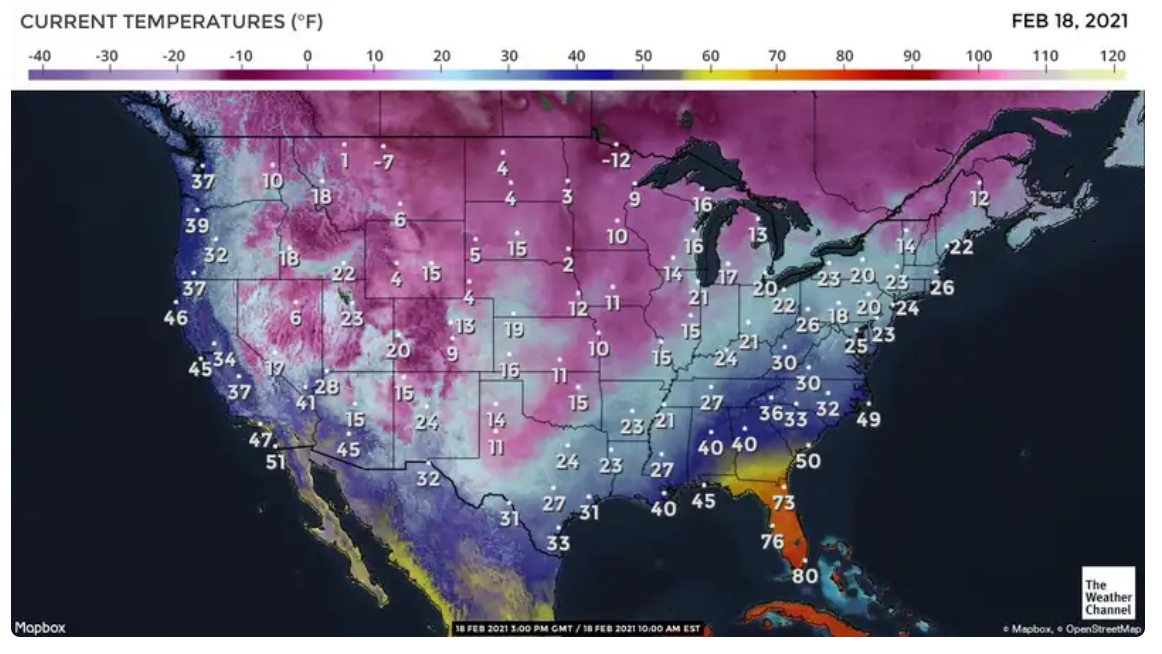

Hot, dry weather following a parched fall and a winter with less snow in some areas has many parts of Washington, Oregon and Idaho experiencing some of the driest weather in a generation. Much of the area that grows spring and winter soft white (SW) and white club wheat is experiencing some form of drought. All eyes will be on USDA’s first estimate of new crop SW production in its July World Agricultural Supply and Demand Estimates report, although a reduction in yield potential and concerns about protein levels are already anticipated.

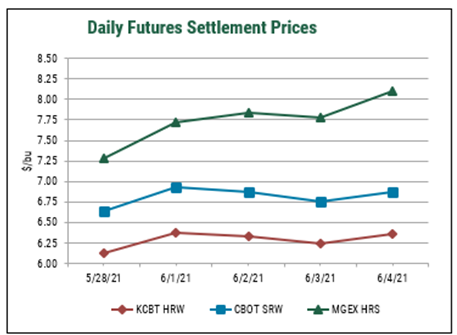

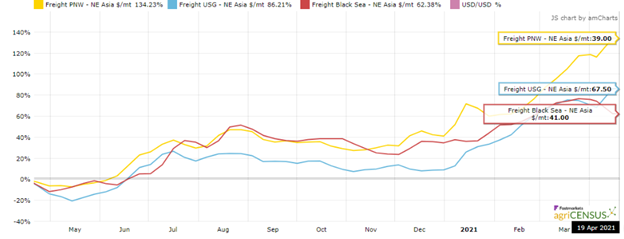

The market has reacted to the weather with FOB prices for ordinary SW up $140.00 per metric ton ($4.00 per bushel) more than a year ago. Demand for the 2020/21 SW crop was quite strong and ending stocks of 1.31 million metric tons are half of what they were in 2019/20. The stocks-to-use ratio for SW ended the year at only 13%.

