Name: Kong Song “Ivan” Goh

Title: Biscuit/Bakery and Noodle Technologist

Office: USW South Asia Regional Office, Singapore

Providing Service to: Indonesia, Malaysia, Myanmar, Republic of the Philippines, Singapore, Sri Lanka, Thailand, and Vietnam

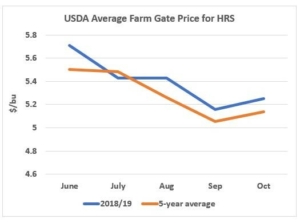

Regional Profile: Rapidly rising disposable income and urbanization in South Asia are opening markets for baked goods, biscuits, cakes, and other foods that require more types of higher-quality flour. As the milling and wheat foods industries rush to increase capacity, USW is helping them improve and expand product lines using high-quality soft white (SW) for cake, biscuit, and confectionery flour, and U.S. hard red winter (HRW) and hard red spring (HRS) for bread flour. USW also conducts baking seminars to introduce new products with higher profit margins using flour milled from U.S. wheat.

Common Roots

From far southern Myanmar and southwest Thailand, the Asian continent continues south as the Malay Peninsula to include Western Malaysia and Singapore near its southern tip. Northwest of Kuala Lumpur is the Malaysian state of Malacca. This area has gained a certain notoriety among South Asian wheat food producers as the source of valuable technical support from long-time U.S. Wheat Associates (USW) Baking Consultant Roy Chung and now USW Biscuit/Bakery and Noodle Technologist Ivan Goh.

“Roy and I were born in the same hometown in Malacca,” Goh said. “Roy’s father ran a bakery, and my story starts with my family, too. My mum earned a living by selling bite-size snacks called Kuih-muih and fried spring rolls called Popiah. I was nine years old when I started helping her make and sell her food. My interest in cooking and food preparation grew from there. In fact, most of my family members are in food-related work.”

Goh went on to earn a bachelor’s degree in Food Science and Technology from the University of Putra Malaysia, and his talent landed him two job offers even before he graduated in 2012. He said because he is “not a shy person who can do routine jobs,” he chose a technical service position with FFM Berhad in Port Klang, Malaysia, that would expose him to as many parts of the flour milling and baking industries as possible.

“The knowledge I gained there has been very valuable,” he said. “I especially enjoyed the opportunities in technical troubleshooting and handling customer complaints.”

He added that the company always taught its colleagues to appreciate the people who helped them in their work, an experience that would prove important to Goh’s next career opportunity.

An Introduction to USW

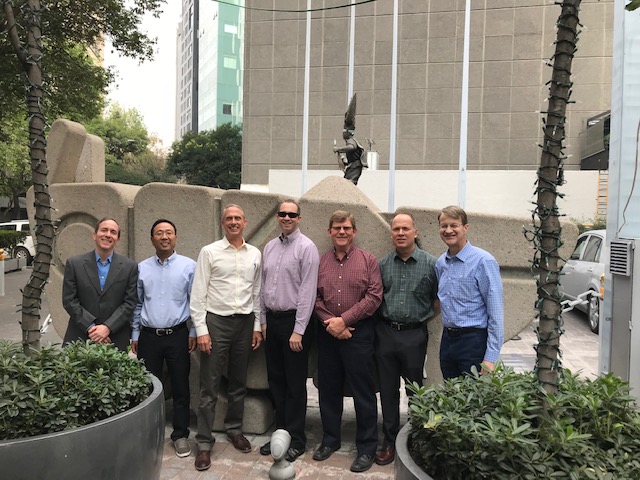

USW first crossed paths with Ivan Goh when Roy Chung conducted a USW baking workshop at FFM Berhad in 2014. In 2015, the company sent Ivan to one of the popular USW baking courses Chung developed and led with the UFM Baking & Cooking School in Bangkok, Thailand. USW Regional Vice President Matt Weimar was also there to identify potential candidates to fill a vacant technical position in USW’s South Asian Region.

“Ivan Goh was one of the individuals who stood out in terms of their work and leadership,” Weimar said. “He also impressed Roy, so we decided to follow his career path until it was the right time to invite him to work for our organization.”

That opportunity emerged early in 2018, and Goh has been representing U.S. wheat farmers in the South Asian region since last March.

