Each year, U.S. Wheat Associates (USW) invests funding from USDA Foreign Agricultural Service export market development programs to bring several teams of overseas customers and stakeholders to the United States. Visiting wheat-producing states connects customers with farmers as well as state wheat commissions and industry partners that co-sponsor local visits. The goal is the same for USW and partners: to promote the reliability, quality and value of all six U.S. wheat classes to customers around the world. Our success relies on the success of our customers and their ability to create products that appeal to consumers in markets around the globe.

So far in 2019, six USW-sponsored teams and an industry-sponsored team have traveled to 10 different states to gain greater understanding of the new U.S. wheat crops, wheat marketing structure and transportation logistics.

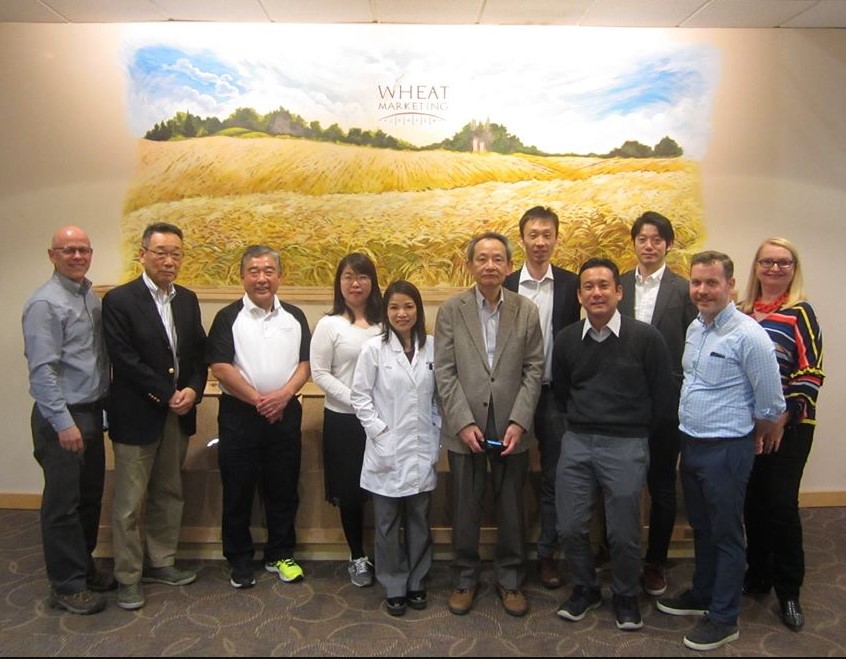

In March, the Wheat Marketing Center in Portland, Ore., sponsored a workshop on the unique characteristics of club wheat, a subclass of soft white (SW), for five baking technologists from Japan. Japan is a major importer of the premier U.S. soft wheat blend of club and SW known as Western White. USW worked with WMC to prepare the workshop and plan a visit to farms in Washington State growing club wheat.

A team of Japanese baking technicians participated in a club wheat workshop at the Wheat Marketing Center in March 2019 with support from USW and state wheat commissions.