Now, the hot dry weather leaves farmers unwilling to forward contract new crop sales as they struggle to identify what volume they will produce and because dry conditions tend to increase protein, what protein levels they will be able to offer. Traders are cautious because the drought’s effect on protein levels could make securing lower protein SW difficult. It is important to remember that SW protein levels have been elevated in some past years. Your local U.S. Wheat Associates (USW) office is an excellent resource to help you identify how to get the most value from every new crop.

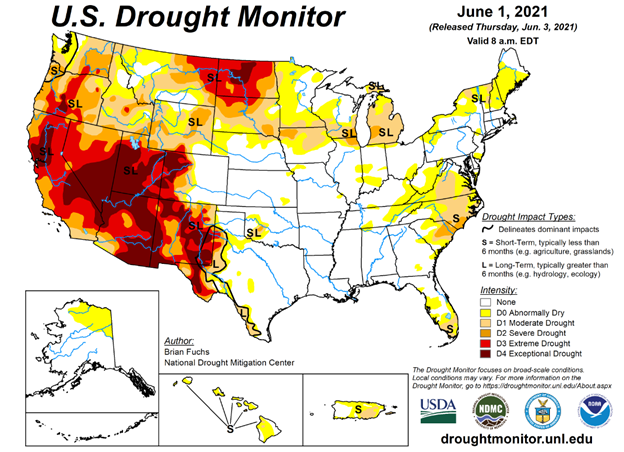

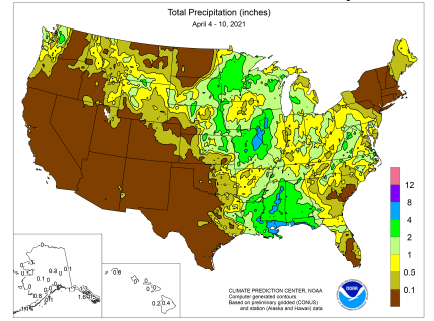

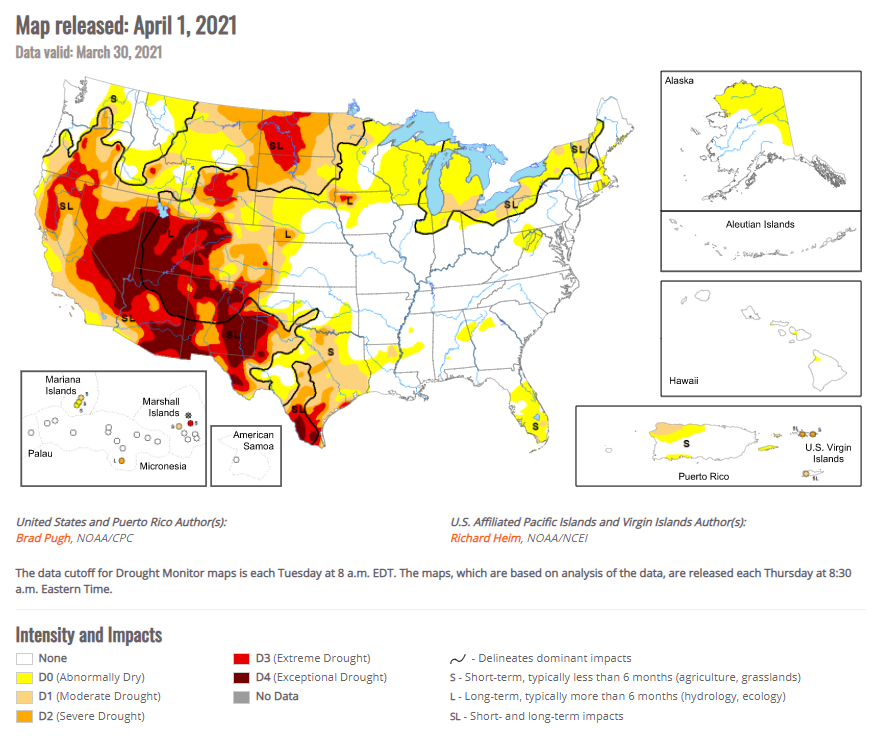

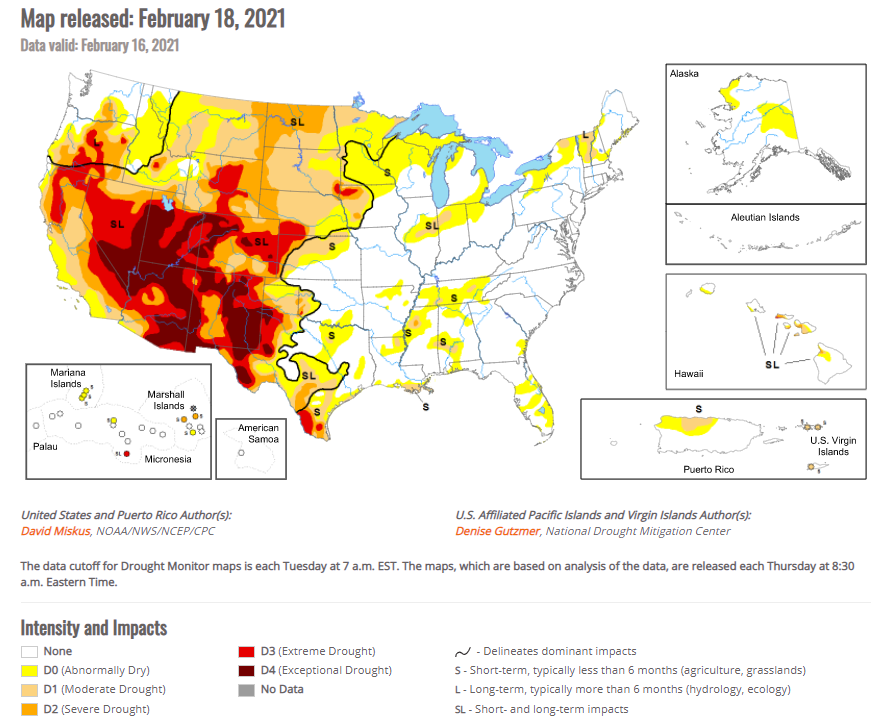

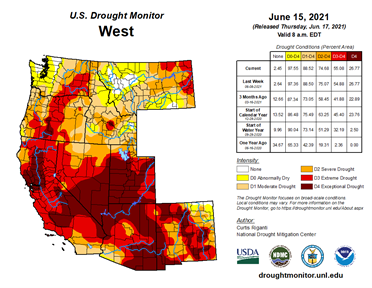