“The wheat foods industry is rapidly expanding in the region, and we knew Ivan’s experience in quality assurance and control was ideal to help flour mills, bakeries, cookie/cracker, and confectionery processors better understand the quality, value, and use of U.S. wheat flour,” said Weimar. “We set up an active development schedule for Ivan. It started with Ivan shadowing Roy at the USW baking classes at UFM, then on an extended technical service visit with Roy to several flour mills and baking customers in Indonesia.”

On the Road

Goh, who is fluent in several languages spoken in the region, participated with millers from the Philippines, Indonesia, and Vietnam in a USW Contracting for Value workshop and joined Weimar as co-host of a regional trade team that visited Washington state, Idaho, and Montana last August. That schedule keeps Goh mostly away from a home office in Kuala Lumpur and the USW South Asia regional office in Singapore. But he is very excited about the opportunity.

“Roy Chung is a legend as a teacher and technical resource in this region,” Goh said. “I never imagined that one day I would be his colleague. Another thing that impressed me is that USW is the only wheat organization that invites overseas millers to evaluate the quality of every U.S. wheat crop and sincerely listens to their feedback. That must be part of the working culture because I am also free to voice my opinions.”

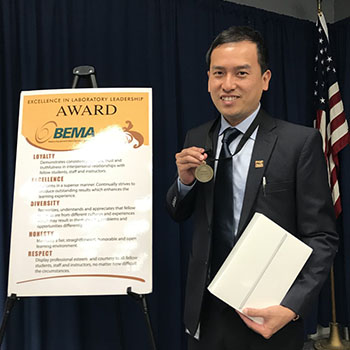

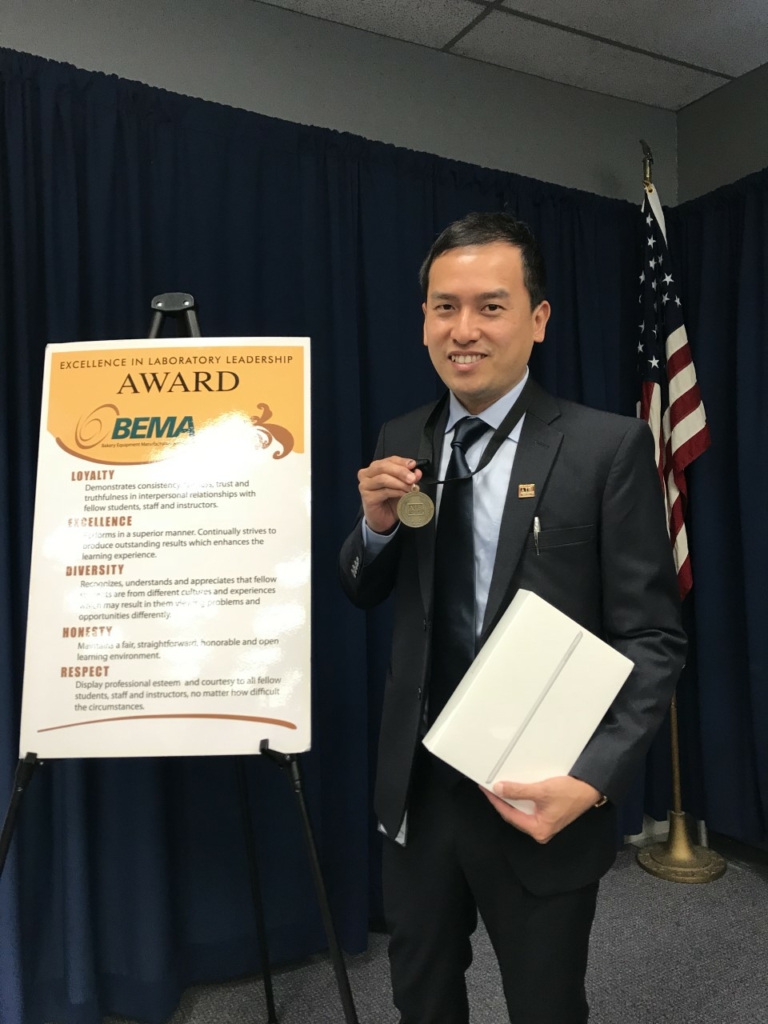

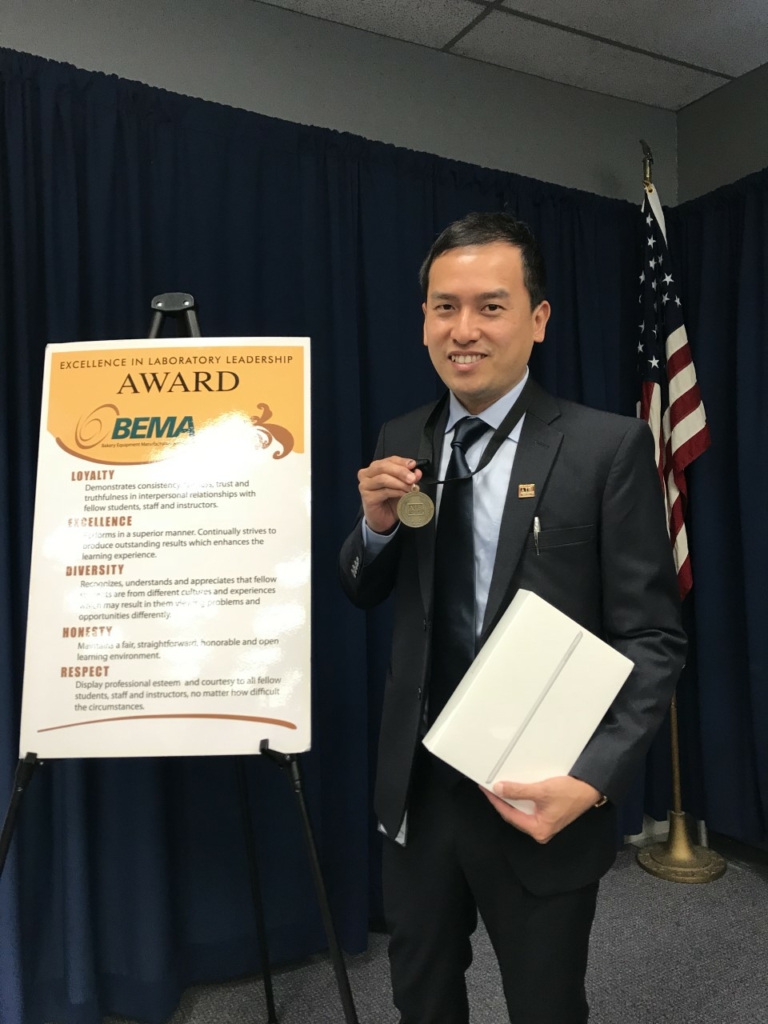

Late in 2018, there was additional, extensive training for Goh as a student in Class 193 of the 16-week Baking Science and Technology Course at the AIB Institute in Manhattan, Kan.

“Our goal is to help customers improve their product lines and manage cost risks, so the course further strengthened my confidence in helping large-scale bakeries,” Ivan said. “In addition, seeing the performance and benefits of using flour from U.S. wheat classes firsthand will help me demonstrate how customers can get the most value possible from those flour products in their own bakeries.”