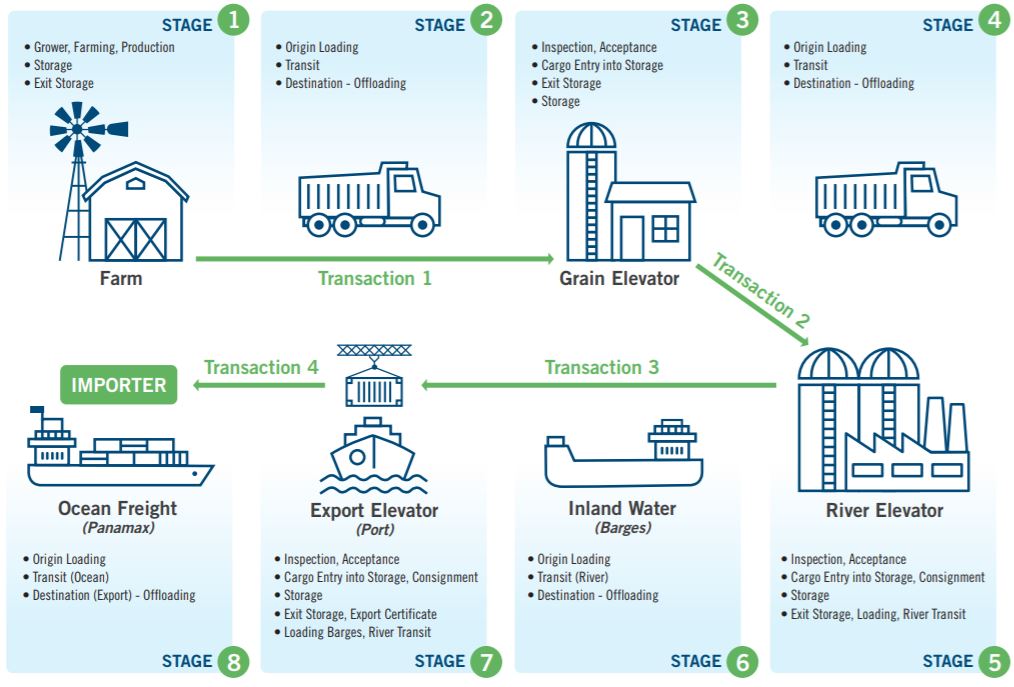

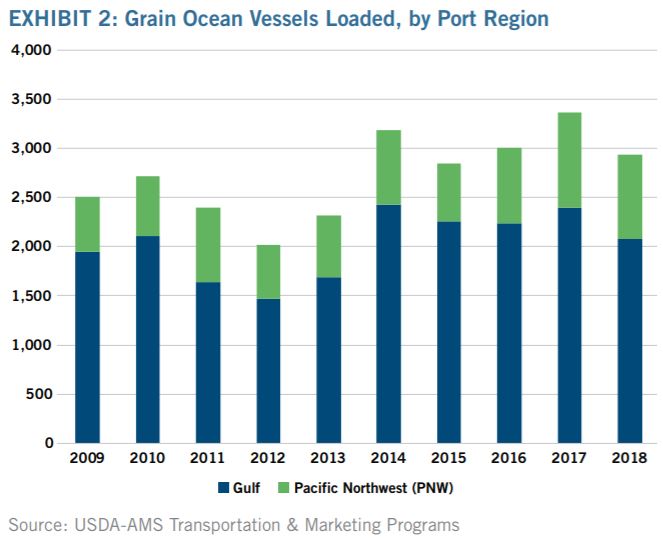

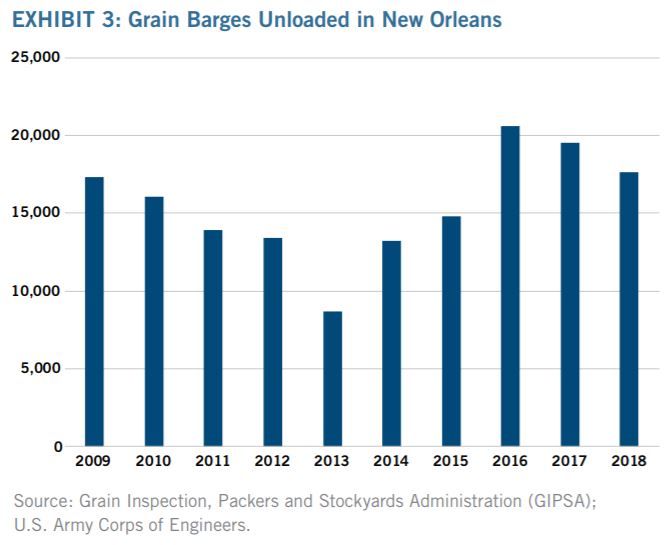

In late April and early May, a team of seven senior executives from Japan’s flour milling industry, led by Country Director Charlie Utsinomiya and Associate Country Director Kazunori “Rick” Nakano, made an annual trip to the United States. These executives took in high-level meetings in Washington, D.C., including with USDA Under Secretary of Agriculture for Trade and Foreign Agricultural Affairs Ted McKinney, to discuss the state of U.S. trade negotiations with Japan. In Montana, the milling executives spent time with then USW Chairman Chris Kolstad on his farm near Ledger, Mont., and toured a local elevator that loads 100-car shuttle trains with hard red winter (HRW) and dark northern spring (DNS) wheat bound for Pacific Northwest export elevators.