Extreme drought is intensifying in the Pacific Northwest and throughout the western United States.

Michelle Hennings, Executive Director of the Washington Association of Wheat Growers, recently noted that while winter planted SW is stressed with lower yield potential, spring planted SW has had so little moisture some farmers may not have any harvest.

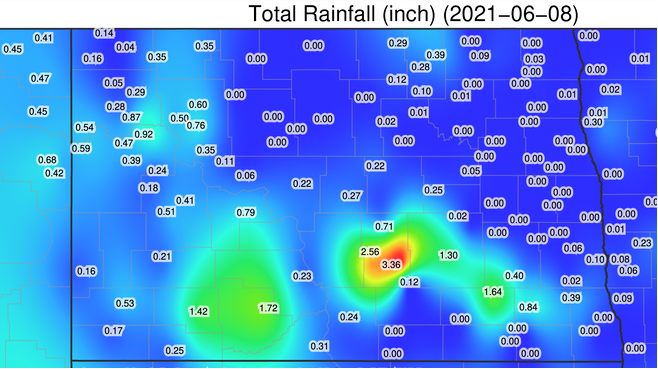

Washington state, which accounts for around 50% of the Pacific Northwest (PNW) SW crop, has received only half of its usual average rainfall according to NOAA’s National Centers for Environmental Information and areas falling into the drought category makeup well over half the state. Areas rated in extreme drought are increasing fast week-over-week and winter wheat conditions in Washington are rated 15% good to excellent.