“Ivan received a medal as the fourth-ranked student in the class and was recognized with one of the Bakery Equipment Manufacturers Association awards recognizing ‘Excellence in Laboratory Leadership Performance,” Weimar said. “The relationships he developed with his fellow students will also be very valuable in the future.”

Weimar noted that Ivan Goh has had a very productive first year with U.S. Wheat Associates, adding “we are proud of Ivan’s progress, and we look forward to many more successful technical support activities to come. That is a commitment to our South Asian customers and the U.S. wheat farmers we are proud to represent.”

By Steve Mercer, USW Vice President of Communications

Editor’s Note: This is the first in a series of posts profiling U.S. Wheat Associates (USW) technical experts in flour milling and wheat foods production. USW Vice President of Global Technical Services Mark Fowler says technical support to overseas customers is an essential part of export market development for U.S. wheat. “Technical support adds differential value to the reliable supply of U.S. wheat,” Fowler says. “Our customers must constantly improve their products in an increasingly competitive environment. We can help them compete by demonstrating the advantages of using the right U.S. wheat class or blend of classes to produce the wide variety of wheat-based foods the world’s consumers demand.”

Meet the other USW Technical Experts in this blog series:

Ting Liu – Opening Doors in a Naturally Winning Way

Shin Hak “David” Oh – Expertise Fermented in Korean Food Culture

Tarik Gahi – ‘For a Piece of Bread, Son’

Gerry Mendoza – Born to Teach and Share His Love for Baking

Marcelo Mitre – A Love of Food and Technology that Bakes in Value and Loyalty

Peter Lloyd – International Man of Milling

Adrian Redondo – Inspired to Help by Hard Work and a Hero

Andrés Saturno – A Family Legacy of Milling Innovation

Wei-lin Chou – Finding Harmony in the Wheat Industry