By Claire Hutchins, USW Market Analyst

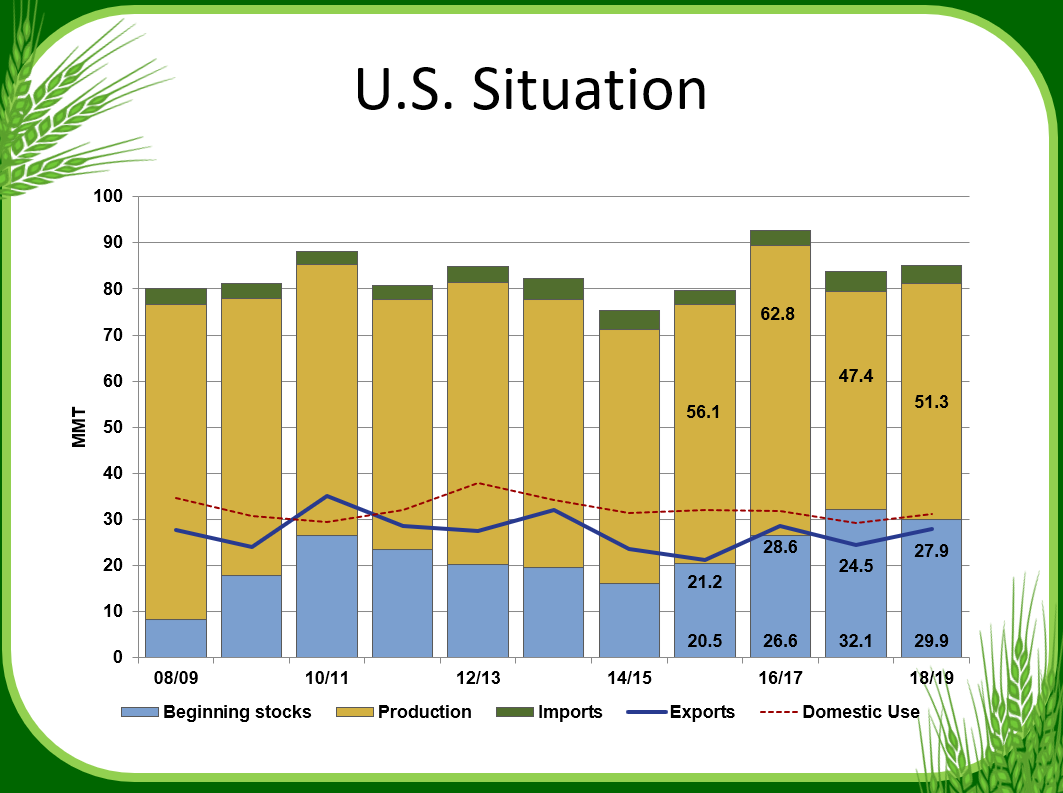

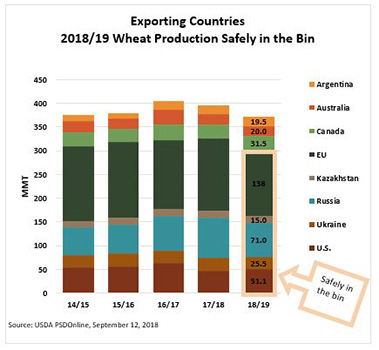

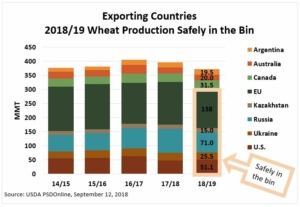

Despite challenging market factors, U.S. wheat exports for marketing year (MY) 2018/19, which ended May 31, totaled 25.8 million metric tons (MMT) (948 million bushels), in line with USDA’s adjusted export volume estimate. That is 9% ahead of MY 2017/18 and 1% ahead of the 5-year average of 25.5 MMT (937 million bushels). Commercial sales of all classes of wheat in MY 2018/19 exceeded 2017/18 levels due to abundant exportable supplies, excellent harvest qualities, competitive export prices and sustained service from U.S. Wheat Associates (USW) representatives supported by its state commissions and USDA’s Foreign Agricultural Service programs. This offset the bearish factors including a strong U.S. dollar, competitor’s advantages, uncertainty about U.S. trade policies and difficult inland transportation logistics.