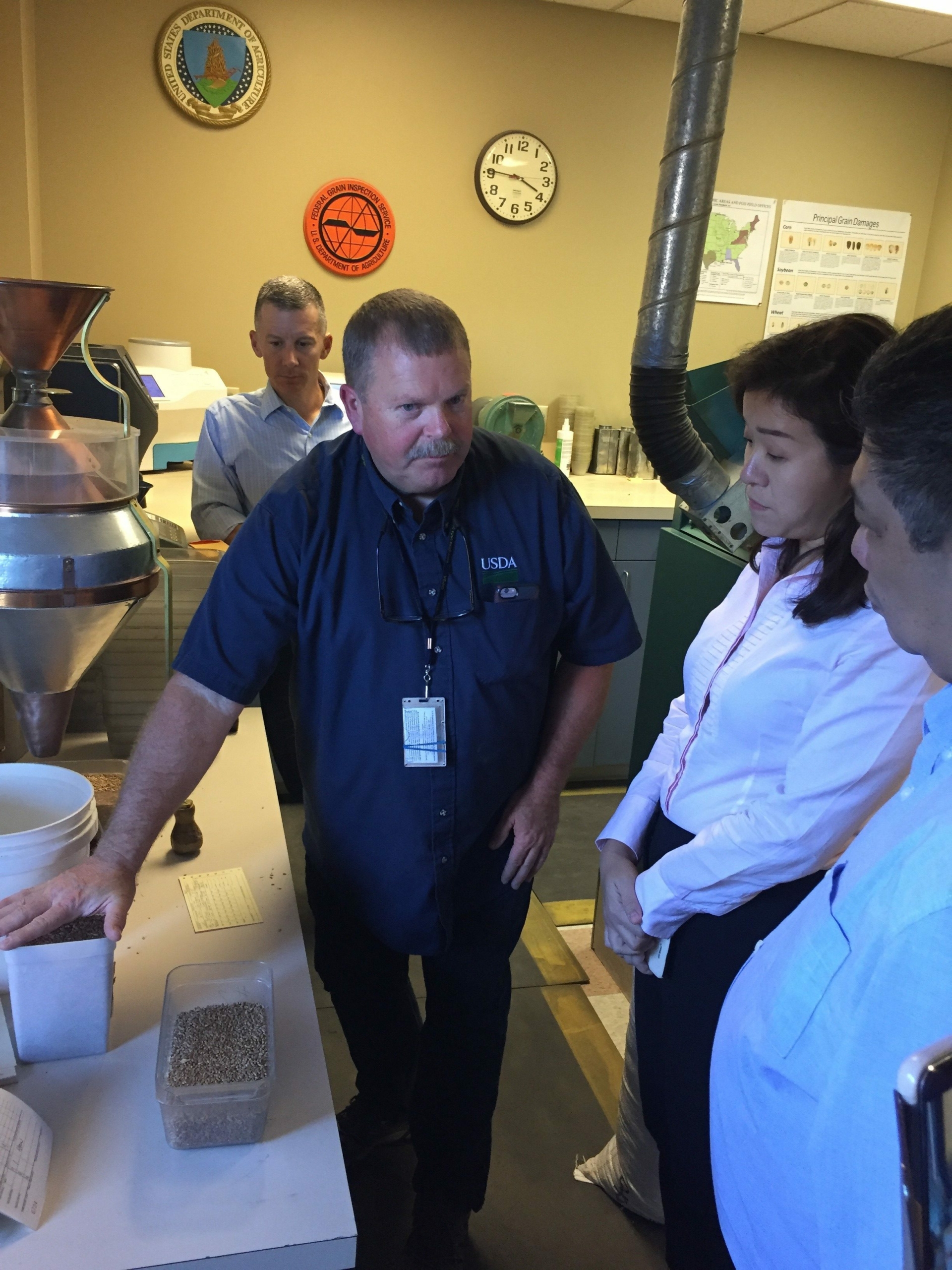

At about the same time, USW/Taiwan Country Director Boyuan Chen led five representatives of the Taipei Bakers Association and three officials from Taiwan’s Department of Public Health on a trade team to Oregon and Manhattan, Kan. The focus for this team was to demonstrate the high-quality of U.S. wheat, sanitation and best management practices employed by domestic flour mills and bakeries and retail trends in the U.S. baking industry. This team saw the Federal Grain Inspection Service process at export, visited high-value commercial flour mills and commercial bakeries, and toured AIB International. USW Vice Chairman Darren Padget also hosted the team at his family’s farm in north-central Oregon. A collection of photos from the team visit is posted online here.

