstances and needs. More than 541,000 metric tons of HRW wheat was donated to Ethiopia in 2022 and almost 490,000 metric tons of SW was donated to Yemen last year. These two wheat classes best meet the preferences for Ethiopian and Yemeni wheat food products.

“Compared to commercial U.S. wheat sales to date in 2022/23, food aid is the fourth largest destination for HRW, the fifth largest destination for SW, and the seventh largest destination for total U.S. wheat sales.” – USW Market Analyst Tyllor Ledford

U.S. wheat farmers have been partners in U.S. international food assistance programs for more than 60 years and take pride in sharing their harvest with populations that need it most.

“Those of us in the U.S. food and agriculture community talk all the time about feeding the world,” Laudeman said. “I think these humanitarian, international programs really resonate with farmers.”

“Farmers are unique stakeholders in the international food aid conversation, and we’ve been loyal partners and advocates of these programs since they started. I want to see us continue our trend of excellence in providing food aid to the countries that need it most,” said Kansas wheat farmer and past USW Chairman Ron Suppes (center) in Congressional testimony after visiting Kenya and Tanzania on a trip to monitor U.S. wheat food aid programs in 2017. Mike Shulte (second from right), executive director of the Oklahoma Wheat Commission, also made the trip.

Big Hearts, Abundant Harvests

“People in the U.S. have big hearts and genuinely see a need to step up to the plate when there are populations around the world that are experiencing hunger, whether that’s due to drought in Ethiopia or conflict in Yemen, or any of the other countries that the U.S. has sent aid to,” USW Vice President of Policy Dalton Henry told the World Food Program USA in December. These shipments show “the generosity of U.S. farmers, as they produce an abundance of commodities that can be shared around the world,” Henry said.

USW and the Food Aid Working Group, a joint working group between USW and the National Association of Wheat Growers, are proud of the wheat provided through these food aid programs and believe that commodity donation is an effective portion of the whole effort.