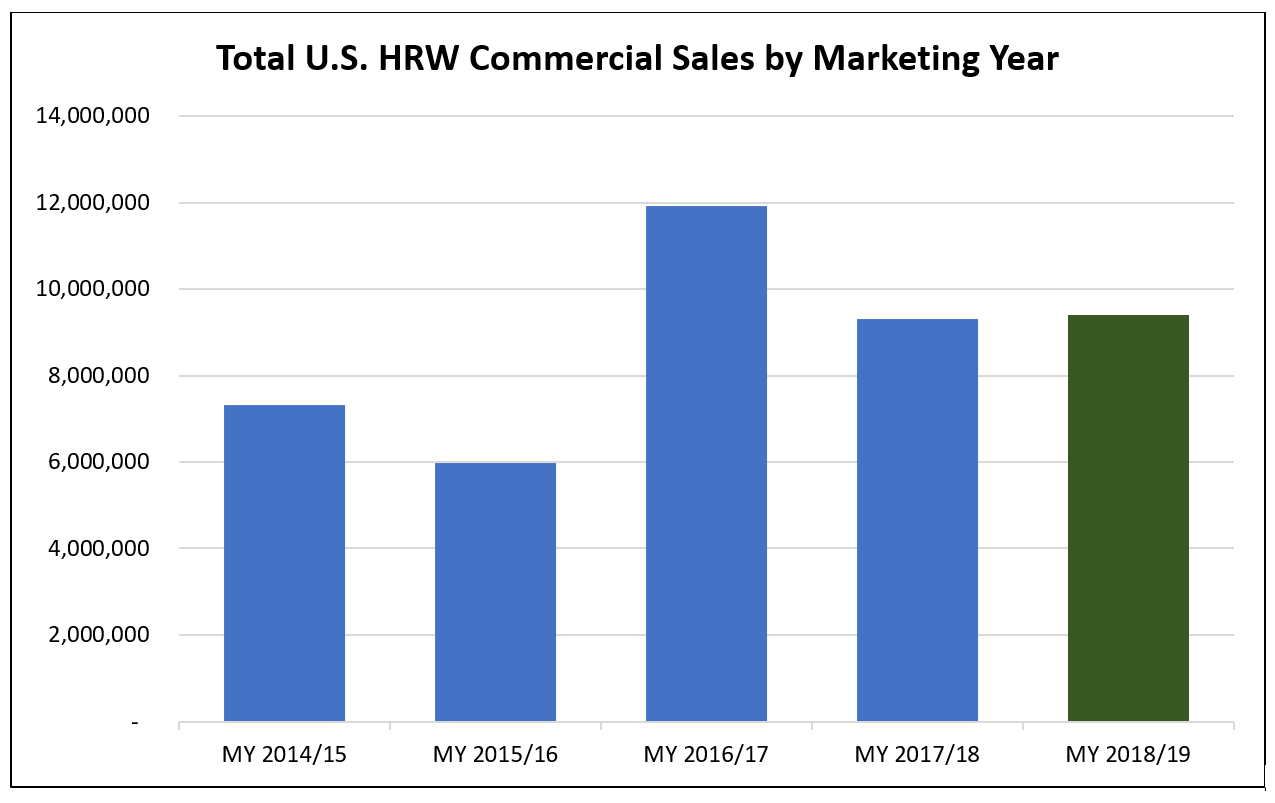

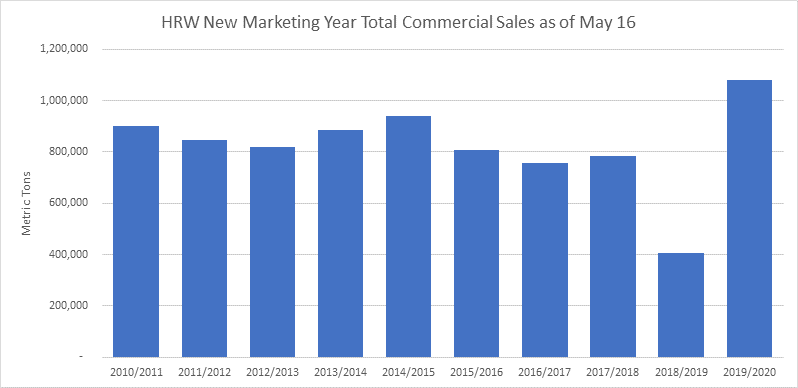

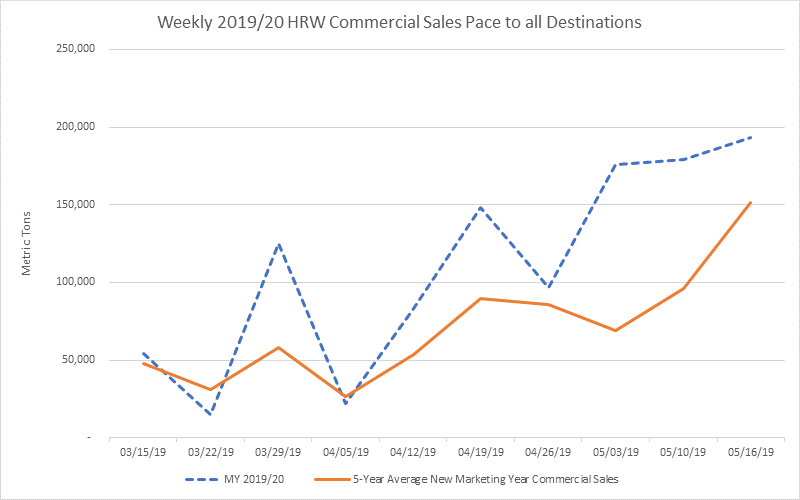

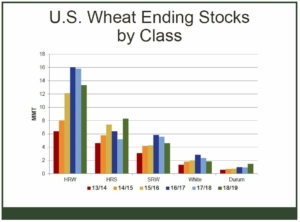

Hard Red Winter. USDA reported hard red winter (HRW) 2018/19 sales totaled 9.40 MMT (345 million bushels), 1% above 2017/18 and 1% above the 5-year average of 9.30 MMT (342 million bushels). Customers took advantage of the highest quality HRW crop in several years at attractive export prices compared to 2017/18. Out of the Gulf, between Jan. 1 and May 31, 2019, the average export price of U.S. HRW 12.0 protein (12% moisture basis) cost $227/metric ton (MT) compared to $257/MT over the same period in 2018. Sales to Mexico and Nigeria were up 6% and 36% respectively, while sales to Japan were down 6%. Sales to Mexico totaled 2.15 MMT (79.0 million bushels), 44% above the 5-year average of 1.49 MMT (55.0 million bushels), once again making Mexico the top HRW buyer. Commercial sales to Iraq, now the fourth-largest consumer of U.S. HRW, were in line with 2017/18 levels at 674,000 metric tons (MT) (24.7 million bushels).