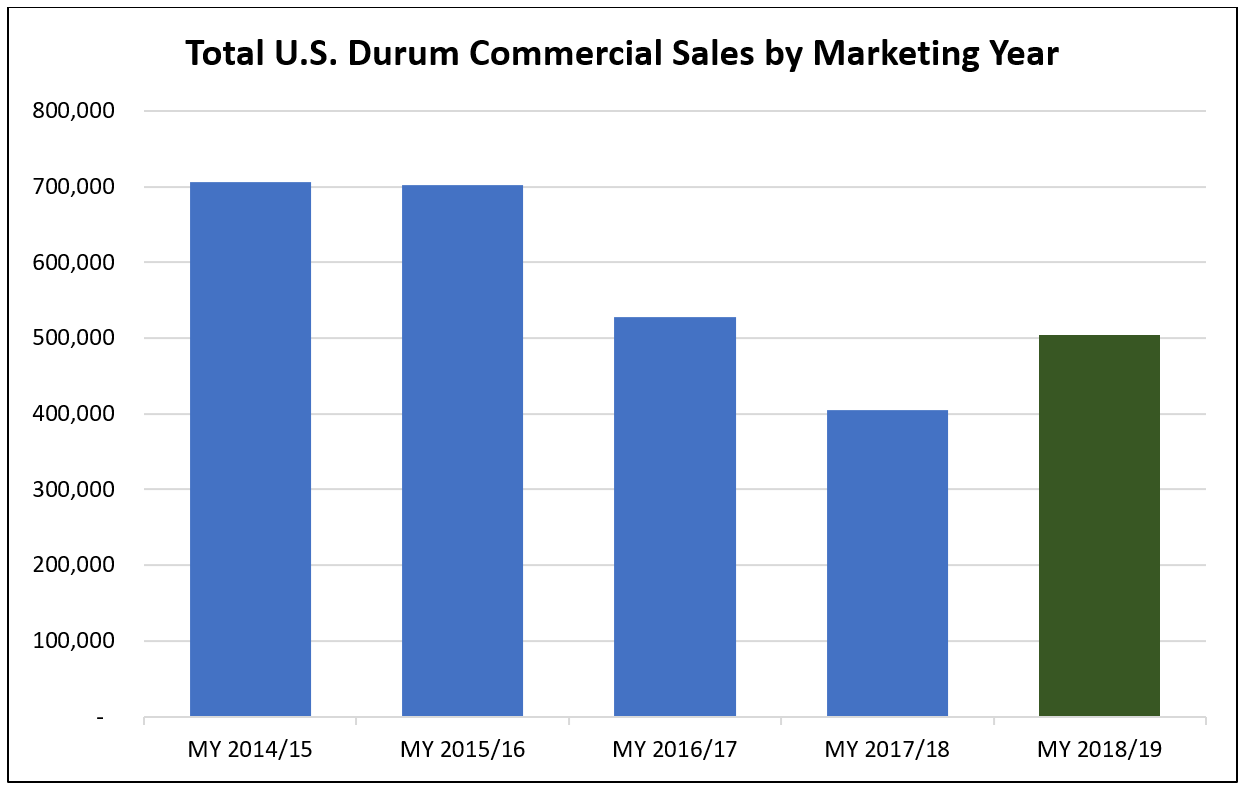

Executives from several Nigerian and South African flour mills traveled with USW Assistant Regional Director Chad Weigand and USW/Lagos Marketing Specialist Olatunde Omotayo to Washington, D.C., North Dakota and Kansas in mid-June. USW, state commissions and educational partners at IGP Institute and Northern Crops Institute demonstrated the excellent quality of HRW, HRS and durum supplies available, as well as the promise of more exportable supply of hard white (HW) for the team and the logistical advantages of purchasing from the United States.

Millers from Nigeria and South Africa saw wheat quality and varietal improvement research at Heartland Innovations in Manhattan, Kan., on their trade team visit this year.

Brazilian flour milling managers who are responsible for quality control in their wheat purchases arrived in Ohio in late June to learn more about U.S. soft red winter (SRW) and HRW quality. The visit coincided with the announcement that Brazil’s government planned to implement a duty-free tariff rate quota (TRQ) for wheat from countries like the United States outside the regional South American trade agreement. If implemented, the TRQ provides an opportunity for U.S. wheat to compete on an equal basis with Argentina for 750,000 metric tons of annual imports. As SRW importers, the Brazilian millers gained good information from a visit to the USDA’s Agricultural Research Service Soft Wheat Laboratory in Wooster, Ohio. The trade team also had the opportunity to tour wheat research facilities at Kansas State University and Texas A&M University in College Station, Tex. USW/Santiago Marketing Manager Casey Chumrau and Technical Specialist Andres Saturno led this team.

USW Market Analyst Claire Hutchins recently provided interesting insight into the trade team experience in a “Wheat Letter” post about the team of seven milling executives from the Philippines while they visited the U.S. wheat supply system in Portland. This team continued from Portland to Eastern Washington State, Idaho and Nebraska before departing for home on June 29. Philippine millers imported more SW and DNS than any other country in marketing year 2018/19 (June to May). Their total U.S. wheat imports put them in a close second position after Mexico.

Looking ahead, additional teams from Peru, Korea, Mexico, Taiwan, Japan and South Asian countries, as well as a team of bakery officials from South American countries, will be in the United States between now and late September. USW wants to thank our partners with USDA-FAS, state wheat commissions, educational organizations and of course the farmers we represent who make these activities possible.