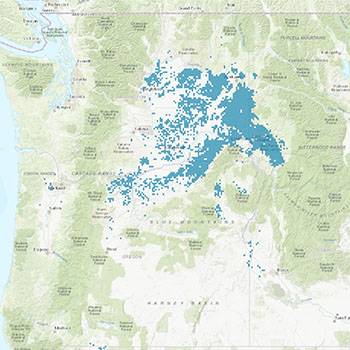

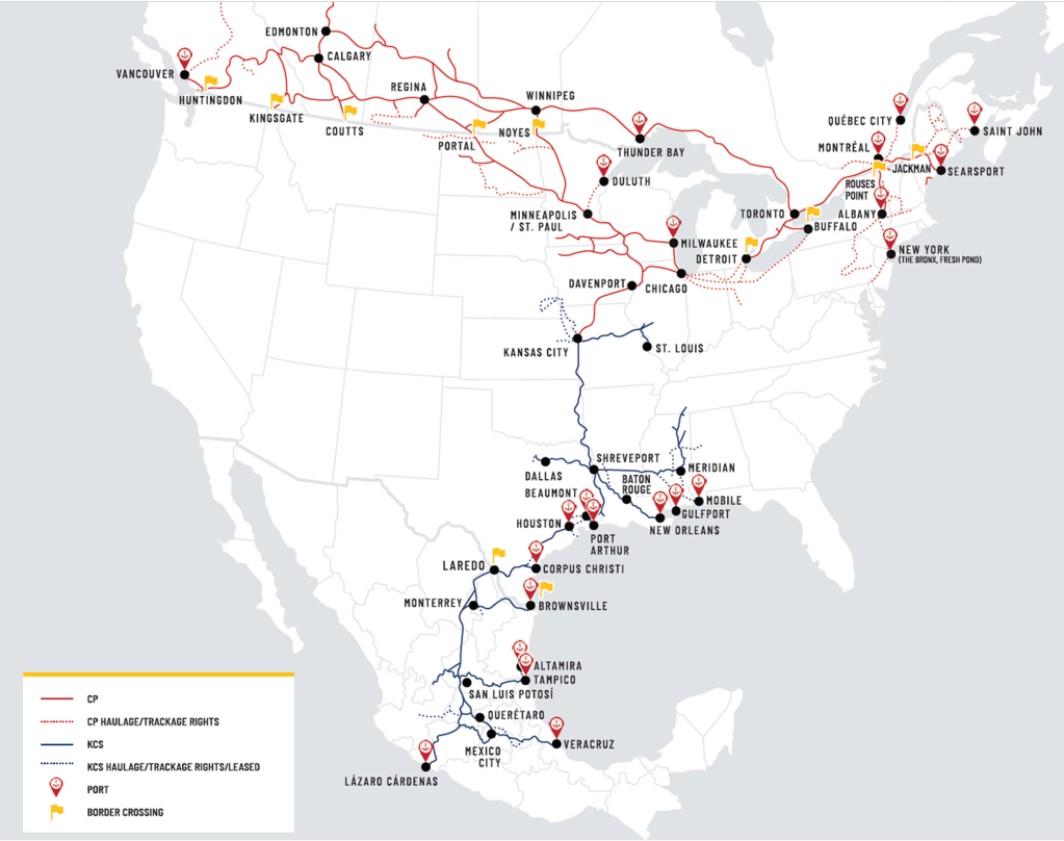

Karin Bumbaco, Assistant State Climatologist, University of Washington, recently noted that the drought in the state has expanded quickly. Just three months ago none of Washington was in extreme drought versus today when more than 23% of the state – and almost all the state’s wheat country – falls into the category (see the PNW SW wheat production area above from the interactive U.S. wheat export supply system map on www.uswheat.org).

Driest in More than 40 Years

The once-in-a-generation drought led one farmer to observe “if you can get an average crop, consider yourself lucky!”

Darren Padget, a dryland wheat farmer in north-central Oregon and the current USW Chairman, noted that harvest may come early this year. The lack of rain has matured his crop enough that harvest, which usually comes at the end of July, may start in less than a month. Padget also mentioned that it is the driest weather he has seen since 1977, a year many farmers remember when looking for a comparison to this year. In Oregon, which accounts for around 20% of the PNW SW crop, winter wheat conditions are rated 11% good to excellent.

Some Good to Excellent Wheat

Idaho, which accounts for around 30% of the PNW SW crop, has also been very dry. Similar to neighboring states, spring planted SW in Idaho is severely stressed, especially on non-irrigated fields. However, some wheat in Idaho is grown under irrigation and farmers there are more optimistic about the condition of fall planted SW fields. In fact, USDA’s latest report puts 44% of SW winter wheat in good to excellent condition.

Despite the challenges to the 2021/22 PNW SW crop, many farmers do have crop insurance and the state governments are also considering other ways to help farmers through this challenge, and USW is there for overseas buyers who have questions and concerns.

Producers, by nature, remain optimistic. One producer in Washington state put it best: “…we are not going to give up.”

By Michael Anderson, USW Market Analyst