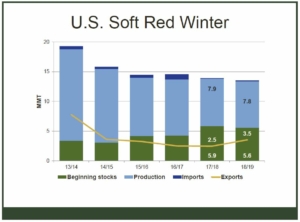

Soft Red Winter. 2018/19 soft red winter (SRW) sales increased 33% year-over-year to 3.33 MMT (123 million bushels), still 14% below the 5-year average of 3.92 MMT (144 million bushels) despite difficult inland transportation logistical issues due to major flooding on the Mississippi River and its tributaries. The 2018/19 SRW crop boasted higher protein levels and good extensibility, making it a valuable blending ingredient for cookies and cakes. A steady decline in SRW futures prices between mid-December 2018 and mid-May 2019 encouraged strong commercial sales to top SRW-importing regions. Export sales to three of the top five SRW purchasers increased or remained steady compared to 2017/18. Sales to Mexico, the top importer of U.S. SRW, increased 25% over last year to 917,000 MT (33.6 million bushels) and sales to Peru, the fifth-largest importer of U.S. SRW, increased 13% over last year to 175,000 MT (6.46 million bushels). Export sales to Nigeria held strong at 272,000 MT (9.96 million bushels).

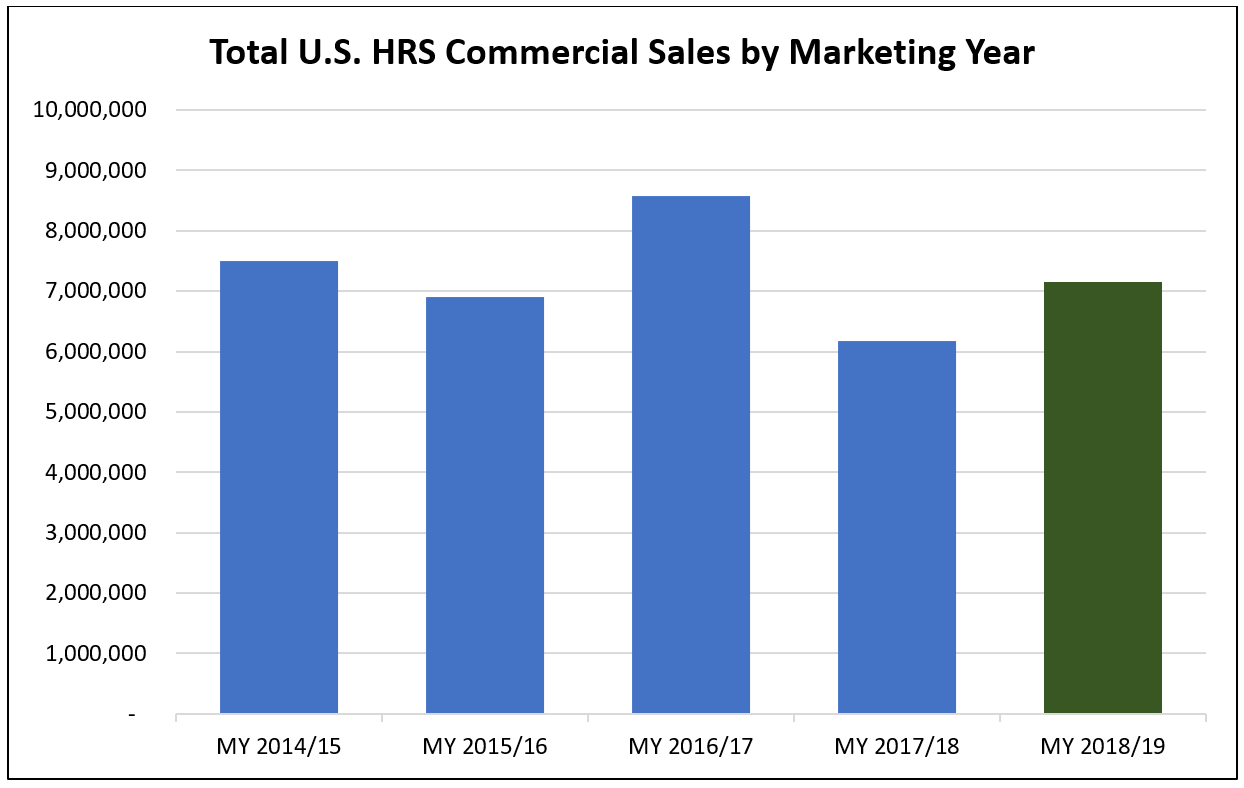

Hard Red Spring. By the end of MY 2018/19, hard red spring (HRS) export sales totaled 7.15 MMT (263 million bushels), 16% ahead of last year’s pace, despite a 94% decrease in commercial sales to China, formerly the fourth-largest importer of U.S. HRS. A 60% year-over-year increase in HRS production, at 16.0 MMT (588 million bushels), higher ending stocks, high protein content and competitive export prices all supported export sales. Gulf exports of HRS 14.0 protein between Jan. 1 and May 31, 2019, cost, on average, $263/MT compared to $305/MT over the same period in 2018. Seven of the country’s top ten HRS-importing partners increased commercial sales year over year. Commercial sales to the Philippines, the top importer of U.S. HRS, jumped to 1.85 MMT (68.0 million bushels) in 2018/19, 39% ahead of last year and 38% ahead of the 5-year average of 1.34 MMT (49.2 million bushels).

