The 2023 U.S. hard red spring (HRS) crop was produced under a wide range of growing conditions. A late spring delayed planting but the early moisture helped establish the crop. Then conditions across the region turned hot and dry with only spotty areas of rain. The rain returned and delayed mid- to late-harvest. Ultimately, total production reached 12.7 million metric tons (MMT), 14% more than in 2022.

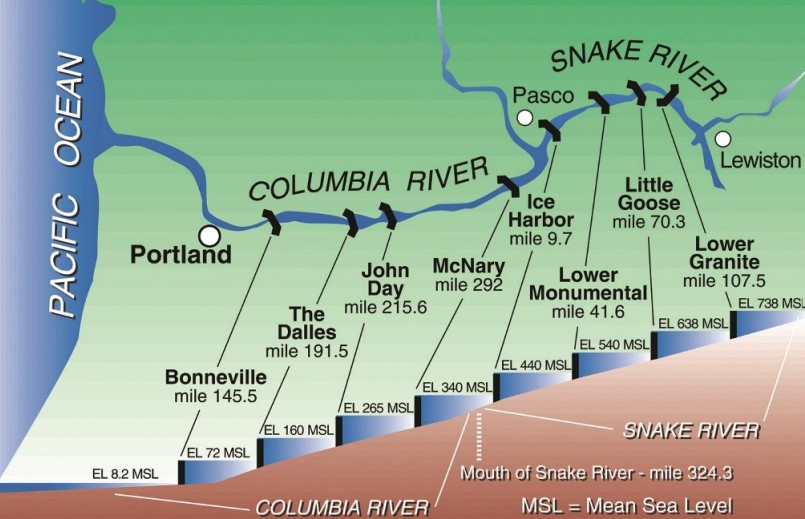

U.S. Wheat Associates (USW) reports hard red spring quality highlights for three export locations. First is for HRS from the western region that supplies export facilities in the Pacific Northwest (PNW). Quality data for HRS that moves from the eastern region to the Gulf of Mexico and to the Great Lakes are reported together. The complete 2023 USW Crop Quality Report and detailed by-class reports are being produced now and will be posted online over the next few weeks.

2023 HRS PNW-Exportable Overview and Highlights

The 2023 U.S. hard red spring (HRS) wheat crop grown in the western (PNW-exportable) region offers strong grading characteristics, good protein content, typical dough strength, and improved bake parameters compared to recent years.

The average grade for the 2023 PNW-exportable HRS harvest survey is U.S. No. 1 Northern Spring (NS), with 84% of samples grading U.S. No. 1.

Average test weight is 60.7 lb/bu (79.8 kg/hl).

The PNW-exportable crop has lower VITREOUS KERNEL (DHV) content, averaging 61% compared to 88% in 2022 and 84% for a 5-year average.

Wheat protein averages 14.1% (12% mb), below 2022 and the 5-year average. Distribution of protein is 32% below 13.5% protein and 40% above 14.5% protein.

Average 1000 kernel weight (TKW) is 32.1 g, well above 2022 and the 5-year average.

Buhler Laboratory Mill flour yield averages 66.7%, above 2022 and the 5-year average. Lab mill settings are not adjusted to account for kernel parameter shifts between crop years. The extraction is calculated on a tempered wheat basis.

Average flour ash is 0.48%, lower than last year and the 5-year average.

Wet gluten averages 32.4%, lower than 2022 and the 5-year average.

Amylograph average of 639 BU is much lower than 2022 and lower than the 5-year average, reflective of isolated areas with harvest rains.

Dough properties suggest a crop that exhibits strong characteristics with greater extensibility, compared to 2022 and the 5-year average.

Farinograph peak and stability times of 7.6 and 12.2 min, respectively, indicate the PNW-exportable crop is similar to 2022 and the 5-year average. Absorption values average 62.8%, down from 2022 and the 5-year average.

The average Alveograph P/L ratio is 0.68 compared to 0.74 in 2022, and the W-value is 384 (10-4 J), down from 396 last year.

The overall extensibility and resistance to extension of the 135-min Extensograph are 13.4 cm and 1001 BU, compared to 12.9 cm and 927 BU last year indicating slightly stronger, yet more extensible dough properties compared to last year.

The average loaf volume is 993 cc, above 940 cc in 2022, and 962 for a 5-year average.

Average bake absorption is 65.4%, lower than 2022 and the 5-year average.

2023 Gulf/Great Lakes-Exportable Overview and Highlights

The 2023 U.S. hard red spring crop grown in the eastern (Gulf/Great Lakes-exportable) region offers a nice balance of protein, strong dough characteristics and very good bake parameters. Overall, this is a highly functional crop.

The average grade is U.S. No. 1 Northern Spring (NS), with 95% of samples grading U.S. No. 1.

Average test weight is 61.7 lb/bu (81.2 kg/hl), lower than 2022 but similar to the 5-year average.

Average vitreous kernel (DHV) content is 44%, lower than last year’s 59% and the 5-year average of 65% due to late-season rain.

Wheat protein averages 14.3% (12% mb) with 21% of the surveyed crop below 13.5%, and 42% above 14.5%.

Average 1000 kernel weight (TKW) is 36.6 g, well above 2022 and the 5-year average.

Buhler Laboratory Mill flour yield averages 66.8, above 2022 but below the 5-year average. Lab mill settings are not adjusted to account for kernel parameter shifts between crop years. The extraction is calculated on a tempered wheat basis.

Average flour ash is 0.47%, similar to 2002, and lower than the 5-year average of 0.51%.

Wet gluten averages 33.2%, slightly lower than 2022 and the 5-year average.

Amylograph average of 566 BU is down from 2022 but similar to the 5-year average.

Dough properties suggest a stronger, slightly less extensible crop as compared to last year and the 5-year average.

Farinograph peak and stability times of 8.2 and 16.1 minutes respectively indicate the Gulf/Great Lakes-exportable crop is much stronger than average. Absorption values average 62.1%, down slightly from 2022, and similar to the 5-year average.

The average Alveograph P/L ratio is 0.78 compared to 0.63 for the 5-year average, and the W-value is 411 (10-4 J), compared to 388 for the 5-year average.

The overall extensibility and resistance to extension of the 135-min Extensograph are 14.0 cm and 1171 BU, compared to 15.6 cm and 743 BU last year indicating stronger, less extensible dough properties.

The average loaf volume is 971 cc, higher than 2022, and similar to the 5-year average.

Average bake absorption is 63.8%, significantly lower than 2022, and lower than the 5-year average.

The final northern durum weekly report showed that compared to the prior week, wheat moisture increased to 11.4%, falling number increased to 416 sec and HVAC decreased from 81% to 80%. Compared to 2022, protein content, 1000-kernel weight, and percent damaged kernels were higher while falling number, test weight and shrunken and broken kernels were lower. The overall grade remained U.S. No. 1 Hard Amber Durum (HAD).

The final northern durum weekly report showed that compared to the prior week, wheat moisture increased to 11.4%, falling number increased to 416 sec and HVAC decreased from 81% to 80%. Compared to 2022, protein content, 1000-kernel weight, and percent damaged kernels were higher while falling number, test weight and shrunken and broken kernels were lower. The overall grade remained U.S. No. 1 Hard Amber Durum (HAD).