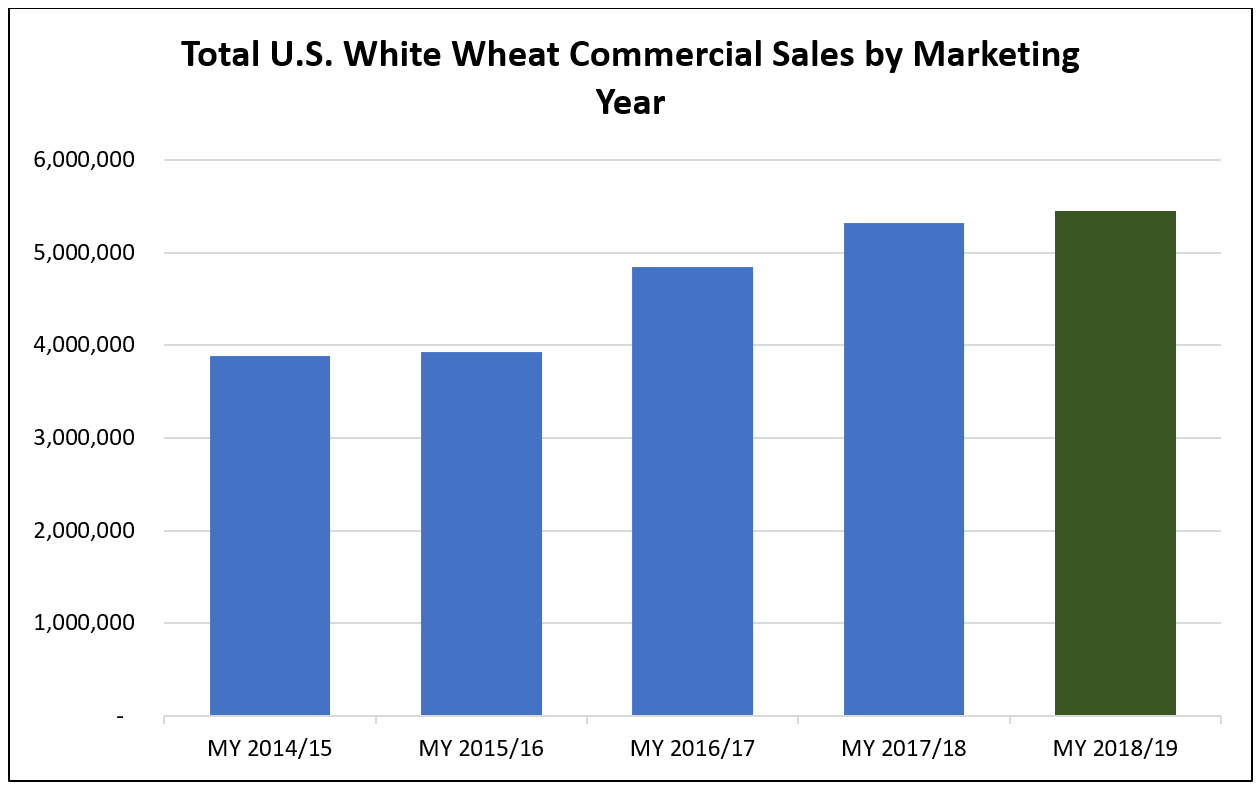

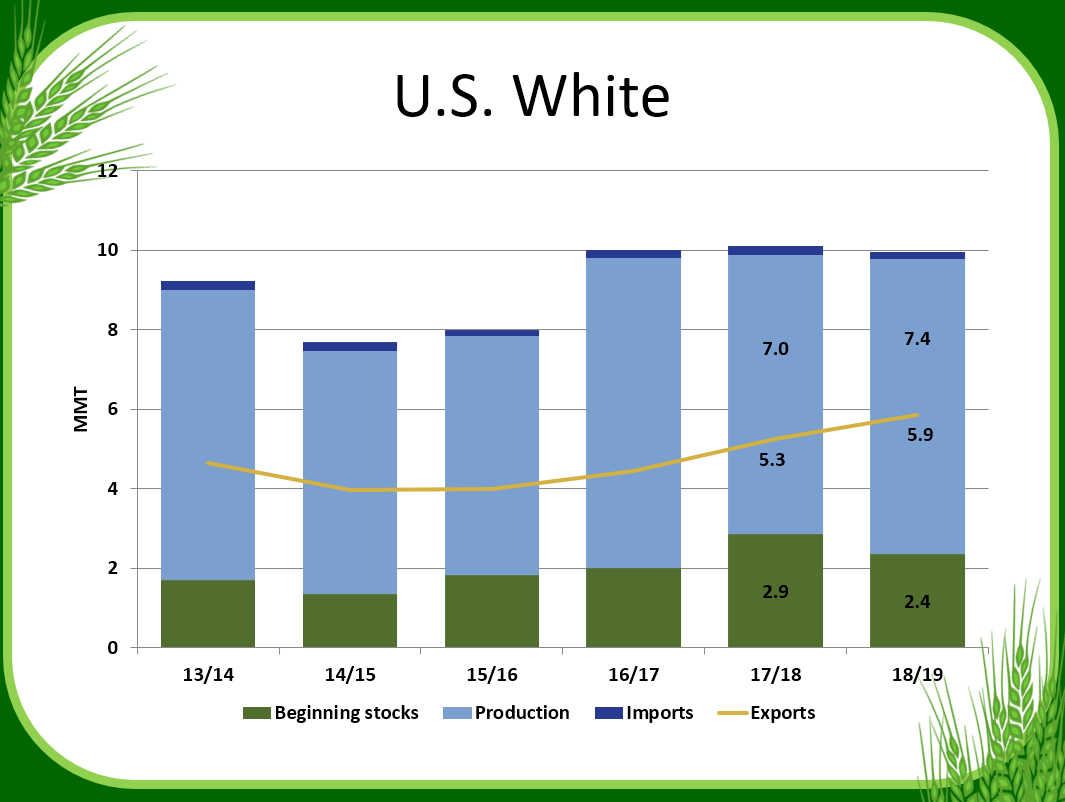

White wheat. Total commercial sales of soft white (SW) and hard white (HW) wheat climbed to 5.45 MMT (200 million bushels) in 2018/19, which includes about 165,000 MT of HW sales to Nigeria. That is slightly ahead of last year’s pace and 21% ahead of the 5-year average of 4.51 MMT (166 million bushels) due to increased production, increased exportable supplies and below-average protein levels compared to years prior. Sales to the Philippines and Japan, the top two importers of U.S. SW, respectively, increased 13% and 7% over 2017/18 levels. The Philippines purchased 1.32 MMT (48.9 million bushels) of SW compared to 1.17 MMT (43.0 million bushels) in 2017/18. White wheat sales to Japan increased to 889,000 MT (32.7 million bushels) compared to 829,000 MT (30.4 million bushels) in 2017/18.

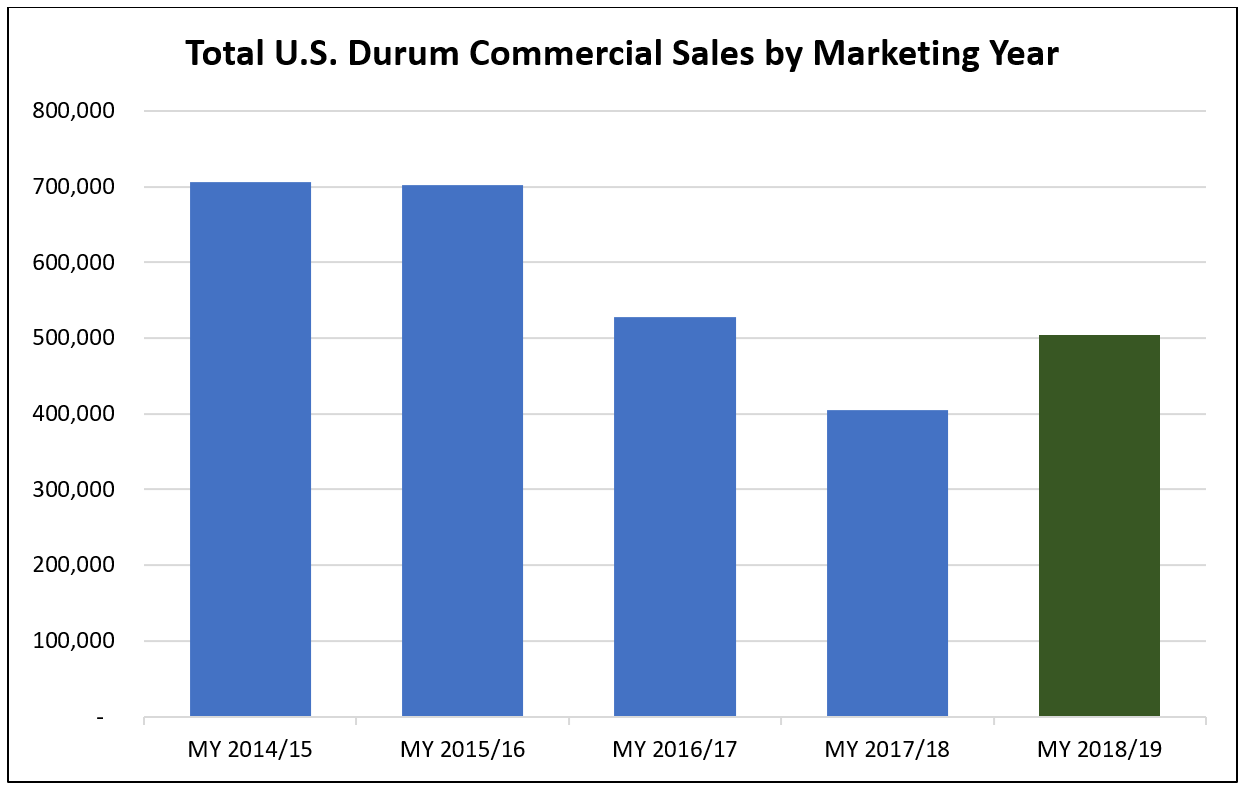

Durum. USDA reported 2018/19 durum sales at 504,000 MT (19.8 million bushels), up 24% from the year prior, but 12% below the 5-year average of 573,000 MT (21.0 million bushels). Increased production, high protein content, excellent kernel characteristics and competitive prices throughout the marketing year all supported northern durum export levels. Increased sales to four of the five top markets for U.S. durum boosted export figures. The European Union (EU) purchased 290,000 MT (10.7 million bushels) of U.S. durum in 2018/19, up 71% year-over-year following a drought that cut production in many EU countries.